Original text: " Why Institutions Aren't Coming On-Chain "

Compiled by: Ken, Chaincatcher

Summary: While current money market protocols (such as Aave, Morpho, Kamino, and Euler) serve lenders well, they fail to serve a broader borrower base , particularly institutional borrowers, due to the lack of fixed borrowing costs. As only lenders are well served, market growth has stagnated.

From the perspective of money market agreements, fixed interest rates for P2P lending are a natural solution, while interest rate markets offer an alternative that is 240-500 times more capital efficient.

P2P fixed-rate lending and the interest rate market are complementary and both are essential for each other's prosperity.

Insights from leading agreements: Everyone wants to offer borrowers a fixed rate.

Each team's roadmap at the beginning of the year usually sets the tone for future development.

Morpho, kamino, and eulerfinance are leading on-chain money markets with a total value locked of $10 billion. Browsing their 2026 roadmaps, one obvious theme stands out: fixed interest rates .

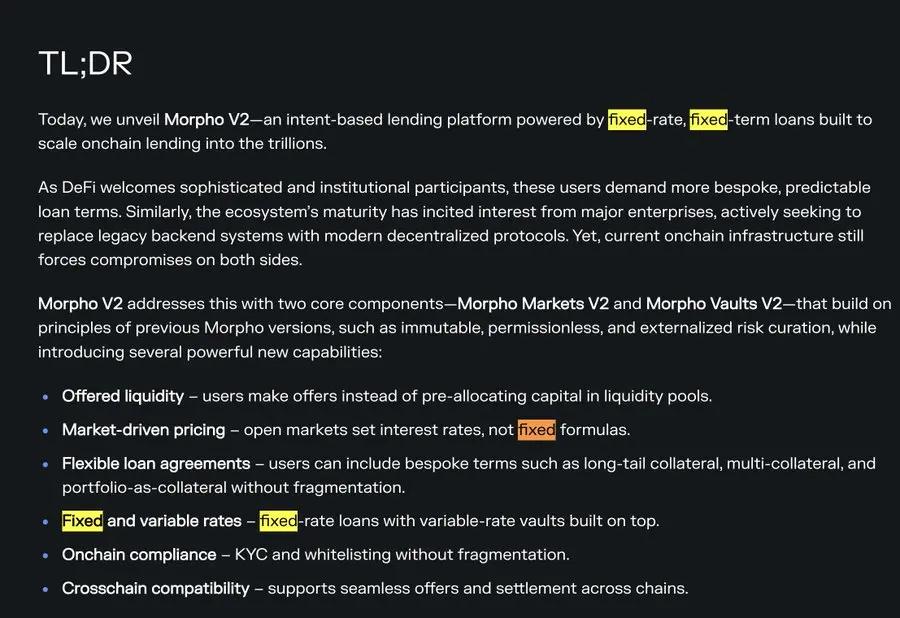

Morpho :

[1] Morpho V2 Briefing

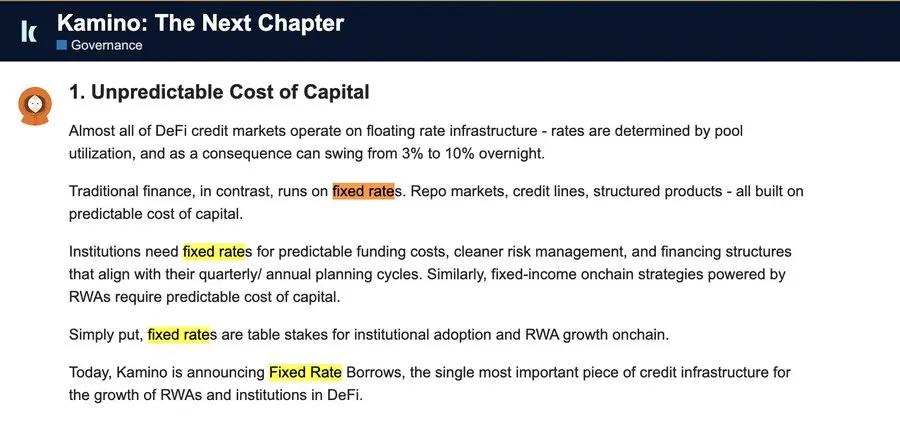

Kamino:

[2] Kamino's 2026 plan

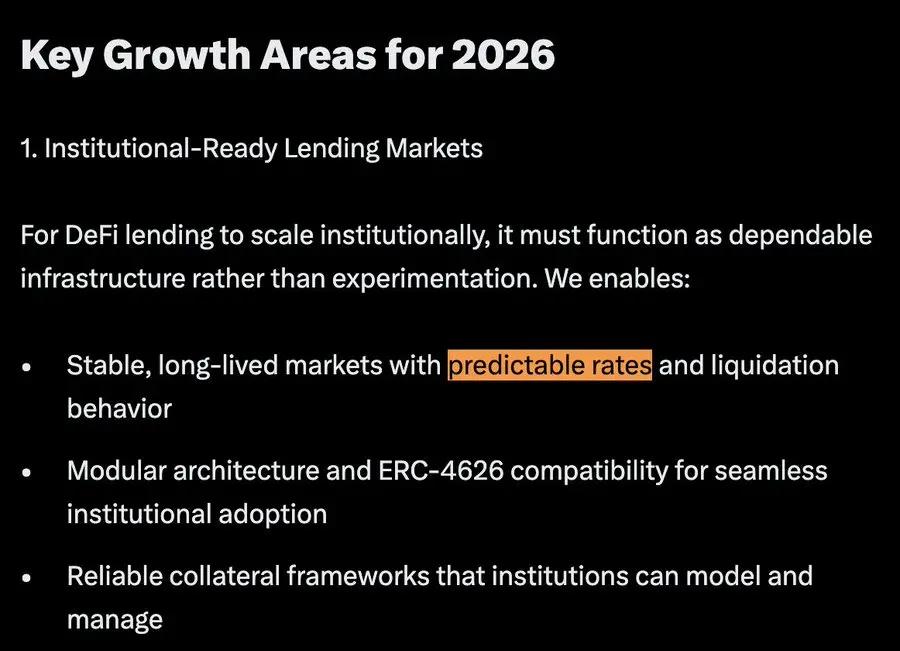

Euler:

[3] Euler's 2026 Roadmap

[3] Euler's 2026 Roadmap

The term “fixed rate” or “predictable rate” appeared 37 times in the 2026 announcements of Morpho, kamino, and eulerfinance. Excluding irrelevant terms, this was the most frequently used term in the announcements and appeared as a top priority in all three roadmaps.

Other keywords include: institutions, real-world assets, and credit.

What's going on?

Early decentralized finance: Fixed interest rates for borrowers "didn't matter at all".

For the builders, early decentralized finance (DeFi) was fun and experimental. But for the users, early DeFi could be summed up in two words: absurd speculation and terrifying hacking attacks .

Absurd speculation

From 2018 to 2024, decentralized finance (DeFi) resembled a "Martian casino" detached from the real world. Liquidity was primarily driven by early retail investors and speculative activity. Everyone was chasing four-figure annualized returns. Nobody cared about borrowing at fixed interest rates.

The market is highly volatile and unpredictable. Liquidity lacks stickiness. The overall loan-to-value ratio fluctuates wildly with market sentiment. Given the negligible demand for fixed-rate borrowing, the demand for fixed-rate lending is even lower.

Lenders prefer the flexibility to withdraw funds at any time. No one wants their funds locked up for a month—because in a nascent and rapidly changing market, a month feels like a lifetime.

Terrible hacking attack

Between 2020 and 2022, hacker attacks were rampant. Even blue-chip protocols were not spared: Compound suffered a major governance vulnerability in 2021, resulting in tens of millions of dollars in losses. Overall, decentralized finance vulnerabilities caused losses of up to billions of dollars during this period, deepening institutional skepticism about the risks of smart contracts.

Institutional investors and high-net-worth individuals have limited trust in the security of smart contracts. Consequently, participation from more conservative funding pools remains extremely low.

Conversely, institutions and high-net-worth individuals borrow from off-chain platforms such as Celsius, BlockFi, Genesis, and Maple Finance to mitigate the risks associated with smart contracts.

At that time, there was no such thing as "just use Aave" because Aave's status as the safest decentralized finance protocol had not yet been established.

Catalyst for change

I'm not sure if this was intentional or a coincidence, but we often refer to platforms like Aave and Morpho as "lending protocols"—and there's definitely something to note about this, even though both lenders and borrowers use them.

The name "lending agreement" is actually quite apt: these platforms excel at serving lenders, but are clearly lacking in serving borrowers.

Borrowers seek fixed borrowing costs, while lenders want the ability to withdraw funds at any time and earn floating interest rates. Current protocols serve lenders well but not borrowers. Without fixed-rate borrowing options, institutions won't lend on-chain, and the two-sided market can't grow—which is why these platforms are currently actively working to build fixed-rate functionality.

Even though this structure is extremely advantageous to lenders, change often stems from user pain points or product improvements. Over the past year and a half, decentralized finance has accumulated considerable experience in both areas.

In terms of pain points, fixed-income cyclical strategies are constantly being hurt by fluctuations in borrowing costs, while the spread between off-chain fixed rates and on-chain floating rates is also widening.

User pain point 1: Fixed income revolving strategy

Traditional finance offers a wide range of fixed-income products. Decentralized finance, however, only really began to offer such products in 2024 when Pendle and liquid staking protocol began splitting the returns on ETH liquidity staking.

When revolving loans on fixed-income tokens, the pain caused by interest rate volatility becomes apparent – the 30-50% APY promised by the revolving strategy is often completely wiped out by interest rate fluctuations.

I personally tried to automate the opening and closing of these strategies based on interest rate changes, but each adjustment incurred costs across multiple levels: the underlying yield source, pens, the money market, and gas fees. Clearly, volatile borrowing rates are unsustainable—it frequently resulted in negative returns for me. Pricing borrowing costs based on on-chain liquidity dynamics introduced volatility far exceeding acceptable levels.

This growing pain is merely the prelude to the on-chaining of private lending. Private lending predominantly tends towards fixed-rate borrowing because real-world business activities require certainty. If decentralized finance is to evolve beyond being merely a "Martian casino" detached from real-world economic activity and truly support meaningful business activities (such as GPU mortgage loans and credit lending to trading companies), then fixed interest rates are inevitable.

User pain point 2: Widening spread between fixed and floating interest rates

Because lending protocols offer lenders excellent services—flexible withdrawals, no KYC required, and easy to programmatically operate—on-chain lending liquidity has been steadily increasing.

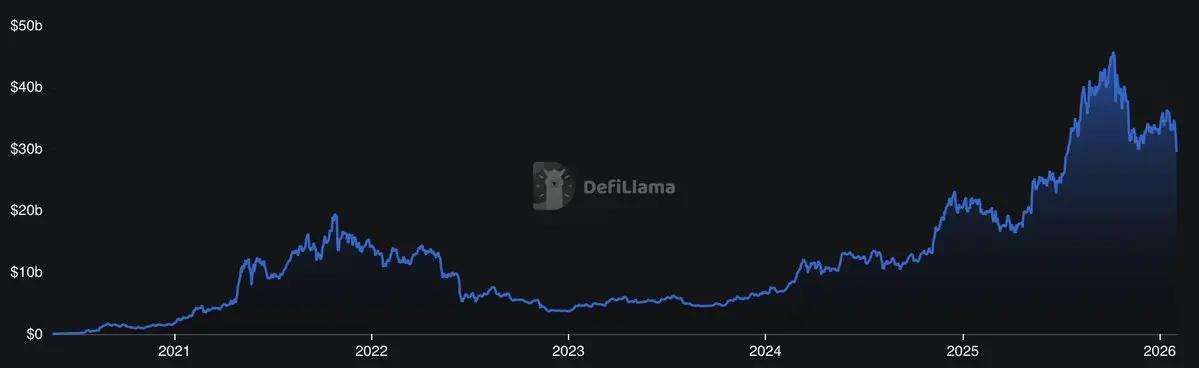

[5] Aave TVL historical price chart. The growth rate of this chart is approximately twice that of Bitcoin's price increase.

As lending liquidity increases, the floating borrowing rates on these protocols are decreasing. While this may seem beneficial to borrowers, it is largely irrelevant to institutional borrowers—who prefer fixed-rate loans and are accessing them through off-chain channels.

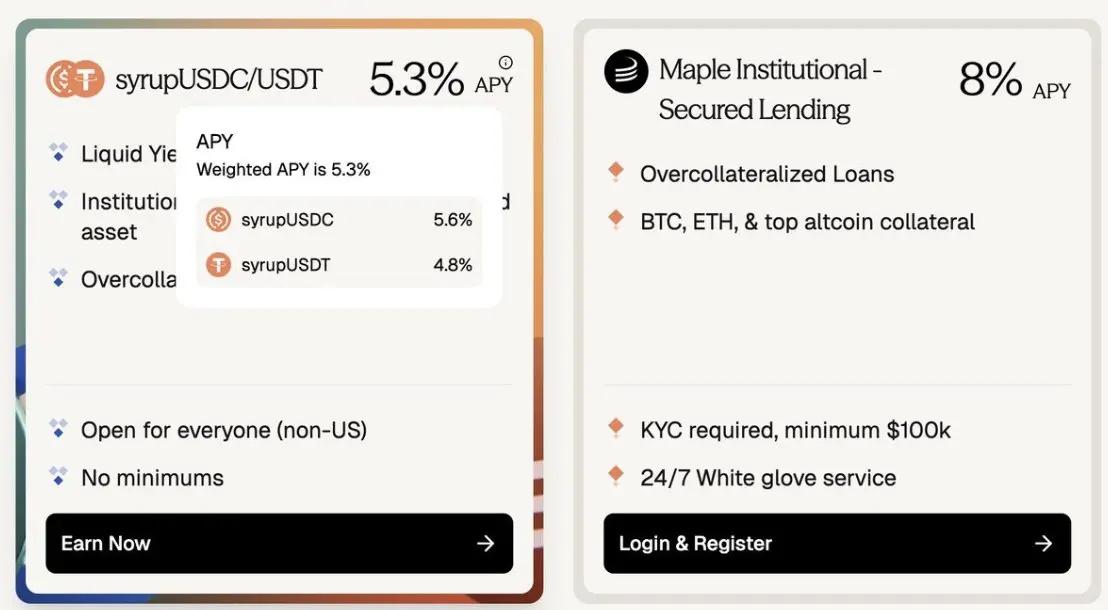

The real pain point in the market lies in the widening gap between off-chain fixed-rate borrowing costs and on-chain floating rates. This gap is quite significant. Institutions pay an average premium of 250 basis points (bps) for fixed-rate borrowing, while for blue-chip Altcoin collateral, the premium can reach as high as 400 bps. Based on the 4% Aave benchmark rate, this represents a premium of 60-100%.

[6] Aave ~3.5% vs Maple ~8%: Fixed-rate loans backed by crypto assets have a premium of approximately 180-400 bps.

The other side of this gap is the compression of on-chain yields. Because the current lending market is structurally biased towards lenders, it attracts more lenders than borrowers—which ultimately hurts lenders' returns and causes protocol growth to plateau.

Product Progress: Decentralized Finance Becomes the Default Choice for Lending

In terms of development, Morpho has been integrated into Coinbase, becoming its primary source of revenue, while Aave has become a pillar of protocol treasury management, retail stablecoin savings applications, and new stablecoin banks. Decentralized finance lending protocols provide the most convenient way to obtain stablecoin yields, with liquidity continuously flowing onto the blockchain.

As TVL increases and yields decrease, these lending agreements are actively iterating, considering how they can also become excellent "borrowing agreements" to serve borrowers and balance the two-sided market.

Meanwhile, decentralized finance protocols are becoming increasingly modular—a natural evolution from Aave's "one-size-fits-all" liquidity pool model (note: although I believe there will still be long-term, ongoing demand for the liquidity pool model—a topic for later articles). With Morpho, Kamino, and Euler leading the modular lending market, loans can now be more precisely customized based on collateral, LTV (loan-to-value ratio), and other parameters. The concept of independent credit markets is emerging. Even Aave v4 is upgrading to a spoke-wheel modular market structure.

The modular market structure paves the way for the on-chaining of new collateral types (Pendle PTs, fixed-income products, private credit, RWA), further amplifying the demand for fixed-rate borrowing.

Mature Decentralized Finance: The Money Market Thrives Through the Interest Rate Market

Market gap:

Borrowers strongly prefer fixed interest rates (good off-chain service) > Lenders strongly prefer floating interest rates and the flexibility to withdraw funds at any time (good on-chain service)

If this market gap is not bridged, the on-chain money market will stagnate at its current size and will be unable to expand into the broader money and credit markets. There are two clear paths to bridge this gap, which are not competing with each other, but rather highly complementary and even symbiotic.

Path 1: P2P fixed interest rate completed by the administrator

The P2P fixed-rate model is very intuitive : for every fixed-rate loan request, an equal amount of funds is locked up for fixed-rate lending. While this model is simple and elegant, it requires a 1:1 liquidity match .

According to the 2026 announcement, all major lending agreements were being built through P2P fixed-rate platforms. However, individual investors did not directly lend to these P2P fixed-rate markets, primarily for two reasons:

They value the flexibility of withdrawals;

They face too many independent markets that need to be evaluated and selected.

Therefore, only the liquidity currently deployed in the vaults of risk management institutions can be lent to these fixed-rate markets—and even then, only a portion can be lent. Risk management institutions must maintain sufficient liquidity to meet depositors' immediate withdrawal needs.

This presents a tricky dynamic game for risk management institutions that need to meet immediate withdrawal requirements:

When deposit withdrawals surge and vault liquidity is insufficient due to funds being locked in fixed-rate loans, vaults lack mechanisms to curb withdrawals or encourage deposits. Unlike money markets with utilization curves, vaults are not structurally designed to maintain withdrawal liquidity . More withdrawals do not necessarily translate into higher yields for vaults. If vaults are forced to sell their fixed-rate loans on the secondary market, these loans are likely to trade at a discount—potentially leading to insolvency (similar to the Silicon Valley Bank situation in March 2023).

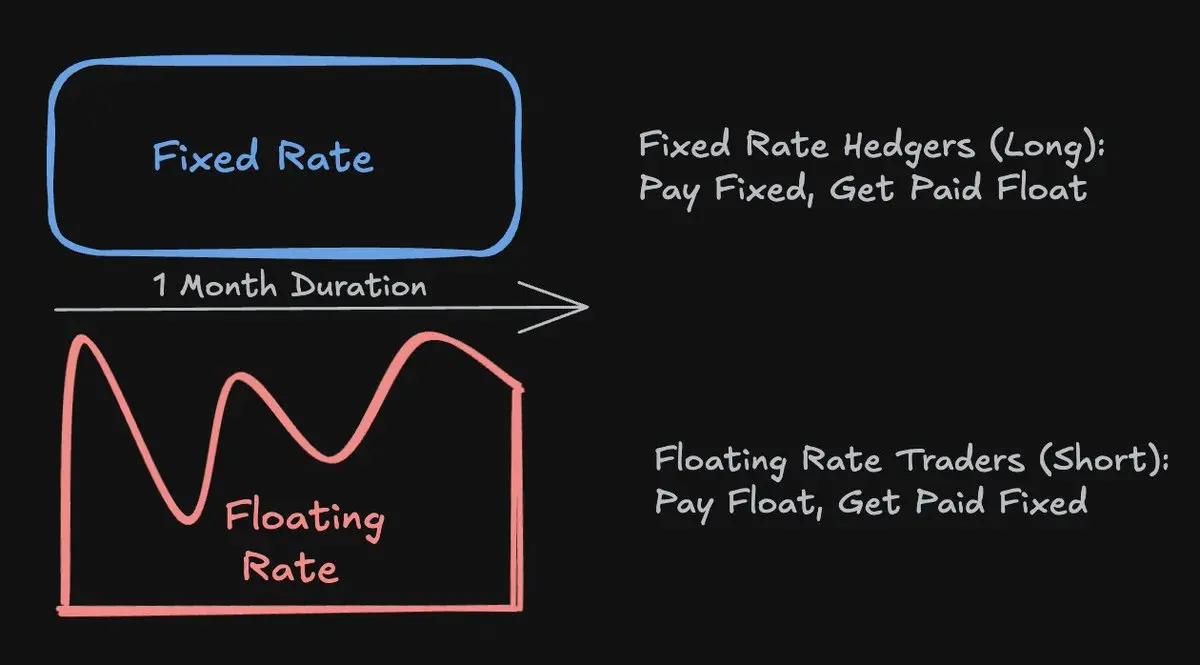

To mitigate this tricky dynamic, risk management firms prefer to do what traditional lenders typically do: swap fixed-rate loans for floating-rate loans through interest rate swaps.

They pay a fixed rate to the swap market and receive a floating rate in return, thus avoiding the risk of being locked into a low fixed rate when floating rates rise and withdrawals increase.

In this context, institutional lenders and risk management firms utilize the interest rate market to better provide fixed-rate liquidity.

Path 2: Interest Rate Market Based on Money Market

The interest rate market does not directly match lenders and borrowers at fixed rates . Instead, it matches borrowers with funds willing to cover the difference between the agreed-upon fixed rate and the floating rate generated by the money market utilization curve. This approach provides capital efficiency that is 240 to 400 times higher than the 1:1 matching liquidity required by the P2P market.

The calculation logic for capital efficiency is as follows:

Borrowing 100m (100 million) from Aave's existing liquidity at a floating rate; the borrower wants to convert this floating rate loan into a one-month fixed rate loan. Assuming the fixed rate is priced at APR 5%; 100m * 5% / 12 = 416k; the interest rate swap achieves an inherent leverage of 100m / 416k ≈ 240 times.

Morpho

Interest rate exchanges help hedgers and traders price and exchange fixed and floating interest rates.

Interest rate exchanges built on the money market cannot offer purely fixed-rate loans like the P2P model—theoretically, hedgers could face automatic liquidation (ADL) risk if interest rates surge tenfold and remain high for an extended period.

However, the likelihood of this happening is extremely low, and it has never occurred in the three-year history of Aave or Morpho. Interest rate exchanges can never completely eliminate ADL risk, but they can employ multiple layers of protection—such as conservative margin requirements, insurance funds, and other safeguards—to reduce it to a negligible level. This trade-off is very attractive: borrowers can obtain fixed-rate loans from tried-and-tested, high-TVL money markets like Aave, Morpho, Euler, and Kamino, while benefiting from capital efficiency 240-500 times higher than in P2P markets.

Path 2 reflects how traditional finance works—the daily $18 trillion in interest rate swap transactions facilitate credit, fixed-income products, and real economic activity.

This approach, which combines proven money market security, $30 billion in existing liquidity on lending protocols, appropriate risk mitigation measures, and superior capital efficiency, makes interest rate exchanges a pragmatic path to scaling fixed-rate lending on-chain.

An Exciting Future: Connecting Markets and Expanding Credit

If you persevered and read through the previous section on dry mechanisms and market microstructures, hopefully this section will inspire your imagination about future development paths!

Some predictions:

1. The interest rate market will become as important as existing lending agreements.

Because borrowing primarily occurs off-chain while lending mainly takes place on-chain, the market remains incomplete. Interest rate markets, by catering to the different preferences of borrowers and lenders to connect lending demand, significantly expand the potential of existing money market protocols and will become an integral part of the on-chain money market.

In traditional finance, the interest rate market and the money market are highly complementary. We will see the same dynamics unfold on the blockchain.

2. Institutional Credit: Interest Rate Markets Become a Pillar of Credit Expansion

Disclaimer: “Credit” here refers to uncollateralized or undercollateralized money markets, not overcollateralized modular markets (such as the Morpho Blue market).

The credit market is even more dependent on the interest rate market than over-collateralized lending. When institutions finance real-world activities such as GPU clusters, acquisitions, or trading operations through credit, predictable funding costs are crucial. Therefore, as on-chain private lending and RWA expand, the interest rate market will evolve accordingly.

To link off-chain, real-world yield opportunities with on-chain stablecoin capital, the interest rate market is a more critical pillar for on-chain credit expansion. @capmoney_ is a leader in institutional lending and a team I closely follow to understand the future direction of the industry. If you are interested in this topic, I recommend you follow them as well.

3. Consumer Credit: Everyone can "borrow to consume".

Selling assets triggers capital gains tax, which is why ultra-high-net-worth individuals (Ultra-HNWs) almost never sell assets; they choose to borrow and consume. I can imagine that in the near future, everyone will have the privilege of "borrowing and consuming" instead of "selling and consuming"—a privilege currently reserved only for the super-rich.

Asset issuers, custodians, and exchanges will have a strong incentive to issue credit cards that allow people to borrow and spend directly using collateralized assets. For this system to operate on a fully self-custodied stack, decentralized interest rate markets are essential.

@EtherFi's credit cards pioneered the collateral-based consumer credit model, with its credit card business growing by 525% last year and processing a peak of $1.2 million in payments in a single day. If you don't already have an EtherFi card, I highly recommend giving it a try and exploring "borrowing to spend"!

Finally, I want to point out that fixed interest rates are far from the only catalyst for money market growth. There are many issues that only money markets can address—for example, supporting off-chain collateral and oracles based on RWA redemption mechanisms for revolving strategies, among others. The challenges ahead are numerous, and I am genuinely curious and hope to contribute to the evolution of this market.

If you've read this far, thank you for joining me in exploring the details of this fascinating market!

At @SupernovaLabs_, we're fascinated by the nuances of this market's evolution every day. Our goal is to be a pillar of existing lending protocols, helping them better serve borrowers in the market. We believe this will unlock borrowing demand, drive credit expansion, and become an integral part of the on-chain economy. The opportunity is there, and now is the time. We'll have more product launch announcements next week.

[ 1] Morpho v2: https://morpho.org/blog/morpho-v2-liberating-the-potential-of-onchain-loans/

[2] Kamino The Next Chapter: https://gov.kamino.finance/t/kamino-the-next-chapter/864

[3] Euler's 2026 Roadmap: https://x.com/0xJHan/status/2014754594253848955

[4] Casino on Mars: https://www.paradigm.xyz/2023/09/casino-on-mars

[5] DefiLlama: Aave TVL https://defillama.com/protocol/aave

[6] Maple Finance Yield: https://maple.finance/app