I. Introduction:

In previous articles, we have mentioned many times that Securitize, Ondo, Coinbase, and other representative institutions in the Web3 industry chose to enter the equity RWA track at almost the same time.

On January 24, Binance, a leading stock exchange, was also reported to be exploring the relaunch of stock-based RWA products on its platform. It's worth noting that these products were taken offline in 2021 due to compliance issues.

Just as major institutions were gearing up to seize the entry point to "on-chain stocks," the U.S. Securities and Exchange Commission (SEC) suddenly released a new guidance document, directly pouring cold water on this craze .

According to the regulatory standards specified in the document, more than half of the equity RWA products currently on the market may face the risk of being eliminated or forced to transform .

II. From "Ignore Item" to Being Acknowledged: The True Size of Equity RWA

In previous RWA data statistics, equity-based RWAs were often excluded from the statistics due to their small size . However, as more and more platforms begin to focus on this area, equity-based RWAs are gradually being included in mainstream statistical categories.

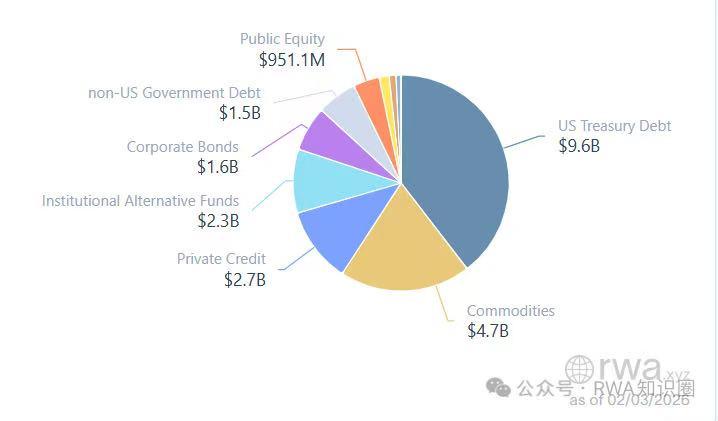

According to the latest data from rwa.xyz, the total market size of RWA excluding stablecoins has reached approximately $24.1 billion , of which public equity RWA accounts for approximately $95.1 million, or about 0.4% .

This proportion still seems small, but when compared to the traditional stock market with its trillion-dollar scale , it reveals enormous potential.

From an asset perspective, stocks possess a mature trading, clearing, and pricing system, making them far more liquid than traditional RWA assets such as real estate . This is precisely why, compared to "difficult-to-transfer" real estate, stocks are more easily "migrated" onto the blockchain, which is one of the key reasons why equity RWA has become a focal point of competition.

But that's precisely where the problem lies— securities are among the most strictly regulated financial products . To circumvent the compliance pressures of securitization, many platforms have begun to employ various methods to find loopholes in regulation.

3. "Like a stock, but not a stock": Equity RWA in the gray area

For example, Robinhood's "tokenized US stocks" product launched in Europe has a trading experience and price linkage mechanism that are highly similar to real stocks, but the tokens have not been authorized by the listed company issuer .

A similar situation has occurred with rumors of so-called " OpenAI tokenized equity ." Previously, a third-party platform claimed to offer "on-chain equity certificates for OpenAI," quickly attracting market attention. Subsequently, OpenAI officially denied any connection with any "tokenized equity," effectively pointing out the core problem with this type of structure—

On-chain assets do not represent a direct claim to the issuer's equity.

In the SEC's regulatory context, these products are closer to synthetic exposures constructed by third parties than to actual stocks.

Let's look at a few more typical cases:

Exodus (EXOD) received SEC approval to issue on-chain stock tokens, but its design is essentially a digital identifier stripped of voting and dividend rights . Users holding EXOD tokens can only reflect stock price fluctuations; they cannot be freely traded on-chain and do not enjoy core shareholder rights .

Backed Finance, on the other hand, uses the Swiss DLT (Democratic Literacy Act) framework and issues bTokens (which will soon be upgraded to xStocks):

After users complete KYC (Know Your Customer) procedures, they mint tokens using USDC. The platform then purchases an equivalent amount of stock in the traditional market as collateral and provides secondary market circulation through Solana. However, even so, these tokens are essentially price-tracking certificates, rather than true equity carriers .

Some platforms have opted for a more "financial engineering" approach, such as creating stock exposure through perpetual contracts or indexed derivatives to attract crypto derivatives players. This type of model does not emphasize settlement and focuses more on creating market buzz through price fluctuations , but it is therefore more prone to price distortions.

As can be seen, in order to avoid direct regulation of securitization issuance, many equity RWA products deliberately downplay the "equity" aspect itself, instead emphasizing returns, indexes, or derivative attributes. However, it is precisely these "borderline structures" that ultimately attracted a concentrated response from regulators.

IV. Latest SEC guidance: It's not a technical issue, but rather an "economic substance."

On January 29, the U.S. Securities and Exchange Commission (SEC) released its latest guidance on tokenized securities . The document did not negate tokenization itself, but rather systematically clarified long-standing structural issues in the market.

The SEC clearly classifies tokenized securities into two main categories:

Category 1: Tokenized securities led by the issuer

In this model, blockchain is directly introduced into the securities holder registration system. Whether the on-chain ledger serves as the primary registration system or runs in parallel with the off-chain database, the core logic remains the same— the transfer of on-chain assets will simultaneously trigger changes to the official shareholder register .

The SEC specifically emphasized that the only difference between this structure and traditional securities is the registration technology; it does not change the legal attributes, rights and obligations, or regulatory requirements of the securities .

in other words:

Tokenization can only change the "form", not the "nature".

Category 2: Third-party-led tokenized securities

These structures are now under a more cautious regulatory perspective. The document states that when a third party tokenizes securities without the issuer's participation, the on-chain assets do not necessarily represent ownership of the underlying securities , and token holders must also bear the additional risks of custody, operation, and even bankruptcy of the third party.

Based on this, the SEC further subdivides third-party tokenization into two typical models:

Custodial tokenized securities: In essence, they are certificates of security interests.

Synthetic tokenized securities: more similar to structured notes or security derivatives, they only track price performance and do not grant shareholder rights.

Throughout the document, the SEC repeatedly emphasizes not "whether blockchain is used," but a consistent criterion: as long as the economic substance of a financial instrument meets the definition of a security or derivative, regulation will not yield to "tokenization."

V. The Other Side of Strict Regulation: Rebuilding Order, Not a One-Size-Fits-All Approach

From an industry perspective, stricter regulation would indeed help to quell the many irregularities that exist in the current market.

Some projects involve the securities issuer actually using blockchain to register equity;

Some are simply tokens issued arbitrarily by third parties, which then claim to be "linked to a certain stock";

Some on-chain assets can trigger official equity changes;

Some of them were things that even the issuers themselves had never heard of.

If these differences are blurred, it is often the ordinary users who are ultimately misled. Of course, it must also be acknowledged that...

Third-party-led tokenization structures are not entirely without market demand.

For some investors, these products do offer a lower barrier to entry and a more convenient way to participate, especially given the high entry costs and restrictions on cross-border transactions in the traditional financial system.

From the project owner's perspective, this type of structure also has real appeal.

Some companies do not wish to introduce complex equity structures in the early stages, or deliberately avoid further dilution of equity for compliance, strategic, or other reasons. In this context, issuing "price-exposed" or "yield-mapped" tokenized products through third parties can meet the market's demand for value representation and trading participation without changing the company's equity structure or introducing new shareholder rights.

For this reason, third-party-led tokenization is not simply "regulatory arbitrage," but rather a compromise solution spontaneously chosen by the market under real-world constraints.

VI. Conclusion: The future of RWA lies not in "circumventing regulation," but in "reconstructing financial infrastructure."

The tension between innovation and regulation has always been an unavoidable theme in the financial industry.

RWA, as a new paradigm that attempts to restructure the way assets are issued and circulated, is also caught in this tug-of-war.

While the SEC's guidance document has indeed tightened the development space for some equity RWAs in the short term, it doesn't mean that "issuer-led" is the only correct approach. Instead, it serves as a reminder to the market that different structures carry different risks, and these risks need to be clearly identified and truthfully disclosed.

From this perspective, third-party-led tokenization structures, synthetic products, and price mapping mechanisms may still play a role in specific stages and markets—especially in scenarios where equity dilution is not desired, direct securities issuance is not feasible, or limited economic exposure is desired .

The real issue is not "which model should be eliminated," but rather: when assets are put on the blockchain, are the rights clear, the risks commensurate, and the boundaries adequately defined ?

RWA's future may not lie in which side it chooses to stand on, but in whether it can provide a more transparent, controllable, and realistic way of representing assets for different participants within regulatory boundaries.