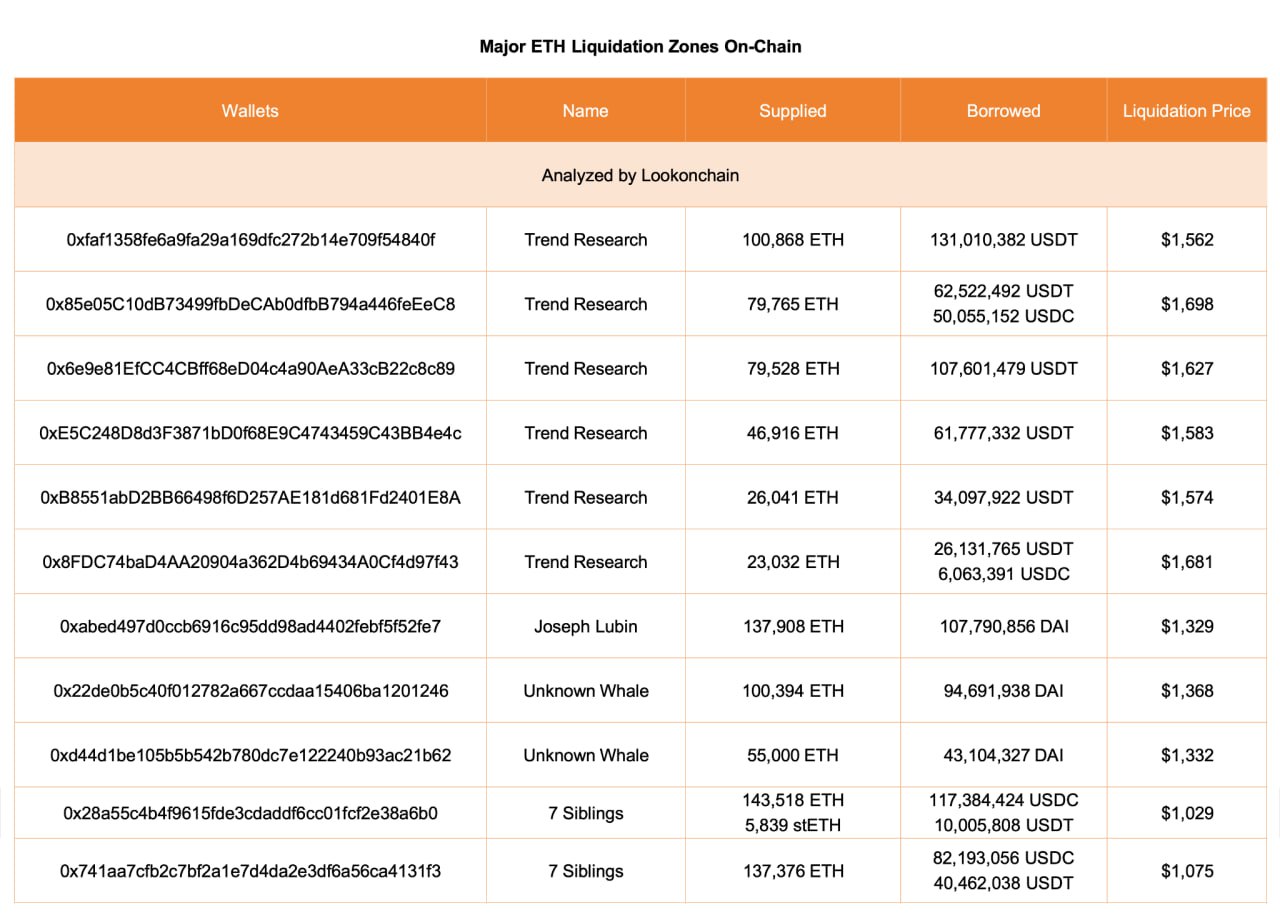

Massive liquidation by Ethereum whales ✅ Large-scale on-chain liquidation risk identified in the $1,700-$1,000 range during Ethereum price declines 🗂 Trend Research 🔘 Holdings: 356,150 ETH (approximately $671 million) 🔘 Liquidation range: $1,562-$1,698 🔘 Characteristics: Concentrated leveraged positions held by multiple wallets, presumed to be the same entity 🗂 Joseph Lubin + 2 unidentified whales 🔘 Holdings: 293,302 ETH (approximately $553 million) 🔘 Liquidation range: $1,329-$1,368 🔘 Characteristics: Intermediate defensive zone with overlapping ETH key players and whale holdings 🗂 7 Siblings 🔘 Holdings: 286,733 ETH (approximately $541 million) 🔘Liquidation range: $1,075 / $1,029 🔘Characteristics: Key macro liquidation zone at the bottom, with a potential for cascading volatility if it collapses. 🧭 See more details 🗄 Comment Currently, Ethereum is facing a more important phase, with the on-chain leverage liquidation zone being more important than simple price support and resistance. In particular, a breakout of the $1,300 level is likely to act as a turning point for medium-term volatility.

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content