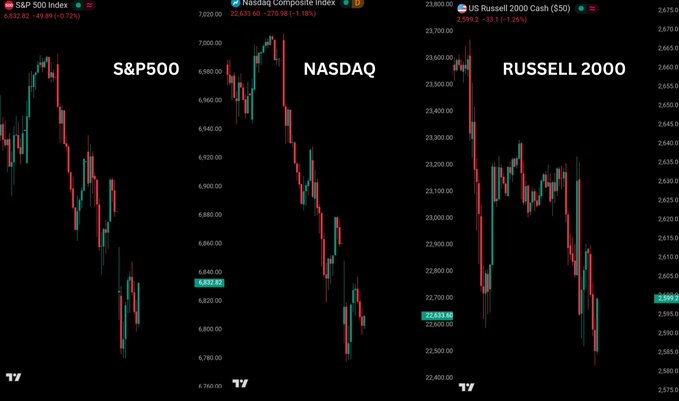

🚨 U.S. STOCKS ARE FALLING AFTER WEAK JOB DATA

Nasdaq is down 1.34% today, wiping out $517 billion in market value.

S&P 500 is down 1.13%, wiping out $695 billion.

Russell 2000 is down 1.5%, wiping out $47 billion.

This move comes after U.S. labor market data came in weaker than expected. Initial jobless claims rose to 231K vs 212K expected, which means layoffs are increasing.

January job cuts were the highest since 2009, meaning companies are letting go of more workers. At the same time, companies announced very few new hiring plans.

When layoffs rise and hiring slows together, it becomes a leading indicator of economic weakness. Markets are now starting to price in that risk.

Everything is crashing like something big is about to happen

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content