Solana is still under strong selling pressure following the recent Dump off, causing the price to form a descending triangle pattern on the daily timeframe. This pattern is quite similar to a setup that appeared in a previous cycle, just before Solana began a significant price surge.

Besides technical factors, on-chain valuation indicators also suggest that SOL may be entering an accumulation phase, as selling pressure is gradually weakening.

Solana holders remain optimistic.

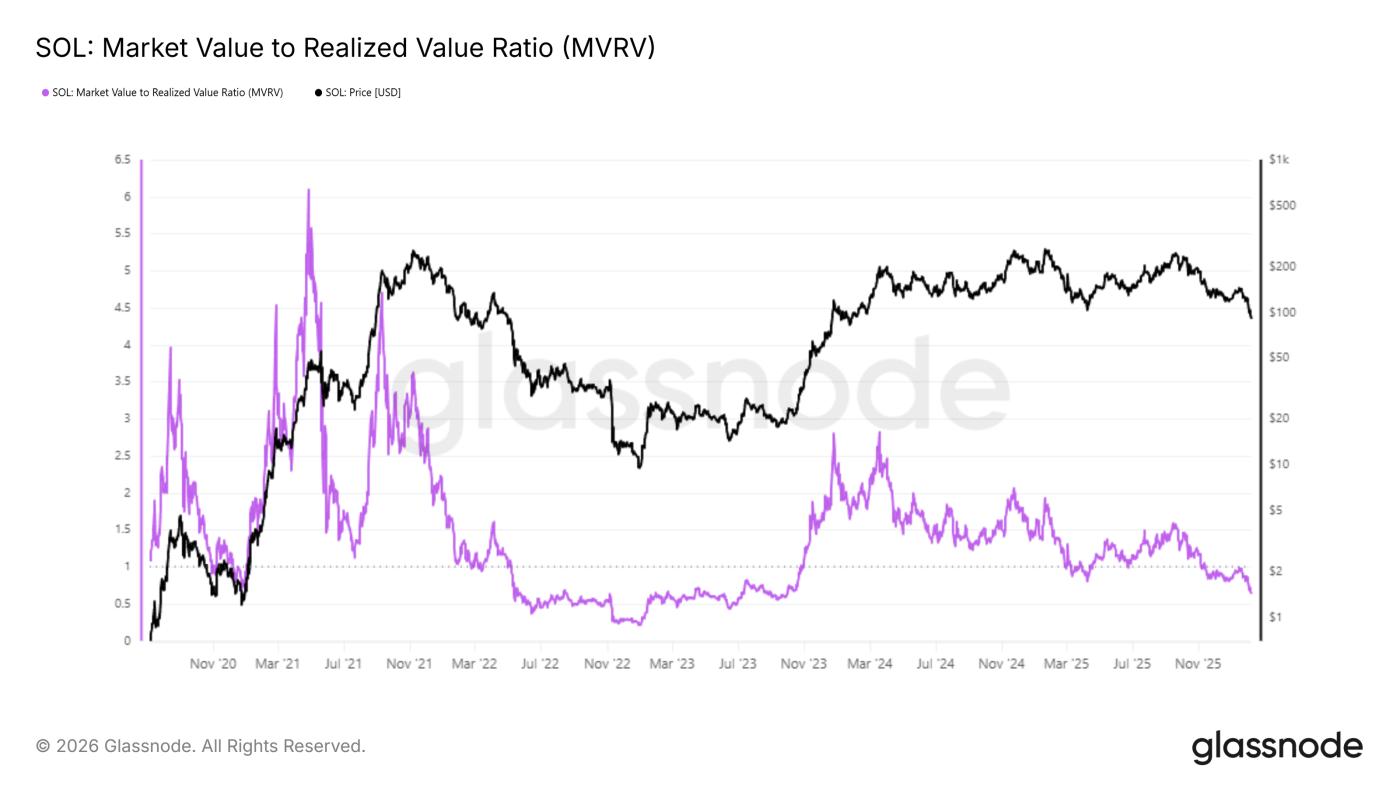

Solana 's Market Value to Actual Value (MVRV) ratio is currently at 0.65, placing it in undervalued territory . This is its lowest level since September 2023 and also close to Dip point in two and a half years. When the MVRV is below 1, it means that the majority of investors are losing money, and this is usually a sign that the market has reached the end of a correction phase, rather than the start of a new sell-off.

In the past, when the MVRV ratio remained low for an extended period, selling pressure typically eased. Most investors, having not yet cut their losses, would choose to observe and wait for the market to recover instead of continuing to sell off. This is also a common scenario before the market stabilizes, although prices may still fluctuate in the short term.

Want more Token analysis like this? Sign up for Editor Harsh Notariya's daily cryptocurrency newsletter here .

Solana's MVRV ratio. Source: Glassnode

Solana's MVRV ratio. Source: GlassnodeDespite the price drop, investor behavior shows patience rather than panic. Notably, Solana 's actual price remains higher than the market price, a pattern often seen nearing a major Dip . This structure previously appeared in March 2025, when SOL entered a consolidation phase before a recovery.

During that period, the market leaned towards a trend of Capital rotation, rather than panic selling.

Current cash flow also suggests a similar scenario is unfolding. From December 2025 to the present, investors have accumulated approximately 5 million SOL, worth around $455 million. The fact that large investors are quietly accumulating shares even during a market downturn indicates that confidence remains quite strong. Historically, continuous accumulation during price corrections has always given Solana the potential for a medium-term reversal.

The actual price and balance on the Solana exchange. Source: Glassnode

The actual price and balance on the Solana exchange. Source: GlassnodeSOL price is heading towards a long-term breakout.

SOL is currently trading around $90, close to the lower edge of a descending triangle pattern – a crucial decision zone. A similar setup occurred in early 2025 when the price found good support here before surging sharply, with a gain of up to 43%. The current price movement also bears many similarities to that period earlier in the year.

This model suggests Solana has the potential to rise by approximately 31%, heading towards the $156 price level. However, confirmation depends on whether the price recovers and holds the $104 level as support. If the price breaks above and sustains above $122, the breakout signal will be clearer, consistent with positive indicators from both macro and on-chain perspectives.

Solana price analysis. Source: TradingView

Solana price analysis. Source: TradingViewNevertheless, downside risk remains. If the accumulation phase reverses or weakens, the SOL risks breaking below the $83 level. If the price breaks significantly below this threshold, it is likely to continue falling to $75 or lower, invalidating the bullish scenario and confirming the continuation of the corrective trend.