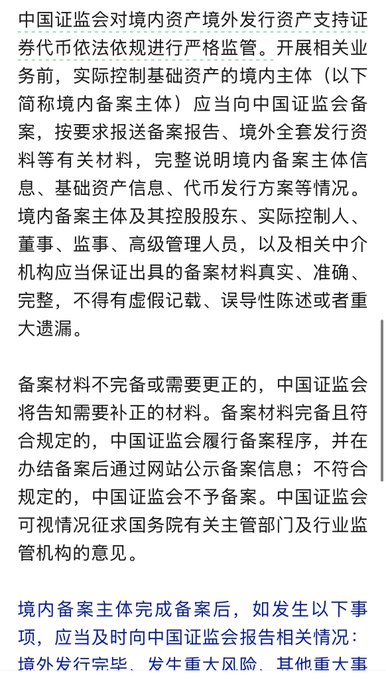

I agree with Frank's view. Yesterday's document from eight ministries establishing the regulation of RWA indicates that regulators understand the true intention behind asset tokenization: The US, through RWA, allows dollar-denominated assets to siphon global liquidity, further strengthening the dollar's hegemony. While Dongda hasn't yet figured out how stablecoins can be used, and doesn't want to call it RWA, this approach is essentially the same as cross-border e-commerce: selling Chinese goods globally, boosting GDP, and generating revenue to support the real economy. The official document calls it "issuing asset-backed security tokens overseas using domestic assets," which is also to distinguish it from RWA, allowing for the definition of their own rules. Let's see what kind of goods will be sold initially.

This article is machine translated

Show original

qinbafrank

@qinbafrank

02-07

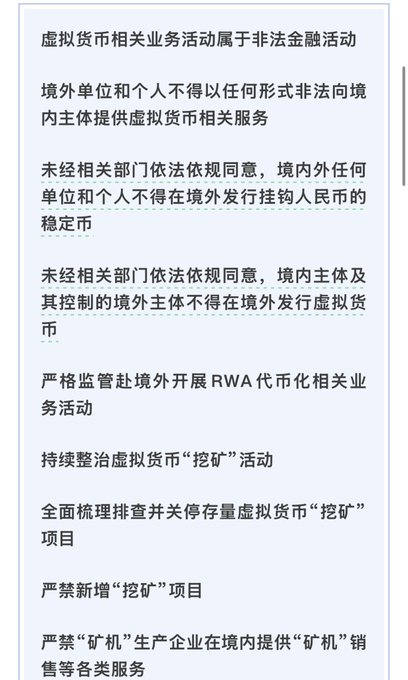

为何一方面八部委加强虚拟货币监管,然后证监会还给境内资产境外发行资产支持证券代币开了口子?昨天中国监管部门连发两份监管文件:第一份是八部委联合加强对虚拟货币监管:不得向境内主体提供虚拟货币服务、不得在境外发行挂钩人民币的稳定币、不得在境外发行虚拟货币、继续整体挖矿活动等,延续了此 x.com/qinbafrank/sta…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content