Welcome to the US Crypto News Morning Bulletin—a compilation of the most important crypto market news of the day to help you start your day!

Brew a cup of coffee and relax—the market has been incredibly volatile lately. Bitcoin has been fluctuating wildly, stocks have been volatile, and news has been pouring in. Some investors are pausing to observe, while others are closely monitoring, trying to grasp the signals behind all that tumultuous activity.

Crypto news of the day: Bitcoin falls below $68,000 due to leverage reduction pressure.

Bitcoin fell below $70,000 on Thursday, before continuing its plunge to below $68,000 – a price level last tested on October 28, 2024. This was due to a massive sell-off that spread across the entire crypto market .

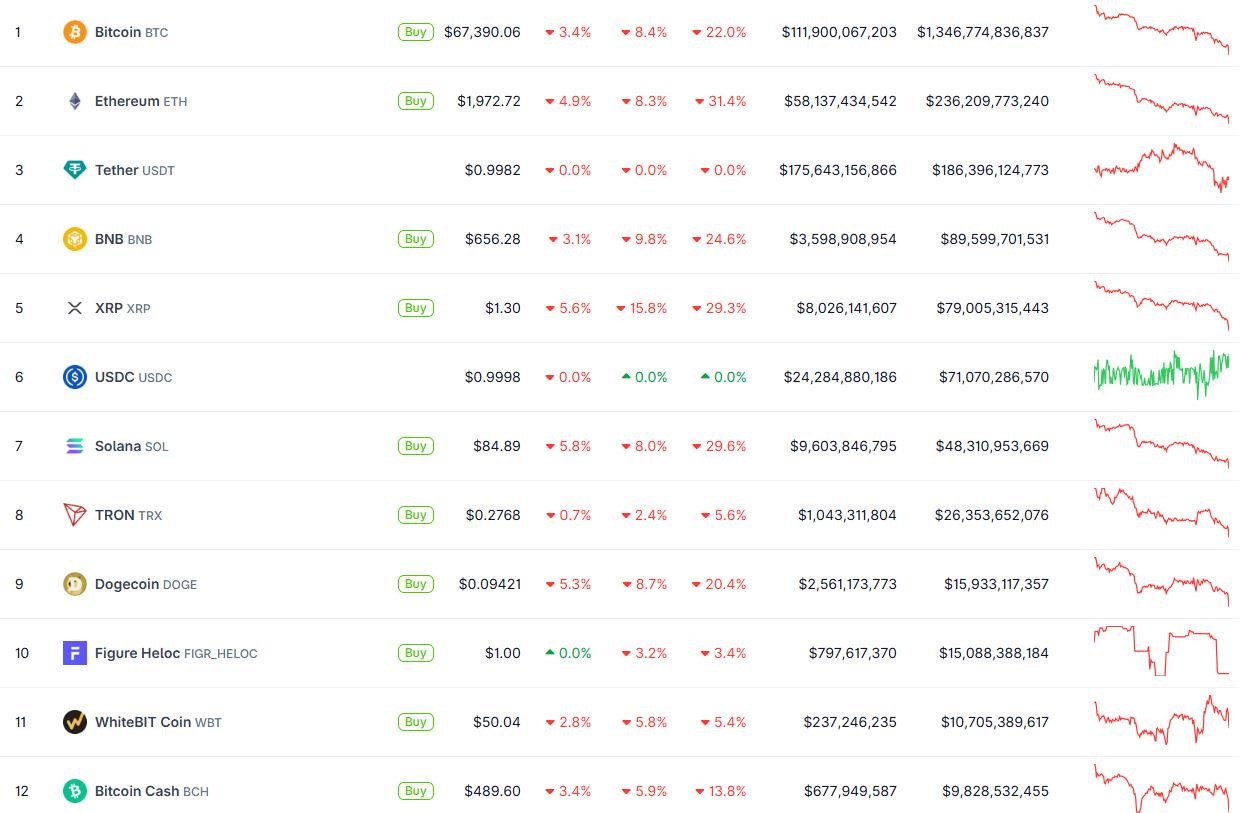

The crypto market is experiencing a sell-off. Source: CoinGecko

The crypto market is experiencing a sell-off. Source: CoinGeckoThis price drop marks a decline of approximately 45% from the peak in October, driven by the impact of ETF Capital , weak demand, and forced Dump in the Derivative market.

“…when demand decreases, ETF Capital dry up, and Futures Contract enter a ‘forced Dump ’ phase. Experts believe that weak volume and prolonged selling pressure have forced many investors to sell at a loss, even though technical indicators suggest the market is oversold,” Walter Deadon Chia .

Low volume and persistent selling pressure have forced many investors to sell at a loss, even though technical indicators are signaling an oversold market.

Despite short-term volatility, JPMorgan remains quite optimistic about Bitcoin's long-term potential compared to gold.

The bank points out that the current BTC price is trading significantly below the estimated production cost of $87,000 —a price level once XEM historical soft support—and Bitcoin's volatility relative to gold has also fallen to record lows.

“…gold has outperformed Bitcoin significantly since last October, and coupled with soaring gold price volatility, this makes Bitcoin even more attractive compared to gold in the long term,” MarketWatch quoted JPMorgan quantitative strategist Nikolaos Panigirtzoglou as saying.

According to the bank, the long-term growth potential remains very high for investors willing to hold their Capital for many years.

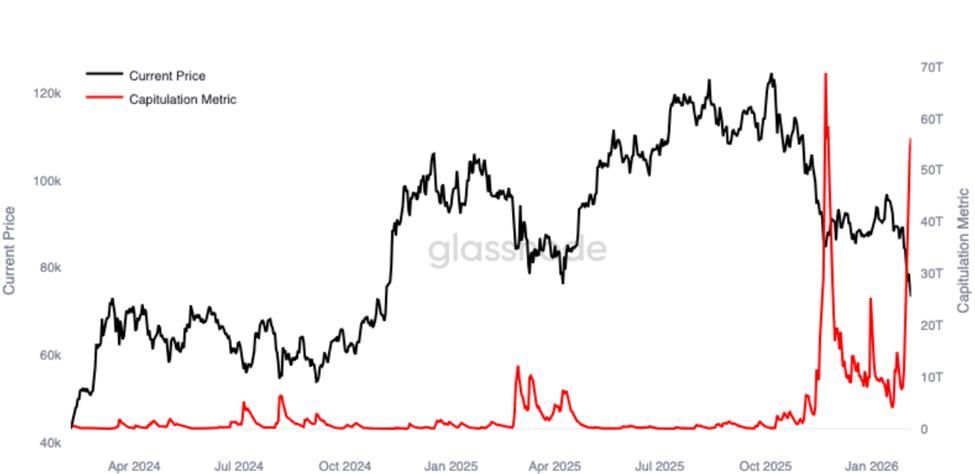

Market stress indicators continue to suggest the current environment is quite fragile. According to data from Glassnode, Bitcoin's capitalization index just recorded its second-highest increase in two years—reflecting strong sell-offs and accelerated risk aversion.

Bitcoin's Capitulation Index and price. Source: Glassnode

Bitcoin's Capitulation Index and price. Source: GlassnodeIt's also worth noting that Bitcoin has lost all of its gains since Donald Trump's election victory, wiping out a 78% post-election increase, further highlighting the ongoing uncertainty.

Crypto stocks plummeted as Bitcoin was sold off and economic uncertainty increased.

Crypto company stocks also showed a weakening trend similar to Bitcoin. Shares of Coinbase , Riot, Marathon, and Strategy all fell between 5% and 7% in pre-market trading after Bitcoin dropped below $70,000, while ETFs also lost more than 5% of their value.

This decline in the crypto market is further influenced by macroeconomic difficulties. According to a report by Challenger, Gray & Christmas, in January in the US, the number of layoffs increased by 205% year-on-year to 108,435—the highest number for January since 2009.

Job cuts are concentrated in the transportation sector—particularly UPS—and the technology sector, where Amazon announced plans to lay off 16,000 people. The healthcare industry has also been significantly impacted.

In addition, federal job protection regulations were also adjusted as the Trump administration completed reforms involving 50,000 civil servants. The number of people filing for unemployment benefits remained consistently high (1.84 million), indicating continued economic uncertainty.

The stock market also faces a complex interplay of factors. BMO Capital Markets forecasts the S&P 500 could reach 7,380 by the end of 2026—representing an expected return of around 8%.

This company prioritizes cyclical sectors such as industrial, materials, energy, and finance, while reducing its holdings in defensive sectors. Inflation remains a major risk, but global monetary and fiscal support measures are helping the market remain stable.

In this context, Bitcoin investors, as well as the entire financial market, are carefully considering the following:

- Technical signals indicate an oversold market and low volatility, suggesting long-term opportunities.

- However, immediate pressure from leveraged positions, ETF Capital , and macroeconomic uncertainty continues to weigh heavily on investor sentiment.

JPMorgan's analysis suggests that patient investors may reap future profits, but the short-term outlook remains volatile, reflecting a market correction phase.

Daily chart

Bitcoin price fluctuations. Source: TradingView

Bitcoin price fluctuations. Source: TradingViewAlpha is concise.

Here's a summary of some of the top cryptocurrency news stories in the US today:

- Ethereum lending activity reached $28 billion after AAVE demonstrated the resilience of DeFi during the weekend's downturn.

- Solana price is approaching the $90 mark , however, long-term investors continue to buy.

- The U.S. Congress is questioning whether the Treasury Department will “rescue Bitcoin” —a strange dialogue that highlights the cryptocurrency’s independence from the federal government .

- The XRP treasury company Evernorth is incurring unrealized losses of up to $380 million due to the price drop.

- Bitcoin has fallen below the $70,000 support level, raising the risk of a further 37% drop .

- Activity on the Ethereum network has increased most significantly , but this is not necessarily a bullish signal.

- Tether surpasses 500 million users as it experiences rapid growth —however, risks and concerns about exchange rates remain .

Overview of the crypto stock market before the market opens.

| Company | Closing price on February 4th | Pre-trading developments |

| Strategy (MSTR) | 129.09 USD | 120.78 USD (-6.58%) |

| Coinbase (COIN) | 168.62 USD | 159.42 USD (-5.46%) |

| Galaxy Digital Holdings (GLXY) | 20.16 USD | 19.10 USD (-5.26%) |

| MARA Holdings (MARA) | 8.28 USD | 7.81 USD (-5.68%) |

| Riot Platforms (RIOT) | 14.14 USD | 13.36 USD (-5.51%) |

| Core Scientific (CORZ) | 16.15 USD | 15.50 USD (-4.02%) |