This article is machine translated

Show original

There are two alarming facts:

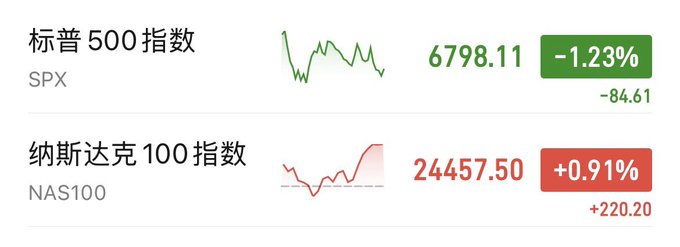

(1) Bitcoin has already plummeted by 50%, while the US stock index remains high. The recent drop to 60,000 was directly linked to the US stock market decline. If the US stock market drops another 5%, where do you think BTC will go?

(2) Whale wallets are reducing their holdings while retail wallets are increasing theirs. This indicates that the bottom hasn't been reached. As long as retail investors haven't completely surrendered, institutions and large investors will continue selling until the public completely loses confidence and leaves the market.

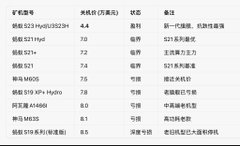

Regarding the shutdown price, I want to reiterate the impact of updated electricity costs!

Current data (electricity cost $0.05/kWh, mining pool fee rate 5%, difficulty 141.67T), weighted by the proportion of total network hashrate, shows that the weighted average pure electricity shutdown price for most mining machines is approximately $52,000.

If depreciation/maintenance (approximately 15%-20% of costs) is included, the actual break-even point needs to be increased by about 20%, resulting in a weighted average of approximately $62,000. Therefore, based on the above data, it can be concluded that building a position around 50,000 BTC is a very safe area, and this is a position that is highly likely to be reached!

子棋(重生版)

@cloakmk

02-05

2026年推演:关机价与熊市底部推理!

核心结论:2026年主流BTC矿机(0.08美元/度)关机价锚定6.9万-7.4万美元。

行业机构化+算力迭代下,熊市底部对关机价偏离度进一步收窄至5%-10%,本轮底部区间预计5.5万-7万美元,底部支撑更“硬”。 x.com/cloakmk/status…

The biggest fear now is a US stock market crash.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content