- Editor's note

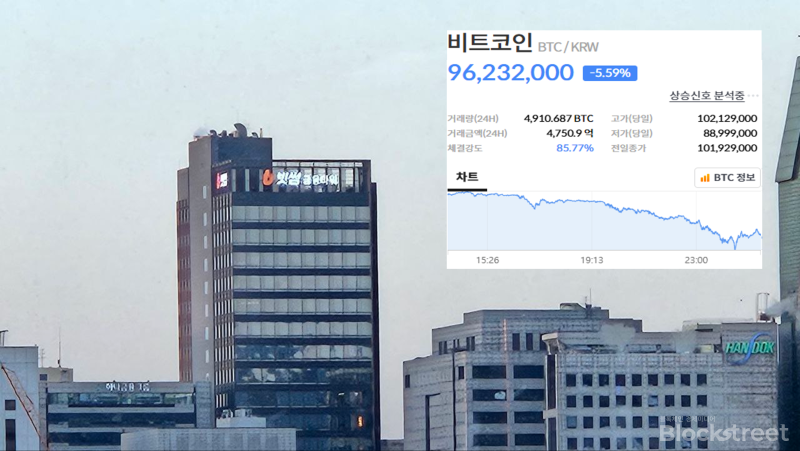

- Based on Bithumb on-chain data: 4:07 PM on February 6, 2026

View all Bithumb market trends: https://www.bithumb.com/react/insight

According to Bithumb's period-by-period return analysis, Seeker delivered an overwhelming return to short-term investors, recording a one-week return of 46.02%. Pocket Network (POKT) also showed outstanding performance for mid- to long-term investors, rising 5.75% on the day, recording a one-week return of 96.98%, a one-month return of 55.95%, and a three-month return of 23.04%. DBR (DBR) rose 6.62% on the day, recording a one-week return of 1.63%.

In terms of medium- to long-term returns, Pocket Network performed well with a 23.04% three-month return. However, most top-performing stocks recorded negative returns in both the three- and six-month periods, reflecting the recent market correction. Lumiwave recorded a -35.76% three-month return and a -69.23% six-month return, while Bifrost recorded a -31.77% three-month return and a -60.27% six-month return. Bitlayer (BTR) rose 3.48% on the day but showed high short-term volatility with a one-week return of -37.37%.

According to Bithumb's "Investment Status of the Wealthy," Bitcoin (81%) holds the largest holding among the top 5,000 investors. This was followed by Ethereum (78%), Ripple (71%), Solana (45%), and Ethereum Classic (36%).

Among the purchased assets, Bitcoin Cash (BCH) accounted for 17%, Hedera (HBAR) 13%, Tether (USDT) 13%, USDC 12%, and SEI 11%. This is an indicator that large investors are diversifying their portfolios beyond major coins with stablecoins and Layer 1 blockchain projects. In particular, the fact that stablecoins Tether and USDC accounted for a combined 25% of purchases suggests a clear preference for safe-haven assets amid market uncertainty.

Bithumb's technical analysis tools provide investors with a variety of trading signals. The "Assets Entering an Uptrend" section provides real-time information on stocks that have captured a "golden cross" signal, where the 20-day moving average crosses above the 60-day moving average. Bitlayer (BTR) showed a golden cross signal with a 2.61% rise, while Exi Infinity (AXS) fell 10.53%, Enso (ENSO) fell 0.59%, Kite (KITE) rose 0.99%, and Mibus (MEV) fell 13.06%, signaling an uptrend entry.

The "Is Now the Bottom?" segment presents stocks with a Relative Strength Index (RSI) below 30%, indicating oversold conditions. Decentraland (MANA), Apcoin (APE), Illuvium (ILV), High Street (HIGH), and Xai (XAI) all recorded an RSI of 0.00%, indicating extreme oversold conditions and presenting opportunities for buying at the bottom. These stocks are down 9.15%, 12.00%, 7.95%, 8.44%, and 7.30%, respectively, suggesting the possibility of a technical rebound.

Analysis of trading volume allows you to identify stocks with strong buying and selling pressure at a glance. BitTorrent (BTT) showed overwhelming buying with a trading volume of 500.00%, followed by Tether (USDT) at 182.36% and USD Coin (USDC) at 130.69%. Tron (TRX) and Status Network Token (SNT) also showed strong buying pressure at 111.60% and 106.68%, respectively. Conversely, stocks with strong selling pressure included Oasis (OAS) at 59.84%, Solar (SXP) at 60.82%, Open Campus (EDU) at 63.53%, World Liberty Financial (WLFI) at 65.07%, and Access Protocol (ACS) at 65.28%.

Bithumb announced that Bitcoin is currently trading at a premium of 0.76% (KRW 729,000) and Ethereum at a premium of 0.61% (KRW 17,000) compared to the global exchange Binance. Ripple is trading at a premium of 0.47% (KRW 9), and Ada at a premium of 0.81% (KRW 3). This is interpreted as an indicator of the continued robust demand for virtual assets among domestic investors.

Joohoon Choi joohoon@blockstreet.co.kr