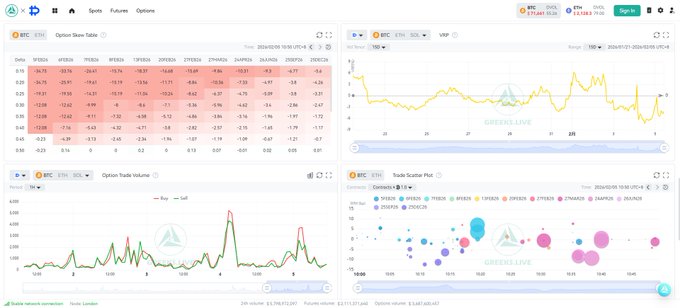

Market Betting $BTC Prices fell below 70,000, market makers were caught in a -Gamma collapse, becoming the biggest driver of the sell-off 🧐 IV and Skew continued to rise, no longer just simple panic, but a disaster. The market deviated too far from the biggest pain point of options; IV remained consistently above 70%, and the 0.15 Delta Skew reached a staggering -34.75%. Market makers hedged regardless of cost, thus falling into a hedging trap and becoming the biggest driver of the sell-off. A large number of Puts sold by market makers became deep in-the-money. To hedge, market makers had to sell more BTC futures. Price falls – market makers sell – price falls further – market makers sell even more. In this process, market makers weren't selling because they were bearish, but rather for risk control and forced liquidation – in other words, to survive. greeks.live/deribit/tools/data...…

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content