In the crypto space, which is hardly ever defined as a technology sector anymore, Ethereum founder Vitalik Buterin is a rare figure who still cares about the direction of blockchain technology's progress.

Starting in the second half of 2025, he began posting lengthy articles on Twitter in rapid succession, with a frequency, length, and breadth of topics rarely seen in his public pronouncements over the past decade. This didn't sound like a successful founder preaching; it sounded more like an anxious thinker trying to rekindle something from the ruins.

We reviewed all his public tweets from 2025 to the present and found that his interests are extremely broad: from underlying consensus mechanisms to upper-level social governance, from cryptography to AI ethics, from geopolitics to social media, there are traces of his deep thinking in all of them.

Amidst these diverse topics, we attempted to extract the keywords he mentioned most frequently and the core issues he cared about most. These reflections not only concern the future of Ethereum but also seem to be an answer to the question of where the entire crypto industry should go from here.

The shift in grassroots narratives

In 2025, Vitalik repeatedly emphasized that Ethereum's underlying narrative must change. It should no longer be the "world computer" that tries to run everything, but rather become an "internet-level public infrastructure" like Linux or BitTorrent, or, in other words, "the TCP/IP of finance."

TCP/IP is the underlying communication protocol of the Internet. It does not belong to any company, yet it supports the operation of the entire network. By relinquishing control over upper-layer applications, it achieves absolute neutrality and robustness.

This is precisely the new direction Vitalik has found for Ethereum: a more mature and pragmatic form of decentralization: a neutral foundational layer that cannot be controlled by a single entity, a cornerstone that allows all financial activities to operate permissionlessly.

"Ethereum should operate like Linux or BitTorrent: an open, decentralized infrastructure that is owned by no one, yet powerful and trustworthy enough for the whole world to build on."

This means that Ethereum's valuation logic is also changing. Its core value cannot be measured by the price-to-earnings ratio or user growth of commercial companies. Its value does not lie in how many users it has or how much profit it generates, like Facebook or Amazon, but in how much value it can carry and how many applications it can support as infrastructure.

This narrative shift means that Ethereum must confront a harsh reality: when "tokenization" itself can no longer provide an emotional premium, it must return to value creation. The acceptance of Ethereum by Wall Street and traditional finance is both an acknowledgment of its value and a recognition of its challenges.

Wall Street is here

Following the launch of Bitcoin spot ETFs, giants like BlackRock, JPMorgan Chase, and Fidelity began a concentrated deployment of Ethereum in 2025. They are no longer content with simple asset allocation but are delving into the infrastructure layer. BlackRock launched a tokenized fund based on Ethereum, and JPMorgan Chase's Onyx platform processes billions of dollars in transactions daily on-chain.

The influx of institutional investors is a double-edged sword. On one hand, it endorses Ethereum's legitimacy; on the other, it directly challenges the decentralized spirit of Ethereum. As BlackRock and Bitmine control more and more Ethereum, will the founders' influence diminish? And how can Ethereum balance institutional demands with its decentralized principles?

Vitalik's attitude is: welcome, but not pandering.

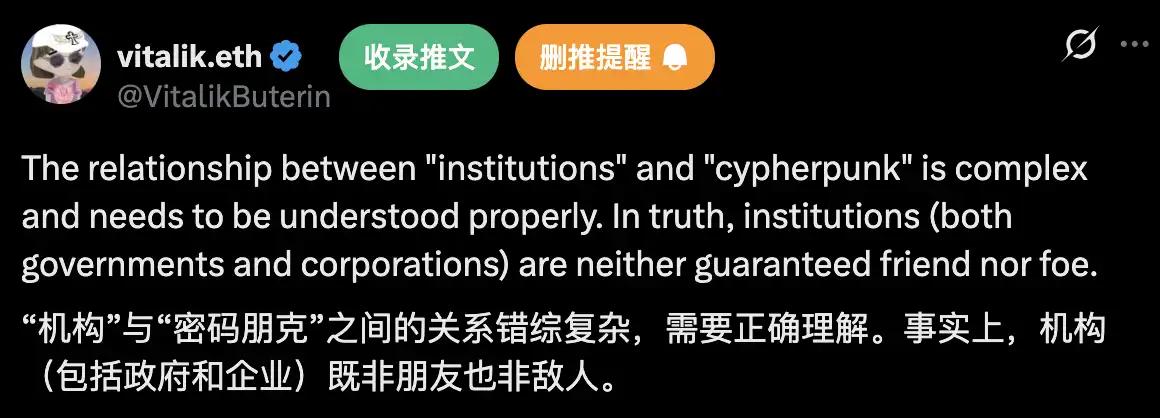

In a Farcaster post, he described the relationship between institutions and cypherpunks as a complex one that needs to be properly understood, arguing that "institutions (whether governments or corporations) are neither necessarily friends nor necessarily enemies."

However, he believes that unrestrained institutionalization will bring two major risks, both of which threaten the very foundation of decentralization.

First, there's the alienation from the core community. In an interview, Vitalik bluntly stated, "It's easy to drive other people away. If Ethereum only pursues commercial utility while ignoring its technical and social attributes, then it will acquire the 'greed-first' mentality of Wall Street, which is exactly what many of us came here to escape from."

This is essentially a community-level crisis of decentralization: if the original builders leave, Ethereum will lose its source of ideas and vitality.

Secondly, there is the issue of poor technology choices. Institutional pressure could lead Ethereum to make decisions that compromise its accessibility.

For example, to meet the demands of high-frequency trading, block times have been reduced to 150 milliseconds. This means that only institutions with professional data centers and low-latency networks can run nodes, completely excluding ordinary users. This could further concentrate node operations in financial centers like New York, undermining geographical decentralization.

Faced with these risks, Vitalik's initial solution was a clear division of responsibilities: the L1 foundational layer would remain absolutely decentralized, focusing on global reach, censorship resistance, and other qualities that Wall Street could not replicate.

"The Layer 1 base layer should remain robust, open, and directly accessible. It should allow individuals, companies, and governments to build on it without relying on any centralized institution."

Organizations can build their own "compliance" applications on L2, but this "L1 resistance to censorship, L2 compliance" solution has encountered new challenges in practice.

L2's new positioning

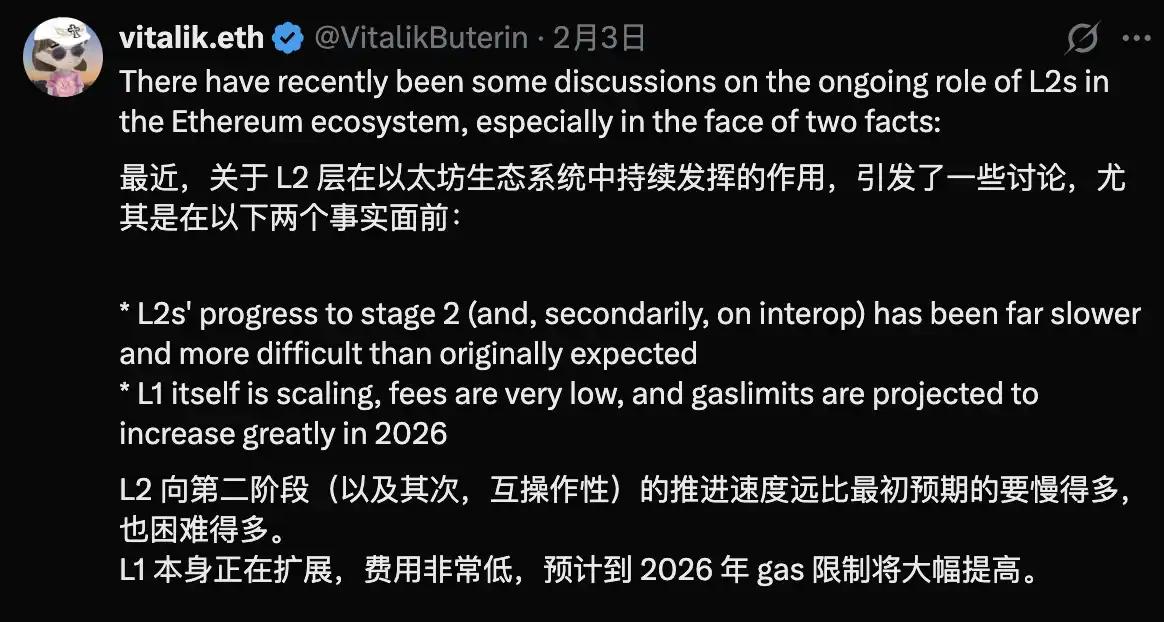

On February 3, 2026, Vitalik published a lengthy article on X, making significant revisions to Ethereum's L2 strategy.

Ethereum's initial scaling roadmap positioned L2 as a "branded shard of Ethereum," which was supposed to inherit Ethereum's security and decentralization attributes and become an extension of the mainnet.

But reality is disappointing. Vitalik directly criticized that most L2 still relies on centralized sequencers, essentially making them more like "centralized databases dressed up as blockchains".

These L2 tokens have raised hundreds of millions of dollars and are valued at tens of billions, but they refuse to decentralize in order to pursue commercial interests (MEV revenue, regulatory compliance, and rapid iteration). After their tokens are launched, they have high valuations and low circulation, and their prices have plummeted.

These general-purpose L2s actually fit very well with the term Vitalik often uses to criticize centralized giants' products—"corposlop" (corporate garbage).

Vitalik's coined term "corposlop" can be understood as: corporate garbage disguised in a glamorous guise. It refers to companies and their products that possess strong business capabilities and sophisticated brand packaging, but in reality engage in unethical practices in pursuit of profit.

Vitalik was scathing in his comments on this L2:

"This might be right for your customers. But it's clear that if you do this, then you're not 'scaling Ethereum'."

While L2 decentralization is progressing slowly, L1's own scaling is progressing unexpectedly rapidly. Fees are already low, and gas limits are expected to increase significantly in 2026. The core value of L2 as a "scaling tool" is being diluted.

Therefore, Vitalik pointed out a new way forward for L2:

"We should stop viewing L2 as a 'branded shard' of Ethereum. L2 can no longer be satisfied with just being 'a little faster than L1,' but must find its own unique value."

He believes the future value of L2 lies in dedicated functions and innovation. For example, innovations in non-financial fields such as privacy, AI, and social; efficiency optimizations for specific applications (application chains); or providing ultra-low latency transaction sequencing.

He even suggested that L2 could explore some "non-computationally verifiable" functions, that is, functions whose results cannot be proven by on-chain computation alone, but require external world information (such as oracles) or social consensus (such as decentralized courts) to adjudicate.

This pushes Ethereum's scaling blueprint into a new phase: a more robust L1 as the cornerstone of security and trust, complemented by a more diverse, functional, and imaginative L2 ecosystem.

Privacy as the top priority

If we were to compile a list of the concepts Vitalik mentioned most frequently in 2025, "privacy" would undoubtedly be near the top. His emphasis on privacy also points to a core centralized issue in today's society—information control.

In October 2025, Vitalik elevated privacy to a "first-class priority" for Ethereum. He admitted that the early neglect of privacy was a last resort due to the immaturity of the technology at the time. But now, with the maturity of zero-knowledge proof technologies such as ZK-SNARKs, privacy can no longer be put aside.

"Privacy is an important safeguard for decentralization: whoever owns the information owns the power, so we need to avoid centralized control over information."

A blockchain without privacy exposes every transaction and vote you make to everyone. When power can exert pressure by tracking on-chain data, the "permissionless" nature of blockchain becomes meaningless.

This struggle for control of information is particularly evident in the stablecoin sector. Stablecoins represent the biggest intersection between the crypto world and traditional finance, with hundreds of billions of dollars flowing through the blockchain daily. Whoever controls the anchoring, issuance, and circulation of stablecoins controls the lifeline of the crypto economy.

In response, Vitalik pointed out that the core struggle in the crypto industry is no longer "innovation vs. regulation," but rather "control vs. independence," with stablecoins being the main battleground in this struggle.

In terms of technological approach, Vitalik has pointed the way for privacy: through ZK-SNARKs and privacy pools, he has achieved "selective disclosure": users can prove the legitimacy of their funds to regulators while protecting transaction details, without exposing all information.

From this perspective, privacy is a necessary condition for Ethereum to become a true "global digital public infrastructure." It ensures that Ethereum is not just a transparent financial ledger, but also a digital society that protects individual freedom, resists censorship, and allows users to safely "stand together."

Only when users have privacy protections can they safely participate in collective action, express dissent, and support sensitive causes without fear of being tracked or retaliated against. This is the essential foundation for true decentralization.

Building Trust in AI

The high priority given to privacy is inextricably linked to the rise of AI. The rapid development of AI has greatly enhanced the data collection and analysis capabilities of tech giants, causing the risks of "surveillance capitalism" to increase exponentially.

Vitalik's concerns are not unfounded. Palantir provides large-scale data surveillance services to the US government and intelligence agencies, Worldcoin collects iris data from hundreds of millions of people worldwide, and Meta uses user chat logs to train models.

AI controlled by a few giants, opaque, and unguided in terms of values is becoming the most powerful centralized tool in human history.

Back in November 2024, Vitalik used OpenAI as an example to warn of the risks of centralized AI:

"OpenAI has now become CloseAI. First, they sacrificed open source for security; then this year, they sacrificed security for profit."

However, Vitalik believes that the Crypto community cannot ignore AI, but must take the initiative to participate and use the power of decentralization to guide the development of AI.

"AI must be used carefully: we must never let a large language model run a DAO... Instead, AI must be placed within a larger, human-driven system and function as a component of it."

This is precisely the original intention behind the Ethereum Foundation's establishment of the dAI (decentralized AI) group and the launch of the ERC-8004 protocol. ERC-8004 provides AI agents with on-chain "identities" and "credit profiles," making AI behavior traceable and auditable.

The core problem it aims to solve is: how can AI agents trust each other as they increasingly replace humans in performing tasks?

In a centralized model, this problem is solved by the platform. You trust OpenAI, so you trust its AI. But this means all that trust is concentrated in the hands of a few giants.

ERC-8004 offers a path to decentralization: through on-chain identity and behavioral records, AI agents can establish verifiable credibility without relying on centralized platforms for endorsement. This makes it possible for the AI ecosystem to operate on a decentralized basis, like DeFi, rather than being monopolized by a few giants.

Vitalik's thinking is clear: since AI is an unstoppable trend, instead of passively accepting a powerful tool controlled by a few giants, we should proactively use Ethereum's decentralized system (identity, payment, privacy, security) to set boundaries for it, ensuring that it serves an open and free society, rather than becoming a new era nuclear weapon of centralized power.

Decentralized social

After building decentralized checks and balances for the two major power centers of finance and AI, Vitalik turned his attention to the core arena of human digital life: social networks.

He believes that current centralized social media platforms have fundamental problems. Their algorithms, in pursuit of short-term interaction rates and advertising revenue, sacrifice the true value of content, ultimately leading to information cocoons, declining content quality, and absolute platform control over users.

In January 2026, the decentralized social networking sector experienced a series of upheavals. Platform X banned APIs to crack down on "click fraud" projects, Farcaster was acquired, and Lens Protocol handed over control to Mask Network. This series of upheavals highlighted the fragility of existing models.

It was against this backdrop that, on January 21, Vitalik published a lengthy article announcing a "complete return to decentralized social networking" and offering a profound critique of the SocialFi model of the past decade.

"Crypto social projects often go astray. We in the crypto space far too often think that if you put a speculative token into something, that's 'innovation'."

He astutely pointed out that the crypto industry's past efforts to incentivize content have yielded little success, stemming from a lack of effective "quality screening mechanisms," rather than insufficient incentives. The value of tokens reflects popularity and hype, not content quality. Friend.tech, which exploded in popularity in 2023, is a prime example; its token price plummeted by 99%, and the platform was virtually abandoned.

Vitalik appreciates Substack's model because it proves that it is entirely possible to build a healthy economy around high-quality content, with its core being "subscribing to creators" and pushing quality content, rather than "creating price bubbles for them."

Based on this, he proposed a novel solution: to establish a non-tokenized, small-scale curatorial DAO.

This DAO uses member voting to select high-quality creators and uses a portion of the proceeds to buy back their tokens. In this way, the role of speculators shifts from "speculating on prices" to "predicting the DAO's choices," thereby directing market forces toward the discovery of quality content.

But in Vitalik's view, the key to solving the problem is not to create more sophisticated speculative tools, but to return to the technology itself and break platform monopolies through decentralization.

"There are no easy tricks to solve these problems. But there is an important starting point: more competition. Decentralization is the way to achieve this: a shared data layer on which anyone can build their own clients."

To this end, he practices what he preaches. Vitalik claims that since the beginning of 2026, all his social activities have been conducted through Firefly. Firefly is a client that aggregates multiple platforms such as X, Lens, and Farcaster. It does not rely on the API of any single platform, but rather uses the concept of a "shared data layer" to allow users to seamlessly move towards a more open and free decentralized social environment while retaining their existing habits.

A spark in the ruins

After reviewing Vitalik's thoughts on various fields over the past year, a main theme gradually becomes clear: what he cares about most and wants to uphold is the original intention of returning to decentralization and the persistence of transcending financial speculation.

Whether it's confronting Wall Street, building identity profiles for AI, defending privacy, or rebuilding decentralized social networks, every issue points to the same core: how to use technology to safeguard individual freedom and sovereignty in an era of ever-expanding centralized power.

In 1993, Eric Hughes wrote in "The Cypherpunk Manifesto":

"We cannot expect governments, corporations, or other large, anonymous organizations to grant us privacy out of goodwill. Talking about us is to their advantage, and they will. ... If we expect any privacy, we must defend it ourselves."

Thirty years later, we understand the weight of these words more than ever before. Tech giants are using data and AI to create information weapons, and geopolitical conflicts mean that any centralized system can become a tool in a power struggle. In today's world order, the value of a truly neutral and open digital public infrastructure has never been more apparent.

While the entire crypto industry is still searching for the next 100x coin, and in a time when industry innovation is waning, at least there are still people guarding the flame amidst the ruins.

Such persistence doesn't guarantee a "win" in the end. But at least this industry still has such thinkers who don't peddle the illusion of instant wealth, nor do they cater to short-term hype; they simply put that ancient creed into practice through thought and action.

"Cypherpunks write code."

And they are taking concrete actions to build a more open and equitable future for this increasingly divided world.