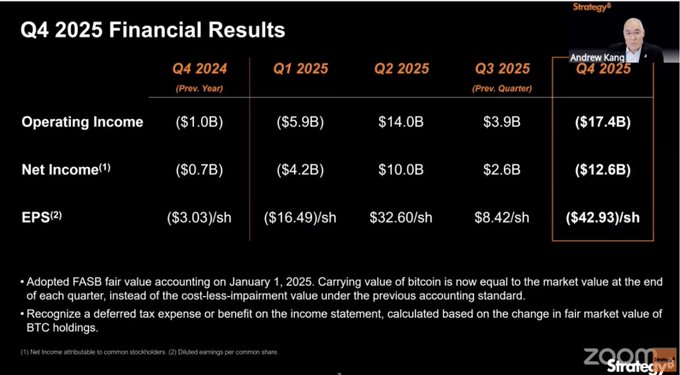

MicroStrategy released its Q4 financial report, showing a loss of $12.4 billion, the largest loss since its IPO. The stock fell from $457 to $104. MicroStrategy's operations in 2025: 1. Added approximately 225,000 BTC, accounting for 3.4% of the circulating supply. 2. Raised $25.3 billion, becoming the largest equity issuer in the US. 3. Launched five types of preferred stock, packaging Bitcoin as an 8%–11% "financial product." This resulted in MicroStrategy incurring $888 million in annual interest expenses. Meanwhile, its annual software revenue was only $477 million. I checked, and MicroStrategy's current average BTC holding price is 76,000; now it's at 69,000, resulting in a loss of over $7 billion. MicroStrategy made a lot of money when BTC was rising; if it falls, it could very well collapse.

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content