Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author: Chang

Article source: ME News

ETF Directional Data

According to SoSoValue data, the Solana spot ETF saw a total net inflow of $2.82 million yesterday (February 5th, Eastern Time).

Yesterday (February 5th, Eastern Time), the Fidelity SOL ETF (FSOL) saw the largest net inflow of spot SOL funds, with a single-day net inflow of $1.86 million and a total historical net inflow of $158 million.

The second largest net inflow was into the Bitwise SOL ETF (BSOL), which saw a net inflow of $1.48 million in a single day, bringing its total historical net inflow to $682 million.

As of press time, the Solana spot ETF has a total net asset value of $675 million, a Solana net asset ratio of 1.51%, and a cumulative net inflow of $874 million.

According to SoSoValue data, Bitcoin spot ETFs saw a total net outflow of $434 million yesterday (February 5th, Eastern Time).

The Bitcoin spot ETF with the largest single-day net outflow yesterday was BlackRock ETF IBIT, with a net outflow of $175 million. IBIT's total historical net inflow has reached $61.609 billion.

The second largest outflow was from the Fidelity ETF FBTC, which saw a net outflow of $109 million in a single day. FBTC's total historical net inflow has reached $11.082 billion.

As of press time, the total net asset value of Bitcoin spot ETFs was $80.763 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 6.34%, and a cumulative net inflow of $54.318 billion.

According to SoSoValue data, the Ethereum spot ETF saw a total net outflow of $80.7923 million yesterday (February 5th, Eastern Time).

The Ethereum spot ETF with the largest single-day net inflow yesterday was the Grayscale Ethereum Mini Trust ETF (ETH), with a single-day net inflow of $7.0526 million. The current total historical net inflow of ETH is $1.653 billion.

The second largest inflow was into the Invesco ETF QETH, with a net inflow of $3.5312 million in a single day. The total historical net inflow into QETH is currently $27.0876 million.

The Ethereum spot ETF with the largest single-day net outflow yesterday was the Fidelity ETF FETH, with a single-day net outflow of $55.7826 million. Currently, FETH's total historical net inflow has reached $2.509 billion.

As of press time, the Ethereum spot ETF has a total net asset value of $10.903 billion, an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 4.83%, and a historical cumulative net inflow of $11.826 billion.

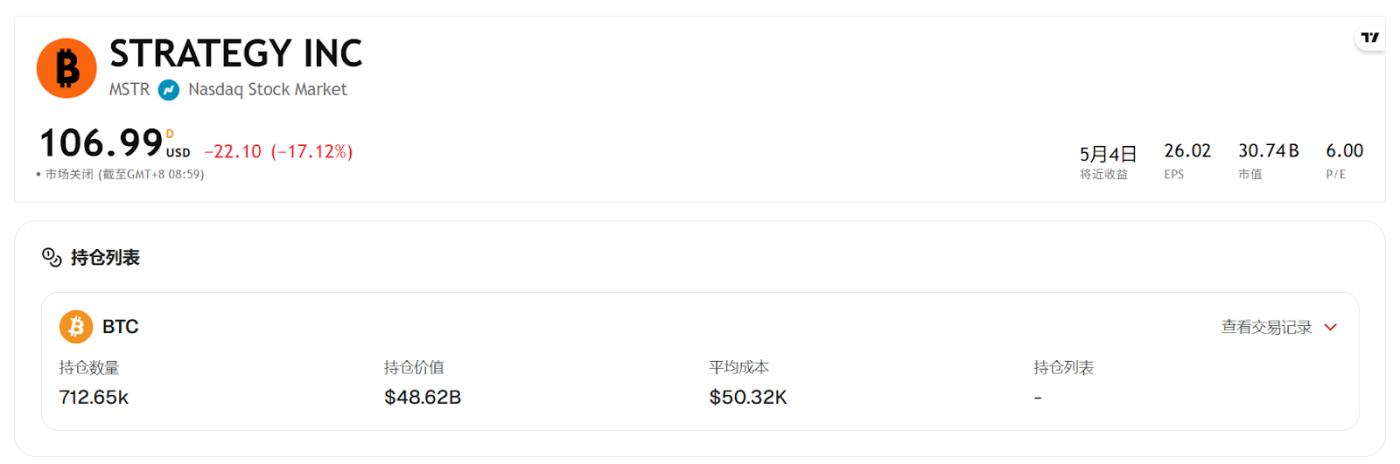

BTC direction

According to CoinFound data, 195 listed companies currently hold a total of 1,205,412 BTC, accounting for 6.06% of the total Bitcoin supply. Among them, Strategy Inc (MSTR) holds 713,502 BTC, accounting for 59.19% of the total holdings of listed companies.

RWA direction

According to CoinFound data:

- Market capitalization of commodities: US$6.6 billion

- Market value of government bonds: US$1.48 billion

- Institutional fund market capitalization: US$2.56 billion

- Private lending market capitalization: $37.19 billion

- Market value of US Treasury bonds: $10.25 billion

- Market value of corporate bonds: US$1.62 billion

- Market capitalization of tokenized stocks: $1.7 billion

Market Dynamics:

- MSTR reported a net loss of $12.4 billion in Q4 2025, causing its stock price to plummet 17% that day.

- The market capitalization of the top 20 DAT companies has shrunk by a total of $17 billion, with Bitmine accounting for over 40%.

- Saylor's unrealized losses exceed $10.1 billion, and Tom Lee's unrealized losses exceed $8.65 billion.

- Ondo Finance's flagship fund USDY is officially launched on the Sei network.

Summarize:

The RWA market is at a dramatic turning point. Under the stress test of a sharp "flash crash" in the broader cryptocurrency market, the RWA sector has demonstrated strong counter-cyclical resilience by leveraging its narratives of "safe haven" and "infrastructure maturity".

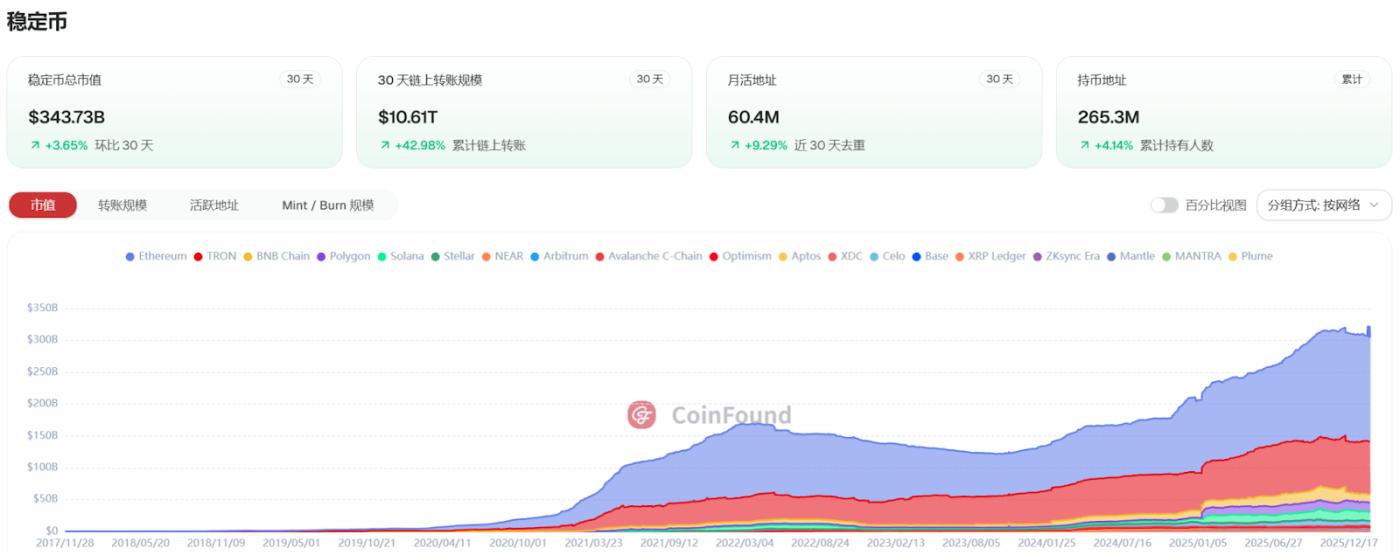

Stablecoin direction

According to CoinFound data:

- USDT market capitalization: $198.16 billion

- USDC market capitalization: US$71 billion

- EURC's market capitalization: $12.25 billion

- USDS market capitalization: $11.11 billion

- USDe market capitalization: $6.56 billion

- PYUSD Market Cap: $3.34 billion

- USD1 Market Cap: $5.32 billion

Market Dynamics:

- Tether releases Q4 report: USDT data to hit multiple new highs in Q4 2025

- Fidelity's FIDD program saw subscriptions exceed $5 billion in its first 48 hours.

- News from the White House summit suggests that the Section 404 amendment may allow for "compliant dividend payments."

- Circle releases USDC "programmable compliance" suite

- The first euro-denominated stablecoin under the European MiCAR framework, EURE, has surpassed 2 billion units in size.

Summarize:

The stablecoin market as a whole is showing growth momentum. Despite the large fluctuations in the overall crypto market, with Bitcoin falling back below $70,000 and Ethereum dropping below $2,000, the role of stablecoins as the "infrastructure pillar" of the digital asset ecosystem has been further strengthened.