On this investment journey, pressure, fear, and self-doubt are unavoidable costs.

Written by: Raoul Pal, Founder of Real Vision

Compiled by: Luffy, Foresight News

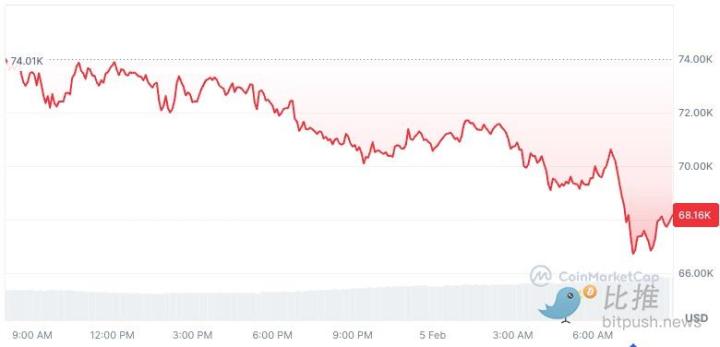

The market is bleak right now, there's no hope in sight, and everything seems to be over. You've missed your chance and messed things up again.

Everyone was gripped by anger and confusion. Even those who had anticipated the downturn, while feeling a sliver of relief that their predictions had come true, could still sense the devastating impact this market condition had had on countless individuals. At this moment, it felt like the darkest hour had arrived.

I have been in the trading market for 38 years and have seen all kinds of crashes and market panics. Every time, the feeling is exactly the same: absolutely terrible.

I entered the crypto market in 2013, when I first bought Bitcoin for $200.

Bitcoin briefly rose after I bought it, then plummeted 75%. This was during a major bull market, and the price eventually soared to more than ten times my purchase price. I didn't sell because it was a long-term investment, and I was aware of the risks.

During the 2014 bear market, Bitcoin plummeted by 87%.

During the subsequent bull market that lasted until 2017, I experienced three crashes of 35% to 45%, which were extremely devastating. Ultimately, due to the Bitcoin fork dispute, I sold all my holdings at the $2,000 price level, which was also the previous high point in 2013.

At that time, my holdings had increased tenfold from my initial entry price. And after I liquidated my position, Bitcoin increased tenfold again by the end of that year, which was unbelievable! Then began another long and brutal bear market.

I perfectly avoided that entire bear market, and at the time I was quite pleased with myself for it.

Then, during the market crash caused by the COVID-19 pandemic, I bought back Bitcoin at $6,500, a price 3.5 times higher than when I sold it all. What I thought was the "right choice" turned out to be a costly mistake.

From April to July 2021, Bitcoin plummeted by 50%, and the market situation then was strikingly similar to the present. Market sentiment on Twitter was extremely negative, truly at its worst. However, even then, the market was far less oversold than it is today.

By November 2021, the market had returned to its historical highs: SOL surged 13 times from its low, Ethereum doubled, and Bitcoin hit a new high with a gain of 150%.

I experienced all of this firsthand. I was present for every single heart-pounding and nerve-wracking moment during this long bull market.

My initial entry price was $200, and now Bitcoin is priced at $65,000. Even though I missed out on a 3.5x increase due to poor timing, the final profit is still considerable.

For me, the first core lesson in a long-term bullish asset is to do nothing . The reason why "HODL (Hold on)" has become a classic tenet in the crypto world is no accident; its power far surpasses the "four-year cycle" theory.

The second lesson is to decisively increase positions during market crashes . Even if the timing isn't perfect, gradually increasing positions during a weak market can lead to compounded returns in the long run, with effects far exceeding those of regular fixed-amount investments.

I don't always have enough funds to buy the dips heavily during market crashes, but I always buy some because it helps me develop a better mindset.

When the market crashes, people often feel they've missed their last chance, that the market will never recover, and that everything will completely collapse, leaving them with no chance of recovery. But that's far from the truth.

Ask yourself two questions: Will the world be more digital tomorrow than it is today? Will fiat currency be less valuable than it is today?

If the answer is yes to all of them, then keep going. Boldly buy the dips and let the power of time overcome timing manipulation, because the former always wins. Adding to your position during a sharp drop can lower your average cost, which can make a world of difference.

On this investment journey, pressure, fear, and self-doubt are unavoidable costs.

Position management should match your own risk tolerance. Don't be anxious; everyone experiences this: when prices fall, you feel your position is too heavy; when prices rise, you regret that your position is too light. All you need to do is learn to regulate these emotions and find a rhythm that suits you.

Another key point is not to blindly follow the judgments of others. "DYOR (Do your own research)" is also a golden rule in the crypto community. Without independent judgment, you simply cannot survive these darkest times.

To form your own firm beliefs, blindly following the opinions of others is like adding leverage, which will eventually lead to your complete defeat.

Please remember: when you're busy blaming others, you're essentially just blaming yourself.

Admittedly, the market is currently bleak, but the sun will soon shine again. This crash will ultimately become another scar on your investment journey, provided you haven't used leverage! Leverage can cause you to lose all your capital, like losing all your chips in a casino. Never lose your chips.

When will this gloom dissipate? I have no idea, but I think it's more like the market situation from April to November 2021: a panic sell-off within a bull market, and I believe it will all be over soon. Even if my judgment is wrong, I won't change my strategy; as long as I have cash on hand, I will continue to add to my positions.

But for you, the situation might be different. Consider creating a "regret-avoidance portfolio": Can you withstand a 50% drop from the current price? If not, reduce your holdings, even if doing so now feels foolish. Having the right mindset is key to surviving a market downturn. My mindset is how to buy more, while yours might be the opposite.

There will always be market timing experts who can accurately time the market top and even short short, and there will always be such people in the future. But honestly, you just need to constantly remind yourself that a crash could happen at any time. When it actually happens, you won't be anxious because you expected it. Let the crash be part of the investment story, not the whole story.

What am I doing right now?

I'm starting to buy more digital art (which is also equivalent to increasing my Ethereum holdings) and plan to continue adding to my crypto assets next week, just like I have done every time such a buy the dips opportunity has presented itself.

I buy the dips during the COVID-19 crash, I buy the dips during the 2021 crash, and I did the same in 2022 and 2023. I will continue to buy the buy the dips in 2024 and 2025! And I will do it again this time. Each time, my account profit or loss has reached a new high before the market. This method has proven effective time and again. I'll say it again: Buy the dips boldly!

Good luck to everyone. The road to investing is never easy.

To hold these assets that can achieve long-term compound growth, you must accept their high volatility; this is the price we must pay. Learn to embrace volatility.