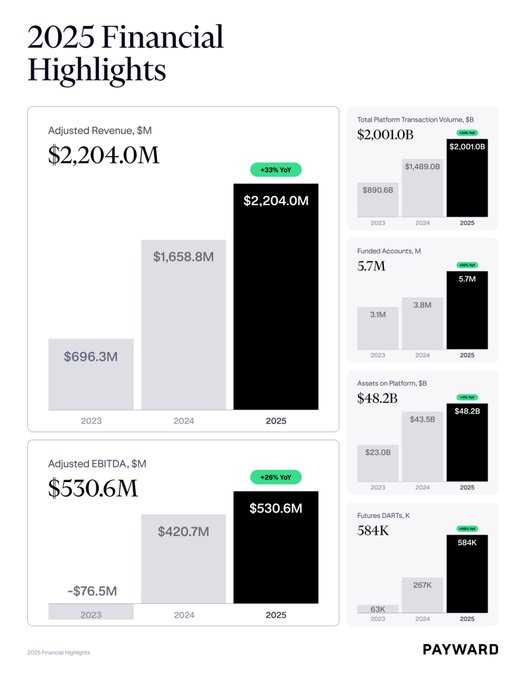

Kraken parent company Payward reported $2.2B in adjusted revenue for 2025, up 33% YoY. Trading made up 47% of revenue, while 53% came from non trading businesses such as custody, payments, yield, and financing.

> Total platform transaction volume reached $2T, up 34% YoY, driven by sustained user engagement and growing assets on platform.

> In 2025, Kraken ramped up diversification, highlighted by the $1.5B NinjaTrader acquisition, the purchase of prop trading firm Breakout, and the acquisition of Backed to expand into tokenized equities via xStocks.

> Kraken also launched the Krak app, positioning itself as a payments focused super app with free transfers, cashback debit cards, salary deposits, and expanded wealth tools.

> On the derivatives front, the exchange expanded across Europe and the UK, while its US platform added CME listed contracts spanning equities, FX, metals, and energy.

> IPO speculation is growing after a Kraken backed SPAC raised $345M on Nasdaq, following a $200M investment from Citadel Securities that valued the company at $20B.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content