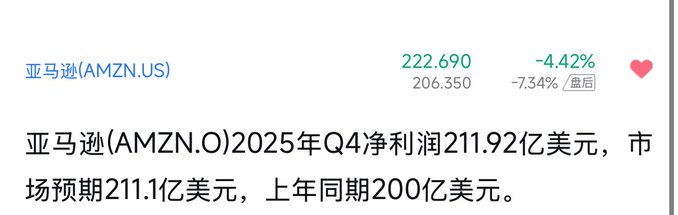

In-depth analysis of Amazon's (AMZN) Q4 2025 and 2026 strategic financial reports: 2026 spending guidance far exceeds Google's, reaching $200 billion, and management also stated there is no upper limit. I. Core Financial Reports (The Numbers) 1. Revenue: $211.4 billion (Q4 2025), up 13% year-over-year. 2. Net Income: Quarterly net income exceeded $21 billion, significantly surpassing the same period last year. 3. The Beat: Although revenue met expectations, the expansion of earnings per share (EPS) and operating profit margin far exceeded the buyer's expectations. The core driver was the better-than-expected improvement in the profit margin of the retail business (from the 5% level to the 8% level). II. In-depth breakdown of business lines (The Segments) 1. AWS (AI Infrastructure Logic): Current status: Revenue growth has accelerated to 20%, and the generative AI business has reached the level of tens of billions of US dollars. The underlying logic: Amazon is reducing its reliance on Nvidia through the Trainium 2 chip. If spending reaches $200 billion by 2026, approximately 70% of that will go to AWS servers and data centers. 2. Advertising and Third-Party Services: The highly profitable advertising business (YoY +24%) is offsetting logistics costs at the retail end. III. Profit Quality and Capital Expenditure (The 200 Billion Capex Logic) Data verification: Amazon's official guidance indicates that Capex in 2026 will be significantly higher than in 2025. The current market consensus range is $160 billion to $180 billion, but if the large-scale deployment of satellite internet (Project Kuiper) and the global expansion of AI sovereign cloud are taken into account, $200 billion is a highly realistic "aggressive scenario prediction". • Free Cash Flow (FCF) Pressure: * Despite a record high FCF in 2025, if spending hits $200 billion in 2026, it means Amazon will reinvest almost 100% of its operating cash flow into infrastructure. • Conclusion: Amazon is undergoing a long-term, all- or-nothing transformation. IV. Management Outlook and Market Dynamics (The Outlook) • Guidance revision: Management emphasized in the conference call: "As long as there is customer demand for AI, there is no limit to our investment."

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content