Most companies holding digital asset treasuries (DATs) are facing increasing unrealized losses as the total crypto market Capital continues to decline. Companies that believe in the long-term value of XRP and hold XRP as a treasury asset, including Evernorth, are in a similar situation.

Despite facing many challenges, positive signals from retail investors and some optimistic developments within the Ripple ecosystem are giving hope that XRP will recover.

Evernorth faces an unrealized loss of $380 million.

Evernorth Holdings – one of the world's largest XRP holders – is facing significant financial pressure as the price of XRP continues to fall.

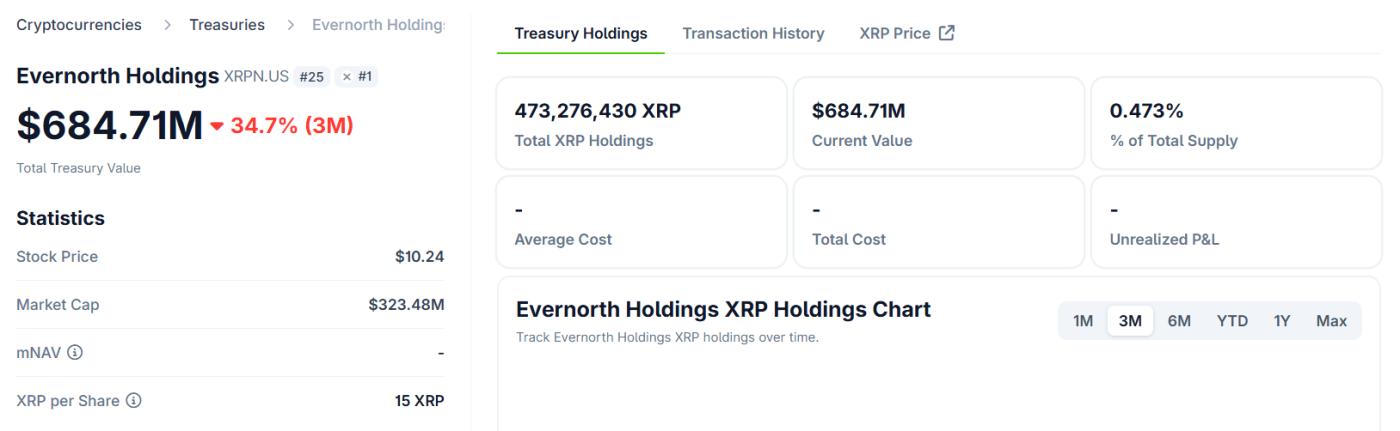

According to data from CoinGecko, Evernorth currently owns 473,276,430 XRP, representing approximately 0.473% of the total circulating supply. The current value of this XRP holdings is approximately $684.7 million.

Evernorth Holdings holds XRP. Source: CoinGecko

Evernorth Holdings holds XRP. Source: CoinGeckoThis company made two large purchases in October and November of last year and has not added any more XRP since then.

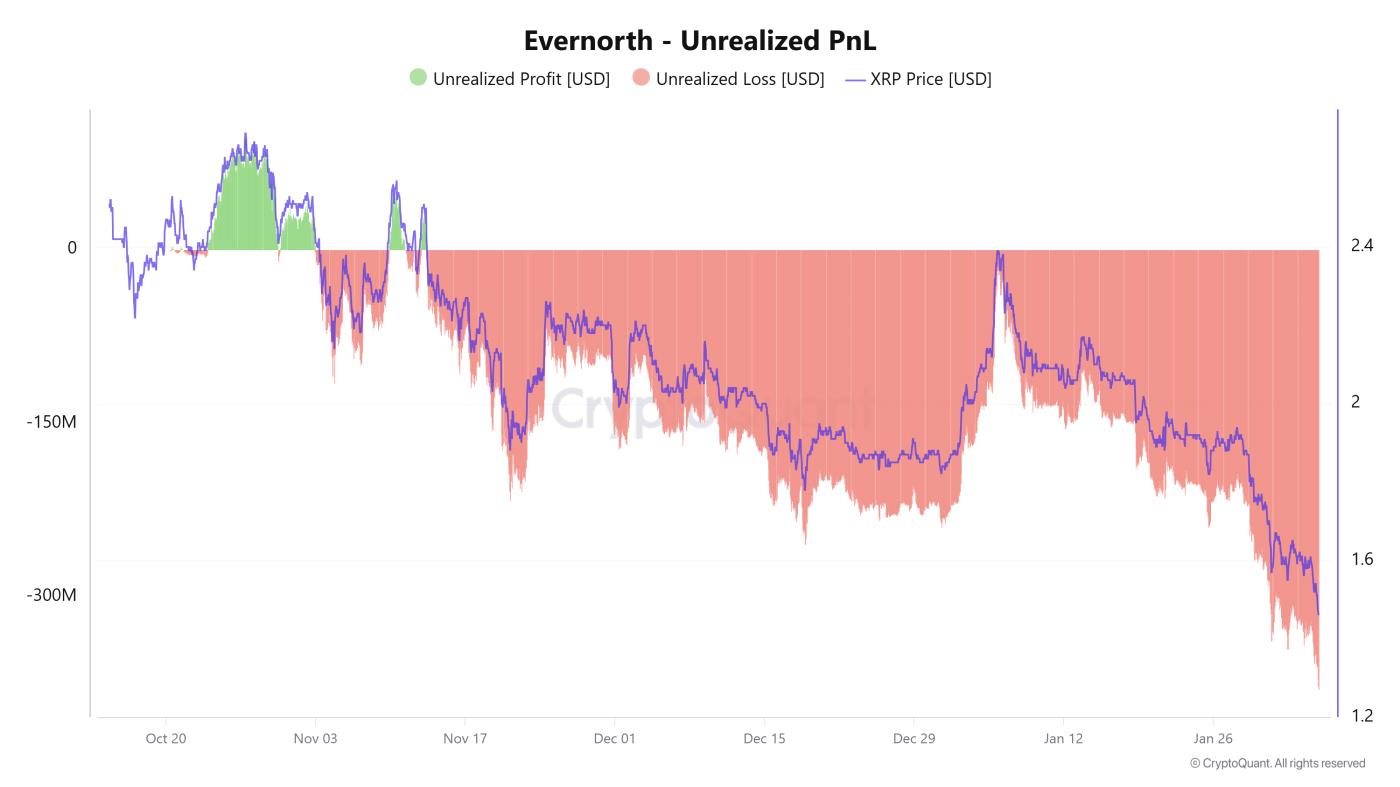

According to data from CryptoQuant, Evernorth's unrealized losses have steadily increased in recent months. This figure has now exceeded $380 million as XRP continues to trade below $1.50.

Evernorth's unrealized loss. Source: CryptoQuant .

Evernorth's unrealized loss. Source: CryptoQuant .BeInCrypto also noted several other DATs (Debit Account Authorities) in a similar situation. BitMine is currently facing nearly $7 billion in unrealized losses from holding over 4.28 million ETH. Strategy also recorded losses of over $4 billion due to Bitcoin's price falling below $71,000.

The drop in XRP and other altcoin prices is putting increasing financial pressure on these businesses. Raising Capital through equity issuance or debt financing will become more difficult, as investors will be more cautious when faced with companies that are recording large treasury losses.

In a worst-case scenario, if a business urgently needs money to pay off debts or cover operating expenses, it may be forced to sell its assets and incur actual losses. Such a sell-off could drive altcoin prices down even further.

Charles Edwards, founder of Capriole Investment, argues that the DAT model is essentially a "leveraged time bomb that could explode at any moment." He compares the rapid expansion of DATs to the wave of investment funds in the 1920s. He also warns that the current impact on the crypto market could be even more severe than the previous collapses of Luna and FTX.

Good news helps XRP absorb selling pressure.

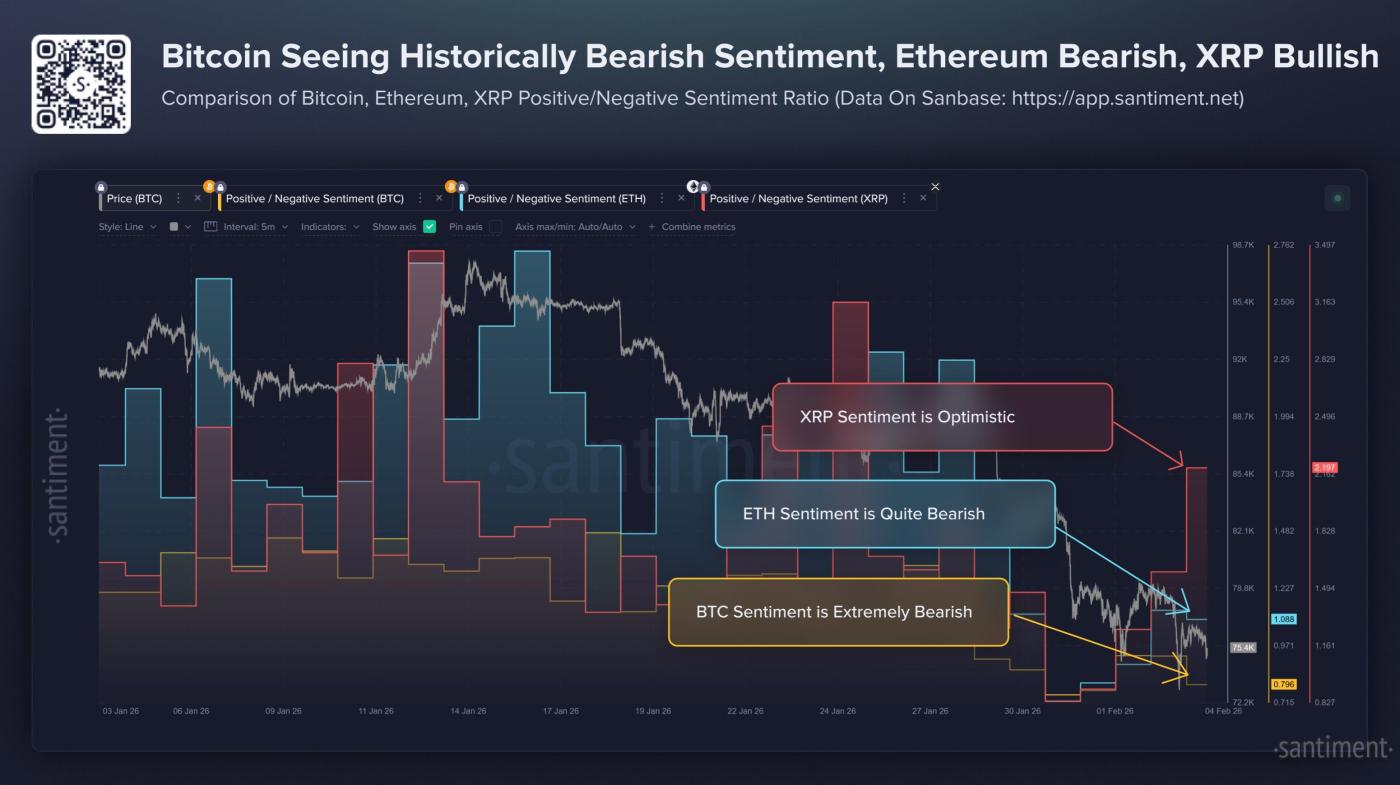

Data from Santiment shows that retail investors remain optimistic about XRP at its current price. This contrasts with the growing pessimism surrounding Bitcoin (BTC) and Ethereum (ETH).

Comparing the positive/negative sentiment ratio between Bitcoin, Ethereum, and XRP. Source: Santiment

Comparing the positive/negative sentiment ratio between Bitcoin, Ethereum, and XRP. Source: SantimentThis wave of optimism may stem from a series of positive news related to XRP. For example, the integration of Hyperliquid into Ripple Prime – Ripple's premium institutional brokerage platform. Additionally, XRPL Permissioned Domains will officially launch on February 4th, 2026, after receiving approval from over 91% of validators.

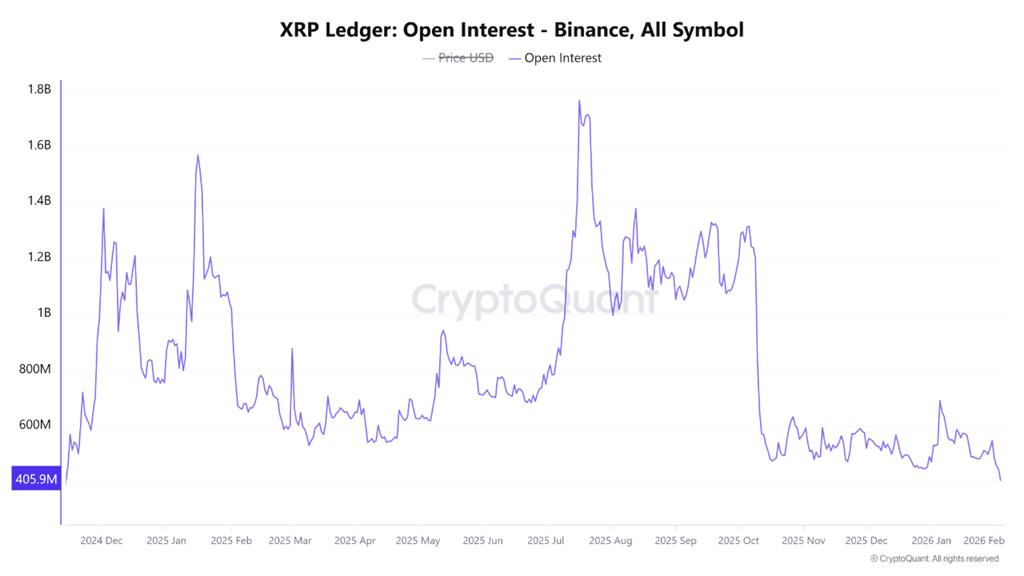

Meanwhile, CryptoQuant's CryptoOnchain analyst noted that XRP 's open interest volume on Binance has fallen to its lowest level since November 2024, at just $405.9 million.

This sharp drop indicates that significant leverage has been "released." With open interest at its current low level, XRP price will be less sensitive to fluctuations caused by Short squeezes or Longing squeezes. This allows the market to re-establish equilibrium and increases the chances of a sustainable recovery.

“A ‘cleanup’ in the Derivative market like this is often a prerequisite for the price to form a sustainable reversal trend. Once high leverage is removed, the selling pressure from forced liquidations also decreases. If spot trading demand increases – as shown by a high on-chain velocity – the price can recover more naturally without the burden of excessive Longing positions.” – CryptoOnchain commented .

Open Interest XRP on Binance. Source: CryptoQuant

Open Interest XRP on Binance. Source: CryptoQuantHowever, a short-term rebound may not be enough to offset Evernorth's unrealized losses . With an Medium purchase price of around $2.40 , XRP needs to rise approximately 70% from its current price of $1.43 at the time of writing. To reach this milestone, significant new Capital inflows and a stronger overall market recovery are required.