Bitcoin has fallen nearly 7% in the last 24 hours and is now approaching the crucial $70,000 mark – a psychological level that could fuel fears across the crypto market if broken. As traders prepare for a sharp decline, attention is shifting to altcoins that could potentially benefit, especially those that could hold firm if Bitcoin falls below $70,000.

While most Token typically decline along with Bitcoin during sharp market sell-offs, analysts at BeInCrypto have identified three cryptocurrencies that are strongly inversely correlated with BTC, exhibiting healthy chart structures and improving Capital flows. These signals suggest they may stand out more during bad market conditions, potentially presenting opportunities even when risk-averse investors prioritize safe haven assets.

The White Whale (WHITEWHALE)

White Whale (WHITEWHALE) is emerging as one of the few altcoins that could benefit if Bitcoin falls below $70,000, thanks to its tendency to become increasingly independent of the overall market trend. While most other Token plummeted along with Bitcoin, WHITEWHALE, based on Solana, has proven to be quite stable.

Over the past 7 days, WHITEWHALE has surged nearly 17%, and in the last 24 hours alone, it has jumped almost 20%. This exceptional strength suggests that traders may be shifting to this Token despite the overall weak crypto market.

Over the past week, White Whale has recorded a strong inverse correlation with Bitcoin at –0.67. This means the two cryptocurrencies typically move in opposite directions. This divergence is significant at a time when retail investors are cautious or risk-averse.

Tương quan ngược với BTC: defillama

Tương quan ngược với BTC: defillamaIf Bitcoin breaks below $70,000, assets with low or inverse correlation tend to attract speculative Capital . This makes WHITEWHALE one of the altcoins that could benefit from a market downturn. Additionally, on the 4-hour chart, this Token is currently trading within an ascending channel pattern.

Technically, key resistance zones are located around $0.127 and $0.143. If this zone is breached, WHITEWHALE could break out, targeting the next level at $0.226 – a nearly 58% increase and a chance to establish a new price. Conversely, support levels are at $0.098, and further down at $0.087. If these levels are broken, the bullish outlook will diminish and a correction to the $0.070 region is possible.

Phân tích giá WHITEWHALE: TradingView

Phân tích giá WHITEWHALE: TradingViewIn summary, thanks to its inverse correlation with Bitcoin, good short-term performance, and bullish chart pattern, the White Whale can be considered a high-risk, high-reward investment if Bitcoin falls further.

Bitcoin Cash (BCH)

Bitcoin Cash is emerging as one of the altcoins that could benefit if Bitcoin falls below $70,000, especially given its relative strength during this period of overall market weakness. While the entire crypto market has fallen nearly 7% in recent sessions, BCH has only dropped slightly over 1%, showing early signs of stabilization. Over the past three months, BCH has also risen nearly 8% – placing it among the rare large - cap altcoins that have maintained medium-term upward momentum.

on-chain data also reinforces this observation. The Spent Coins Age Band index, which tracks the number of dormant coins that are now being moved, has seen a sharp decline in trading activity.

Since the beginning of February 2024, this index has fallen from approximately 18,900 coins to nearly 8,278 – a drop of almost 56% in just a few days. This means that fewer and fewer long-held BCH Token are being sold, even though the price remains under pressure. If Token remain relatively stable during market fluctuations, it usually indicates increasing confidence among retail investors.

Want more Token analysis like this? Sign up for editor Harsh Notariya's Daily Crypto newsletter here .

Coin activity plummets: Santiment

Coin activity plummets: SantimentMeanwhile, the Chaikin Money Flow (CMF) index – used to track large capital flows into and out of assets based on price and volume – also gradually increased from January 29th to February 5th. The CMF approached and even slightly crossed the zero mark, indicating that large capital flows were quietly accumulating assets despite the generally cautious sentiment.

Technically, BCH needs to maintain above the $523 level to hold this structure. If it closes above $558, the uptrend will be further strengthened, potentially reaching targets of $615 and $655, or even $707 if market conditions are favorable.

Phân tích giá BCH: TradingView

Phân tích giá BCH: TradingViewHowever, if the price fails to regain the $523 mark, it could fall further to the $466 region.

Hyperliquid (HYPE)

HYPE, the native Token of Hyperliquid , is emerging as one of the altcoins likely to benefit if Bitcoin falls below $70,000. This is primarily because HYPE typically moves in the opposite direction to BTC. Over the past month, HYPE has surged nearly 28%, while Bitcoin has declined around 24%.

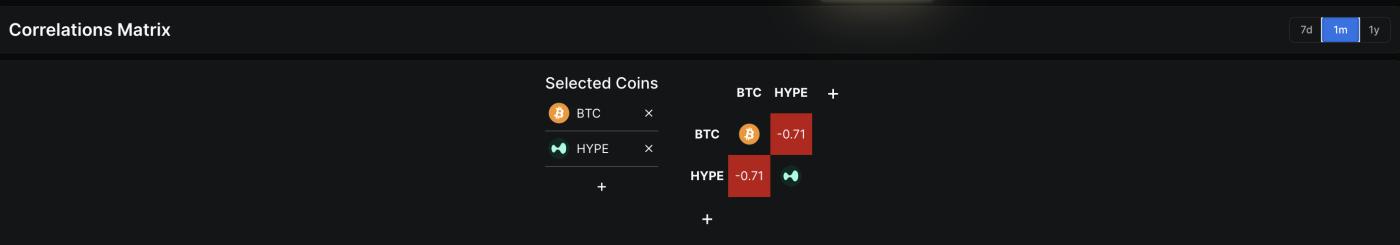

During this same period, HYPE's correlation coefficient with BTC was -0.71, indicating a very strong inverse relationship. This means that when Bitcoin weakens, HYPE has recently tended to rise, becoming an option for retail investors seeking relative strength during challenging market periods.

Biểu đồ tương quan HYPE- BTC: defillama

Biểu đồ tương quan HYPE- BTC: defillamaThe HYPE price chart also shows this difference. After surging to the $38.43 region, HYPE is now entering a consolidation phase and forming a bullish flag-and-pole pattern. This structure typically appears when an asset pauses after a strong price increase and prepares for the next breakout. If the price breaks above the upper trend line, this pattern forecasts a potential upside of approximately 87%.

The money flow is also showing support. The Chaikin Money Flow (CMF) indicator remains positive, indicating significant money inflow. However, the CMF is currently running below a descending trend line, suggesting that stronger money flow is needed to confirm HYPE's breakout from this bullish flag pattern.

To confirm an uptrend, HYPE needs to close the daily candle above $34.87. If it breaks above this level, HYPE could head towards $38.43, and further to $65.70 if the upward momentum continues. Conversely, if the price falls below $28.21, the bullish pattern will be affected, and if it drops below $23.82, the bullish structure will be completely broken.

HYPE price analysis: TradingView

HYPE price analysis: TradingViewIf Bitcoin falls below $70,000 and HYPE continues to maintain a negative correlation, with a good structure and strong cash flow, this is one of the altcoins that has the potential to benefit from market volatility rather than be negatively affected.