This article is machine translated

Show original

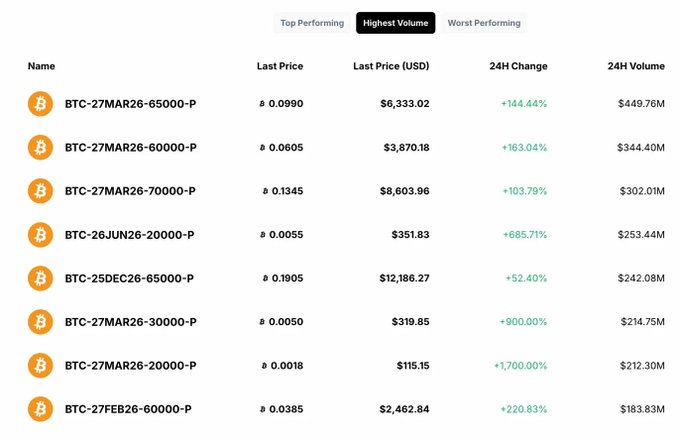

0206 - Options betting exceeding hundreds of millions of dollars following market crash | _2024111120230_ | May fall below 20K this year

There are two bets on the trading volume charts that suggest Bitcoin may fall below $20,000 this year... Are institutions still frantically seeking safe havens?

Options trading volume rose again today, peaking at over $400 million.

1️⃣ All the stocks on the list are puts, mainly betting that the price of Bitcoin will fall below these prices, including some black swan events like 23,000.

2️⃣ The 60K, 65K, and 70K options currently set to exercise at the end of March happen to be the top three options in terms of trading volume, indicating that institutions believe the probability of a short-term rebound exceeding 70K in the next two months is low.

3️⃣ The first appearance of 25DEC26 on the list indicates an increasing probability of a bear market throughout the year. Some traders are starting to bet on this, and today presented a potential buy the dips opportunity with a "potential Lunar New Year rally." However, it seems that institutional betting has not improved at all, and reducing trading frequency remains the most important thing.

alvin617.eth

@Alvin0617

02-05

0205 期權 - 市場已經不相信短期能反彈回 $85K 以上

繼續來看一下今天的比特幣期權數據

幾個重點

- 今天交易量高的期權其中在 Put ,避險情緒嚴重,甚至都到 60K 的價格了 , 市場認為當前 3 月 26 可能都回不到 70K , 接下來是 6 月底的 75K , 9 月底的 75K , 12 月底的 65K ...

- x.com/Alvin0617/stat…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content