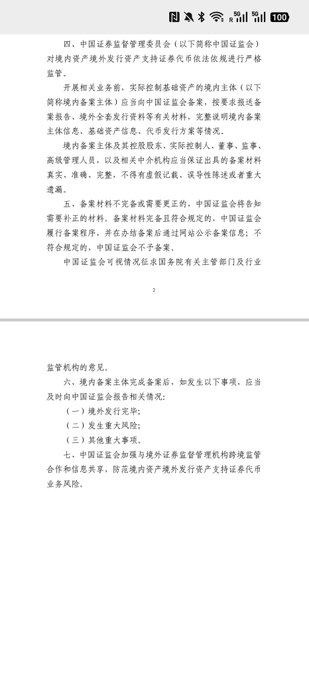

The biggest highlight of this announcement is actually allowing the tokenization of domestic assets and their issuance overseas! Although it requires registration with the China Securities Regulatory Commission (CSRC), they've thoughtfully included regulatory guidelines as an appendix. This means domestic investors can't be exploited, but overseas investors can. However, it's crucial to ensure this doesn't become a channel for asset outflow.

This article is machine translated

Show original

加密大漂亮| C Labs | 招人

@giantcutie666

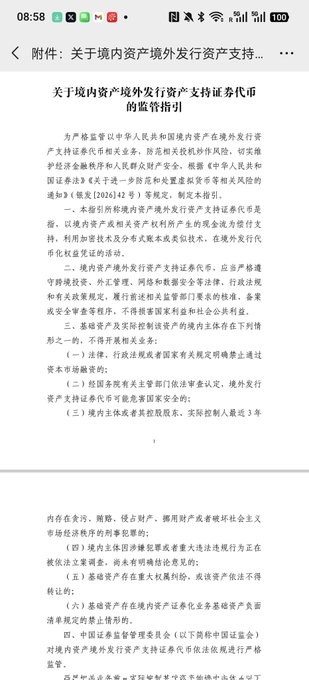

就在刚才,中国人民银行等八部委又发了一个通告,取代了原2021 年发布的通知,区别主要有:

1. 近年来号称“合规”的RWA也被明确禁止。

2. 境内主体若以境内资产为基础在境外发行代币,必须向中国证监会进行备案,防止资产外流

3. 强化“属地落实”,哪个省的案子哪个省来办,减少跨省逐利执法。

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content