Original author: Luis Flavio Nunes

Original translation: TechFlow TechFlow

Introduction: On January 29, 2026, Bitcoin plummeted 15% in a single day, falling from $96,000 to $80,000. Strangely, it should have risen as a safe-haven asset during a stock market crash, but it fell; it should have fallen as a risk asset when the Federal Reserve released hawkish signals, but it also fell. Bitcoin crashed in two contradictory events.

This article points out that Bitcoin is simultaneously playing four contradictory roles: an inflation hedge, a tech stock, digital gold, and an institutional reserve asset. When these four roles vie for control, the result is chaos.

The authors propose four possible solutions and analyze which path would push Bitcoin to $150,000.

The full text is as follows:

On January 29, 2026, Bitcoin plummeted 15% in a single day, falling from $96,000 to $80,000. What's remarkable isn't the crash itself, but that Bitcoin fell while two opposing events occurred simultaneously.

The stock market crash. This should help Bitcoin as a safe-haven asset.

The Federal Reserve has signaled a tightening policy. This should dampen Bitcoin's performance as a risk asset.

Bitcoin crashed on both occasions. When it should have moved inversely to stocks, it moved in tandem with them. When digital gold should have risen, it fell on hawkish news. The fundamental logic by which the market understands Bitcoin has been shattered.

Four Incompatible Identities

Bitcoin is traded simultaneously as four different assets. Each identity demands different price behavior. When all four identities vie for control, the result is chaos.

Identity 1: Inflation Hedging

Bitcoin has a fixed supply of 21 million coins. When governments print money and devalue their currencies, Bitcoin should rise. This was the initial promise. Digital scarcity triumphs over the government's printing press.

The data tells different stories. In 2025, when inflation fears dominated the market, gold rose 64%, while Bitcoin fell 26%. Bitcoin sometimes rose when the Consumer Price Index (CPI) showed an unexpected increase. Bitcoin sometimes fell when core personal consumption expenditures (Core PCE) showed inflation. The reaction was random, not consistent.

If Bitcoin were truly an inflation hedge, it should react equally to all inflation signals. Instead, it reacts to some signals but ignores others. This suggests that Bitcoin reacts to other things, perhaps energy prices that influence mining costs and consumer inflation.

Identity Two: Technology Stock

Bitcoin moves in tandem with the Nasdaq. The 30-day correlation is 0.68. When tech stocks fall due to growth concerns, Bitcoin falls. When the Federal Reserve hints at tightening and tech stocks sell off, Bitcoin sells off even more sharply.

If Bitcoin were a tech stock, investors might as well just buy the Nasdaq index. Tech stocks don't pay dividends, but they generate revenue and profits. Bitcoin generates neither. It makes more sense to bet purely on technology through actual tech stocks.

The problem goes deeper. Bitcoin is supposed to be uncorrelated with traditional markets. That's the whole value proposition. If Bitcoin is just a leveraged Nasdaq bet, then it serves no purpose in an already held stock portfolio.

Identity Three: Digital Gold

In late January, gold surged to $5,500 as investors fled risk. Bitcoin crashed to $80,000. At exactly the moment when digital gold should have proven its worth, the two assets moved in opposite directions.

The correlation between Bitcoin and gold turned negative in 2026, specifically -0.27. While gold rose 3.5% on hawkish Federal Reserve news, Bitcoin fell 15%. The Bitcoin-to-gold ratio hit an all-time low of 16.68.

If Bitcoin is digital gold, it fails the most basic test. Gold is effective as a crisis hedge because it moves away from risky assets when panic rises. Bitcoin moves with risky assets, proving that it is not gold in any meaningful sense.

Identity Four: Institutional Reserve Assets

Some corporations and governments hold Bitcoin as strategic reserves. Metaplanet in Japan holds 35,100 Bitcoins. The US government has consolidated seized Bitcoins into its strategic reserves. This narrative suggests that Bitcoin will become a core holding for pension funds and central banks.

The behavior contradicts the narrative. Institutional investors are not holding amidst volatility. They are running basis trades, selling volatility, and treating Bitcoin as a trading instrument. ETF flows primarily indicate arbitrage activity, not long-term conviction buying.

If institutions truly viewed Bitcoin as a reserve asset like gold, they would accumulate it during crashes and never sell it. Instead, they sell during crashes and buy during rallies. This is trader behavior, not reserve manager behavior.

Valuation Paradox

Each identity implies a different fair value for Bitcoin.

If Bitcoin is an inflation hedge, its price should be between $120,000 and $150,000, based on gold's performance under similar monetary conditions.

If Bitcoin were a tech stock, its price should be between $50,000 and $70,000, based on its correlation with the Nasdaq and its lack of cash flow.

If Bitcoin is digital gold, based on the 65-year value trajectory of gold applied to digital scarcity, its price should exceed $150,000.

If Bitcoin is an institutional reserve asset, its price should track adoption rates by governments and businesses, implying a potential price of $100,000 to $120,000 by the end of the year.

The current price of $80,000 does not satisfy any of these frameworks. It's in the middle, neither pleasing any model nor validating any argument. This is not a market seeking equilibrium. This is a market that cannot agree on its pricing object.

When Wall Street cannot define what it owns

Robbie Mitchnick manages digital asset strategies at BlackRock, the world's largest asset management firm. In March 2025, he made some noteworthy remarks:

"Bitcoin fundamentally looks like digital gold. But there are days when it doesn't trade that way. When tariffs were announced, it dropped like a stock, which puzzled me because I didn't understand why tariffs would affect Bitcoin. The answer is they don't."

Even major institutional advocates of Bitcoin admit to confusion. If BlackRock doesn't understand what Bitcoin is, how can retail investors be expected to know?

This confusion creates a mechanical problem. When institutions cannot categorize assets, they default to using correlation-based risk models. These models assume that historical correlations persist. When correlations suddenly shift, as happened in January, institutions must rebalance their portfolios. Rebalancing during a crash means forced selling. Forced selling creates a cascading effect.

Imagine it as a ship's autopilot. The autopilot steers based on past wind patterns. When the wind suddenly changes direction, the autopilot overcorrects, causing violent swaying. Humans can judge whether the course can be smoothed out, but the autopilot only knows historical patterns. Bitcoin's identity crisis is like the changing winds, and institutional algorithms are like the autopilot overcorrecting in the storm.

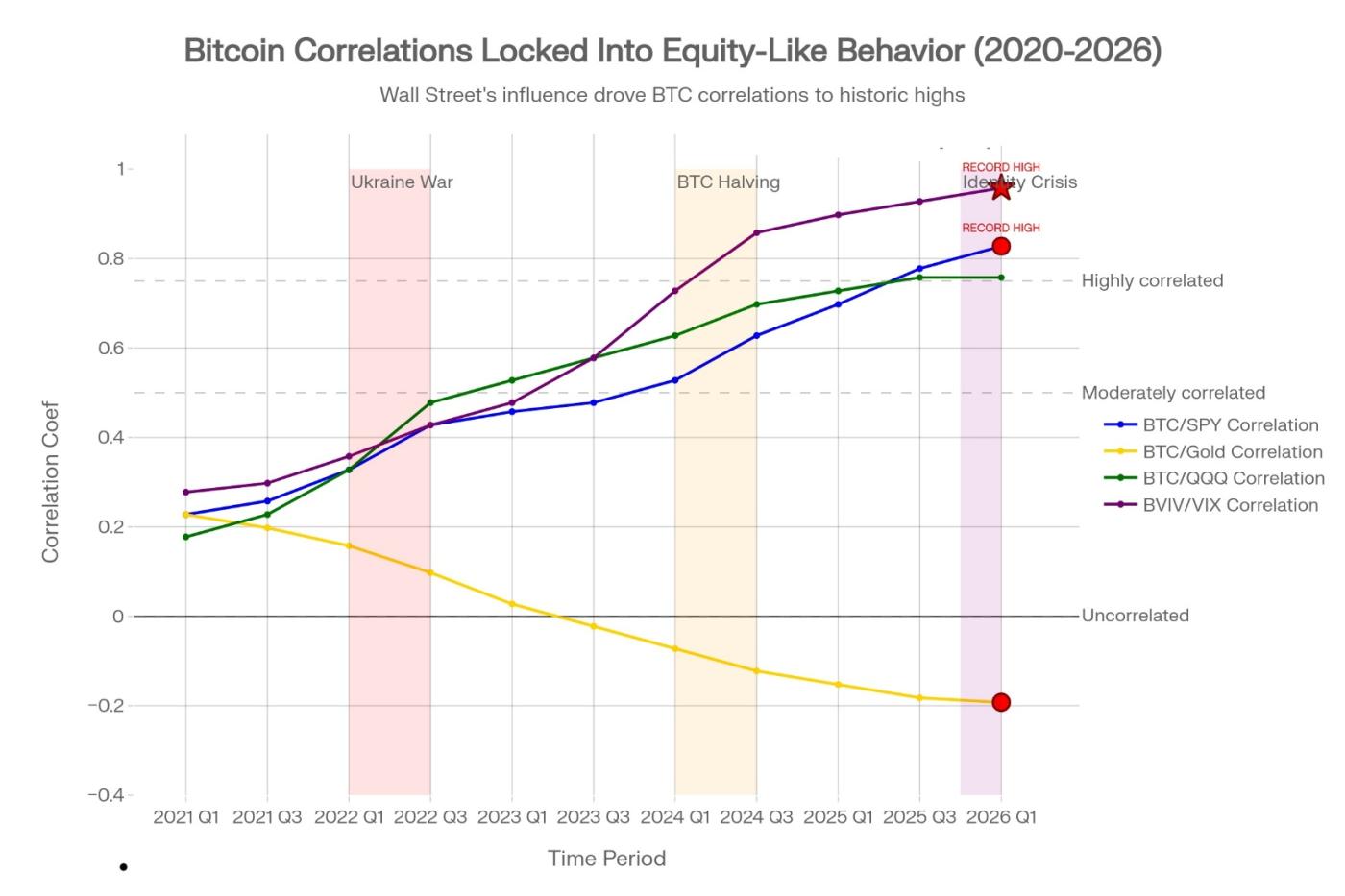

The Death of Diversification: Bitcoin's correlation with stocks has surged from 0.15 (2021) to 0.75 (January 2026), a five-year shift driven entirely by institutional risk management, rather than Bitcoin adoption or fundamentals. An even more damaging metric: Bitcoin volatility now correlates with stock volatility at 0.88 (purple line), the highest level ever recorded. This proves that Bitcoin is traded mechanically based on stocks, rather than on its intrinsic utility. Investors buying Bitcoin as a hedge are essentially buying leveraged, volatile stock bets that amplify rather than offset losses during crashes.

Volatility homogenization

Bitcoin volatility is now moving in tandem with stock market volatility. The correlation between Bitcoin volatility and the VIX stock volatility index reached 0.88 in January 2026. This is the highest reading ever recorded.

In 2020, this correlation was 0.2. Bitcoin volatility is independent. By 2026, it has become similar to stock volatility.

This is because institutional traders are simultaneously selling volatility across all asset classes. When the VIX rises above certain levels, the algorithm automatically sells Bitcoin, stocks, and commodities to reduce portfolio volatility. This mechanical selling is unrelated to Bitcoin fundamentals. It's pure risk management, applied equally across all assets.

The result is that Bitcoin has lost its independent price discovery mechanism. Its price is no longer driven by adoption, use, or scarcity. It is driven by correlation assumptions and volatility control algorithms.

The data proves this. In January 2026, even as the price rebounded to $96,000, Bitcoin's daily active addresses continued to decline. Even with institutional adoption reportedly accelerating, transaction volume was still decreasing. The Lightning Network, which processes actual Bitcoin payments, saw a 266% year-over-year increase. However, the price fell.

Usage increased. Prices fell. This proves that price is driven by positioning and correlation, not fundamentals.

Reflexivity Trap

George Soros describes reflexivity as a feedback loop in which price movements themselves drive further movements, independent of fundamentals.

Bitcoin has fallen into a state of reflexivity.

The institution assumes a correlation of 0.75 between Bitcoin and stocks. Options traders construct hedges based on this assumption. When the stock moves by 2%, the algorithm triggers a 2% movement in Bitcoin. This creates a self-fulfilling prophecy. Bitcoin moves with the stock, so traders treat it as a stock. Retail investors adopt this view and trade accordingly. The actual fundamentals of Bitcoin become irrelevant. Price becomes completely detached from utility.

This isn't temporary confusion. It's structural. The reflexive cycle will persist until institutions agree on what Bitcoin is. Every rally will contain the seeds of the next crash because the market can't agree on why it's rallying.

What do retail investors actually own?

Most retail investors believe they are diversifying when buying Bitcoin. They believe Bitcoin can hedge against inflation and reduce stock exposure. Mathematical proofs otherwise.

To give a simple example, an investor holds $100,000 in stocks and allocates $5,000 to Bitcoin in hopes of diversification.

When stocks fall 10%, the portfolio loses $9,000. However, Bitcoin, with a correlation of 0.75 with stocks, loses $750 when it falls 15%. Total loss: $9,750.

Without Bitcoin, the loss would have been $9,000. Bitcoin made the portfolio worse, not better. This correlation means that Bitcoin amplified stock losses, rather than offset them.

True diversification requires negative correlation. During periods of risk aversion, bonds and stocks are negatively correlated. Gold is negatively correlated during crises. Bitcoin is positively correlated, rendering it useless as a hedge.

The inevitable solution

Bitcoin cannot maintain four conflicting identities. The market will force a resolution through one of four paths in 2026.

Path 1: Strategic Reserves

Governments and corporations treated Bitcoin like a gold reserve. They bought and never sold. Price fluctuations became irrelevant because holders measured success in decades, not quarters. Institutions stopped trading Bitcoin and began hoarding it. The price found equilibrium based on slow, steady accumulation. This path led to $120,000 to $150,000 by the end of the year.

Path Two: Normalization of Risky Assets

Institutions have officially categorized Bitcoin as a commodity derivative or equity analogue. They construct risk models that account for extreme volatility. They accept that Bitcoin is not a hedging tool, but rather a leveraged bet on monetary expansion. Position sizes are adjusted accordingly. Correlation becomes predictable because everyone agrees on what Bitcoin is. The price trades in the $80,000 to $110,000 range with low volatility.

Path Three: Acceptance of Inflation Hedging

After addressing which inflation metric was more important, the market agreed that Bitcoin reacts to currency devaluation rather than changes in consumer prices. Its correlation with stocks dropped to 0.3 or 0.4. Bitcoin became a true alternative to gold. This path led to a price range of $110,000 to $140,000 as portfolio managers allocated for inflation protection.

Path Four: Diversification Failure

Institutions realized that Bitcoin could not diversify their stock portfolios. The correlation of 0.75 was too high to justify the allocation. Capital flows reversed as portfolio managers exited. Retail investors understood that Bitcoin was not a hedging tool. As the strategic allocation narrative collapsed, the price plummeted to between $40,000 and $60,000.

The most likely outcome is a slow resolution in 2026. Bitcoin will gradually shift from a risk asset to a reserve asset, experiencing cyclical corrections as institutions recalibrate. The price will consolidate between $80,000 and $110,000 until one path dominates.

What needs attention?

Four indicators will show which path Bitcoin is taking.

- Correlation inflection point: If Bitcoin stops moving with stocks and the correlation drops below 0.5, it will once again become a hedging tool. This favors path three.

- Government announcements: Path One will accelerate if major governments formally allocate Bitcoin to their reserves. Pay attention to announcements from the US, EU, or Japan.

- On-chain metrics: If daily active addresses and transaction volume reverse upwards when prices are flat or falling, it indicates improving fundamentals even with reduced speculation. This demonstrates long-term strength.

- Volatility Normalization: If the correlation between Bitcoin volatility and stock volatility falls below 0.60, institutional volatility selling is easing. This allows for a return to true price discovery.

These indicators don't require capital to track. They offer better insights than price charts.

in conclusion

Bitcoin's drop to $80,000 was not unexpected. It confronts a question Bitcoin has been avoiding since the arrival of institutional funds: What am I?

Until this question has a clear answer, every rally will contain the seeds of the next crash. Bitcoin will move with stocks when it should diverge. It will fall on news that should help it. It will rise on developments that shouldn't matter.

This is not a temporary confusion. This is a structural identity crisis that defines the entire narrative of 2026.

Investors who buy Bitcoin as an inflation hedge will be disappointed during periods of inflation panic. Investors who buy it as a diversification tool will be disappointed when it amplifies stock losses. Investors who buy it as digital gold will be disappointed when it trades like tech stocks.

The only investors who will succeed are those who understand that Bitcoin is not what it is right now. It is a position-driven, correlation-dependent, volatility-controlled tool that has temporarily lost its connection to its fundamental purpose.

The crash exposed this truth. Recovery will depend on whether Bitcoin can answer what it is before institutions decide its fate.