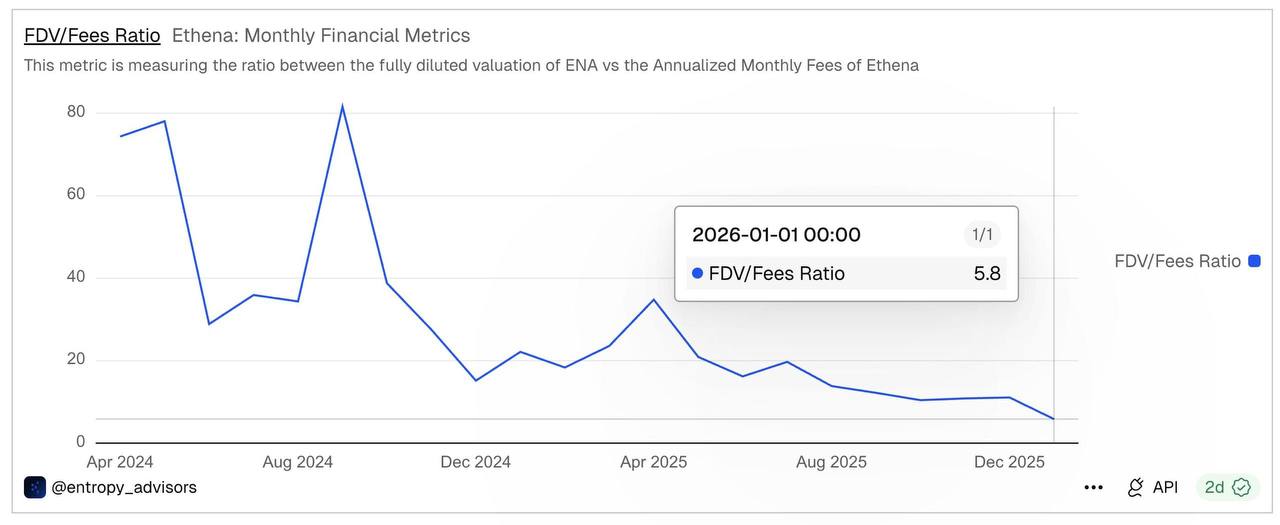

Ethena’s FDV-to-fees ratio compressed to ~5.8 in January, while fees hit $29M (+32% MoM). With ENA trading near ATL, the playbook is clear: push USDe into TradFi and CeFi, embed it deeper as collateral, and optimize duration and yield as rates roll over. If execution lands, Ethena likely looks very different in a lower-rate regime.

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content