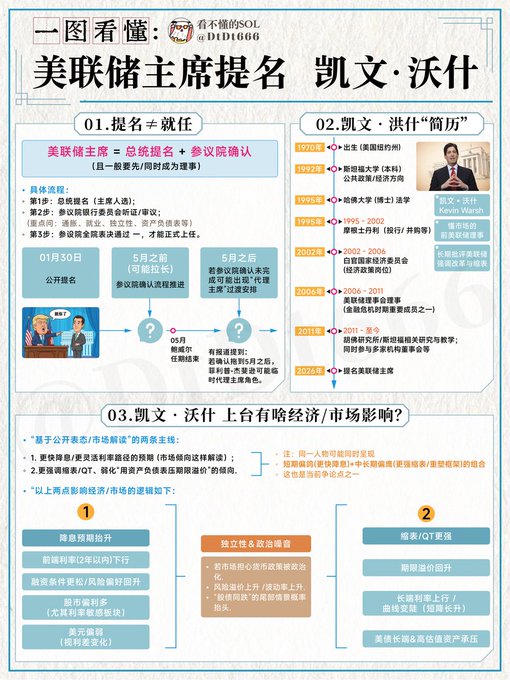

De-dollarization facing obstacles? Is there an AI bubble in US stocks? Has a bear market begun in the crypto? —The new Federal Reserve Chairman Warsh's series of moves are too ruthless! The most discussed topic these past few days has been the economic proposals of the next Federal Reserve Chairman, Kevin Warsh, including balance sheet reduction and interest rate cuts. Global markets have begun to plummet. Warsh has crossed three disciplines and has been nominated twice. Born in 1970, Walsh's resume spans politics, business, and academia, making him a truly "all-around" financial talent. There was a strange sense of familiarity. What he's doing is clearly implementing an American-style financial supply-side structural reform. The goal is to protect the credit of the US dollar, safeguard US dollar assets, and encourage the return of US dollars. The methods employed were extremely demanding, requiring both high standards and low demands. Walsh's proposed combination punches include the following moves: 1. Balance sheet reduction + interest rate cuts: a prudent and neutral monetary policy that aims to deleverage and return finance to its core functions while simultaneously shifting from speculative to real-economy development. Trump talks about "interest rate cuts" all the time, so of course Walsh has to play along. However, simply cutting interest rates would weaken the dollar's status as a hard currency and would not control inflation. Therefore, Walsh's combination is to pair it with a reduced table. He holds a view that is widely accepted by most netizens in China: inflation is caused by printing too much money. Walsh had been Friedman's research assistant and regarded him as his teacher. Friedman's classic argument is that all inflation is a monetary phenomenon. Walsh also felt that, Inflation is not due to supply chain fragmentation, not due to face masks, not due to Russia and Ukraine. It is the Federal Reserve's own responsibility. Moreover, the excessive expansion of the balance sheet has led to a surplus of money, not because of interest rates. Therefore, the best way to stop inflation is to reduce the balance sheet (QT), put the printing presses to a halt, and withdraw liquidity. Stop distorting long-term interest rates to accommodate government deficit spending. This is essentially telling the world that the Federal Reserve will not monetize US Treasury bonds indefinitely, and the purchasing power of the dollar will not be diluted. So after Walsh was nominated Why did precious metals, which have long been considered part of the "de-dollarization" strategy, suddenly experience such an extreme drop? One reason is that the market is afraid that he will deleverage the financial sector and create a strong dollar. 2. Utilizing the narrative of "AI-driven new productivity," this represents the prosperity and growth of the American supply side. Traditional economics talks about the Phillips curve, which states that low unemployment leads to high inflation. To control inflation, interest rates must be raised, thus dampening demand. But he's not a traditional hawk; he's close to Silicon Valley. Therefore, he is optimistic that AI will greatly improve productivity, coupled with Trump's relaxation of regulations. These can all offset inflation. He compared himself to Federal Reserve Chairman Alan Greenspan in the late 1990s when facing inflationary pressures. Insist on not raising interest rates. By betting on the explosive growth of internet technology, they successfully achieved high growth and low inflation. This narrative, Firstly, it's about rationalizing interest rate cuts. Secondly, it can show the world that the US economy is experiencing real growth driven by AI. The bubble isn't created by printing money; that's the fundamental force supporting the dollar system. This is why, in his logical system, The view is that quantitative tightening combined with interest rate cuts can simultaneously achieve a strong dollar, low inflation, and dollar repatriation. He wants to leverage AI+ to regulate the resulting surge in supply-side productivity and suppress inflation expectations. At the same time, a strong dollar is achieved through quantitative tightening. It also frees up pricing power for long-term interest rates, which can lead to higher real yields. In this way, global capital will flock in from other countries and from other assets such as gold and silver. 3. Establish a new "fiscal-Federal Reserve agreement" to strengthen the coordination between fiscal and monetary policies. His vision for the Federal Reserve is to return to its roots as a narrow central bank, not an omnipotent one. Don't meddle in things that aren't your business. For example, the purchase of MBS (mortgage-backed securities). Essentially, it's about providing targeted subsidies to the real estate sector, which falls under the scope of public finance. Therefore, Warsh advocated that the Federal Reserve should buy short-term bonds and sell long-term bonds. This can meet the market's short-term liquidity needs. This can reduce intervention in long-term interest rates and allow the market to price dollar assets more efficiently. In this process, To prevent market turmoil Therefore, a new mechanism needs to be established, with the two departments jointly managing national debt. Maintain global capital confidence in dollar assets. 4. Shifting from "data-driven" to "trend-driven" approaches, and engaging in cross-cycle adjustments. Warsh criticized the Federal Reserve for its forward guidance, dot plot, and frequent public speeches. Relying too heavily on monthly employment data is not only lagging but also very noisy. Medium- to long-term economic trends should be considered. Therefore, his style tends to be more about talking less and doing more. It is very likely that raster graphics will be abolished or weakened. He does not want the Federal Reserve to get bogged down in a fiscal quagmire. They also don't want the Federal Reserve to act as a babysitter for the market; the market should bear the pricing risk itself. But the less you want to appear in public and communicate with the market, the more... On the contrary, every time you appear in public, volatility will surge significantly. Because market pricing will no longer be driven by macroeconomic data. All we can do is guess how the policies will be negotiated. The strategy is very vague. Those rare appearances only amplify its authority. In addition, regarding financial security, He advocates for the adoption of stablecoins. We also need to develop a wholesale central bank digital currency. Transforming interbank clearing systems with blockchain technology to ensure the competitiveness of the US dollar in global trade settlements. This series of combined measures has further strengthened the dollar system. Of course, this is the ideal situation. Upon reflection, I realized that his proposals actually contain quite a few contradictions and risks. For example, how can quantitative tightening ensure that long-term debt doesn't spiral out of control? If the Federal Reserve doesn't buy, who will? Of course, the Federal Reserve doesn't actually have much room to shrink its balance sheet right now. For example, During Greenspan's era, a significant reason for the success of the program was the availability of cheap labor from the University of Tokyo's entry into the WTO. It helped absorb the inflation in the United States. Now, if we isolate the University of Tokyo's production capacity, If AI productivity doesn't outpace inflation in the short term... That would mean the theory that interest rate cuts do not affect inflation has failed. For example, He believes that AI can reduce inflation, drive high growth, and not affect wages or unemployment. This is more like the ultimate form of utopia. In the short term, Musk's technological optimism should be viewed with caution. A wave of unemployment is expected across all industries in 2027; having a degree won't help. No matter how you look at Walsh's logic, it's more like painting a picture of a pie that someone who's starving can eat ten years from now. Warsh's nomination was the result of a complex interplay between the government and the market, the White House and the Federal Reserve, and political and professional considerations. This also means that after taking office, Warsh will have to satisfy Trump's political demands while maintaining the market credibility of the Federal Reserve. How to navigate the policy "balance beam" will likely be Warsh's biggest test during his tenure as head of the Federal Reserve... However, since things have come to this point, The market is, of course, still trading based on current expectations. The US has launched a war to protect the credibility of the dollar, and AI is the core driver of all productivity improvements. That's right, AI.

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content