6,899 units sold at an average price of $2,052, with the remaining 9,484 units being operated on the lending platform.

- Editor's note

- ※ If you break it down easily,

Vitalik planned to sell approximately 50 billion won worth of Ethereum for charity, and has so far sold 42% (approximately 20.8 billion won). The remaining 58% (approximately 28.6 billion won) is held in a coin bank called "Aave."

Selling all at once could cause the market price to drop, so they're selling in small increments. When they're not selling, they deposit their holdings in the bank to earn interest. This is a smart strategy. It's similar to how major shareholders mitigate market shocks by "announced sales" when selling their holdings.

Ethereum founder Vitalik Buterin's planned sale of 16,384 Ethereum (ETH) tokens for charitable purposes is underway. According to on-chain analysis, 6,899.5 ETH (approximately $14.15 million, or approximately 20.8 billion won) were sold, representing 42.1% of the total supply as of the previous day.

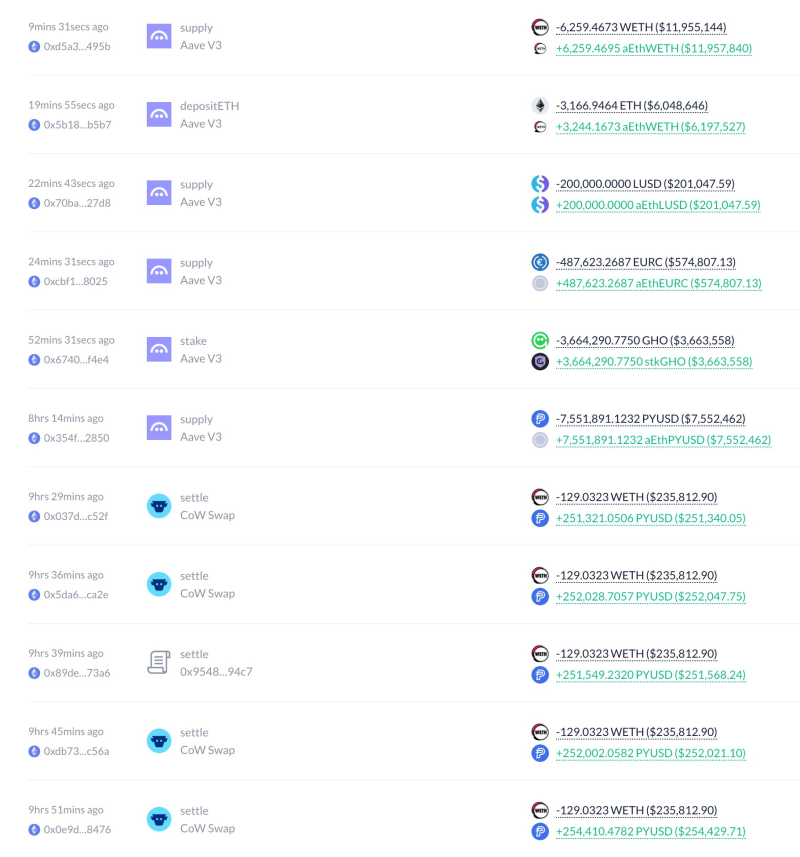

Vitalik sold his Ethereum at an average price of $2,052 (approximately 3.02 million won), with 9,484.5 ETH (approximately 19.46 million won, approximately 28.6 billion won) still pending sale. According to recent reports, Vitalik has deposited all of his remaining Ethereum into the lending protocol Aave.

Vitalik's plan to sell 16,384 ETH was clearly disclosed from the beginning as a charitable donation. The number 16,384 is 2 to the 14th power (2^14), a significant number in computer science and cryptography. This suggests that this was not a simple asset sale, but rather a planned donation project.

On-chain analysts believe Vitalik is adopting a distributed selling strategy to avoid excessive market pressure. In fact, he is minimizing market shock by avoiding direct Ethereum sales and instead converting them into stablecoins like USDC and GHO.

Vitalik's decision to deposit his remaining Ethereum in Aave appears to have been a strategic move. Aave is the world's largest decentralized lending platform, allowing users to earn interest on their coins.

Vitalik has previously demonstrated a cautious approach to asset sales. In January, he sold 211.84 ETH to secure 500,000 USDC, and in another transaction, he converted 13,217 ETH into wrapped Ethereum (wETH). This is interpreted as an attempt to avoid abrupt selling pressure in the market.

Joohoon Choi joohoon@blockstreet.co.kr