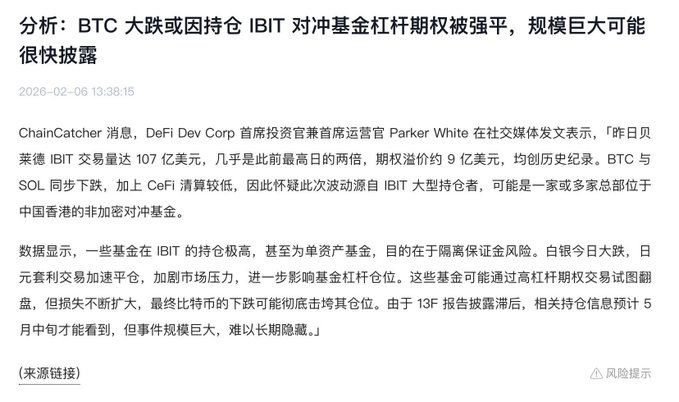

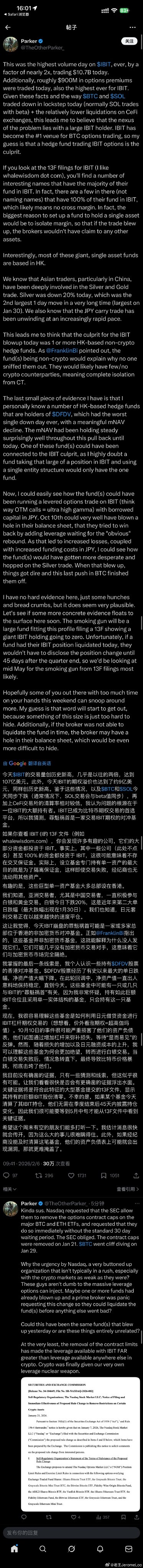

The sharp drop in BTC prices may be due to the forced liquidation of leveraged options held by hedge funds in IBIT. There is no direct, hard evidence yet. But judging from the market situation, I believe it is true. This wave just makes people feel... There is an endless supply of coins. They kept smashing it down regardless of the cost. Let alone a rebound, There wasn't even a period of consolidation. From the entire history of BTC These are all extremely rare. Especially when it accelerated and dropped to 60,000 at the end, Overselling is extremely serious. That's why I reacted after the last dip this morning. Buy the dips ETH spot at 1850 | _2024111120230_ | This kind of opportunity probably only happens once or twice a year. Now that we've seen it, it would be a waste not to make a profit :)

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share