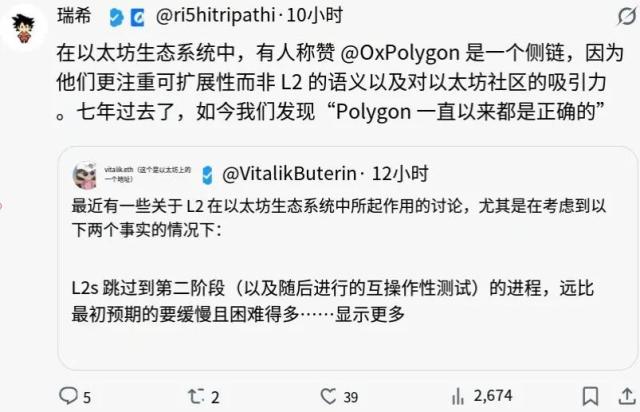

Recently, Vitalik Buterin, co-founder of Ethereum, garnered significant attention on social media when he posted a candid tweet about the current Layer-2 landscape — and more specifically, about how he envisions Ethereum's scalability over the next few years.

The core message sounds "calm," but it's extremely sensitive to traders: Not all Layer-2 funds have a reason to exist in the long term. And if this narrative spreads, it will have a very practical consequence: money flows will become more selective .

Layer-2 is no longer just a "side arm" of Ethereum.

Initially, Layer-2 was expected to be a scaling tool: reducing fees, increasing speed, and improving the experience for Ethereum. But according to Vitalik, this view is becoming too simplistic compared to the current reality.

Layer-2 networks today are no longer moving in the same direction. Instead, each network is evolving according to different priorities: some focus on applications, some prioritize infrastructure, some prioritize privacy, and some build specialized environments for developers.

This leads to a very important question for the holder: Does the Layer-2 project you hold have a clear "reason for existence"?

As Ethereum Layer-1 becomes stronger, the pressure on Layer-2 increases.

A key point in Vitalik's Chia was: Ethereum Layer-1 is not static. As L1 continues to improve its scalability and performance, the "to-load" Vai of Layer-2 will shrink.

With the holder, this doesn't mean Layer-2 loses its value. But it does mean:

Layer-2 is no longer protected by the narrative "Ethereum needs to expand".

Only Layer-2 companies that create real added value will maintain their position in the long term.

In other words, L2 will not disappear, but will be filtered more intensely .

Something Layer-2 holder often overlook.

Many holder choose Layer-2 based on:

Name

TVL

Current ecosystem

Relationship with Ethereum

But what Vitalik is subtly emphasizing is the future direction . In the next few years, the value of a Layer-2 will not only come from the current number of users, but from:

The degree of difference compared to other L2s.

The ability to retain users even when Ethereum is cheaper.

A clear Vai within the entire Ethereum ecosystem.

If a Layer-2 asset fails to answer these questions , the holder needs to reconsider their long-term expectations.

Hold or restructure? Holder need to assess the Layer-2 assets they hold.

From a long-term perspective, Layer-2 is entering a "mature" phase. This is often accompanied by:

Few common sources for the entire industry.

There are many differences between each project.

Highly differentiated pricing

For holder, this isn't necessarily bad news. On the contrary, it opens up opportunities for those holding the right Layer-2 assets with a solid foundation and vision . But at the same time, it's also a reminder: Not all Layer-2 assets are worth holding long-term.

Conclusion: Vitalik's tweet is a test of holder confidence.

Vitalik wasn't warning about the collapse of Layer 2. He was talking about natural selection .

In the long term, some Layer-2 cryptocurrencies will become pillars of Ethereum; others will fade away, despite their former prominence. And for holder, the most important question isn't "Does Layer-2 still exist?", but rather: Does the Layer-2 you hold belong to the group that will be strengthened… or the group that will be filtered out?

If you are a Layer-2 holder , now is the time to review the roadmap, reassess the project's Vai —and adjust expectations for the cycle ahead.