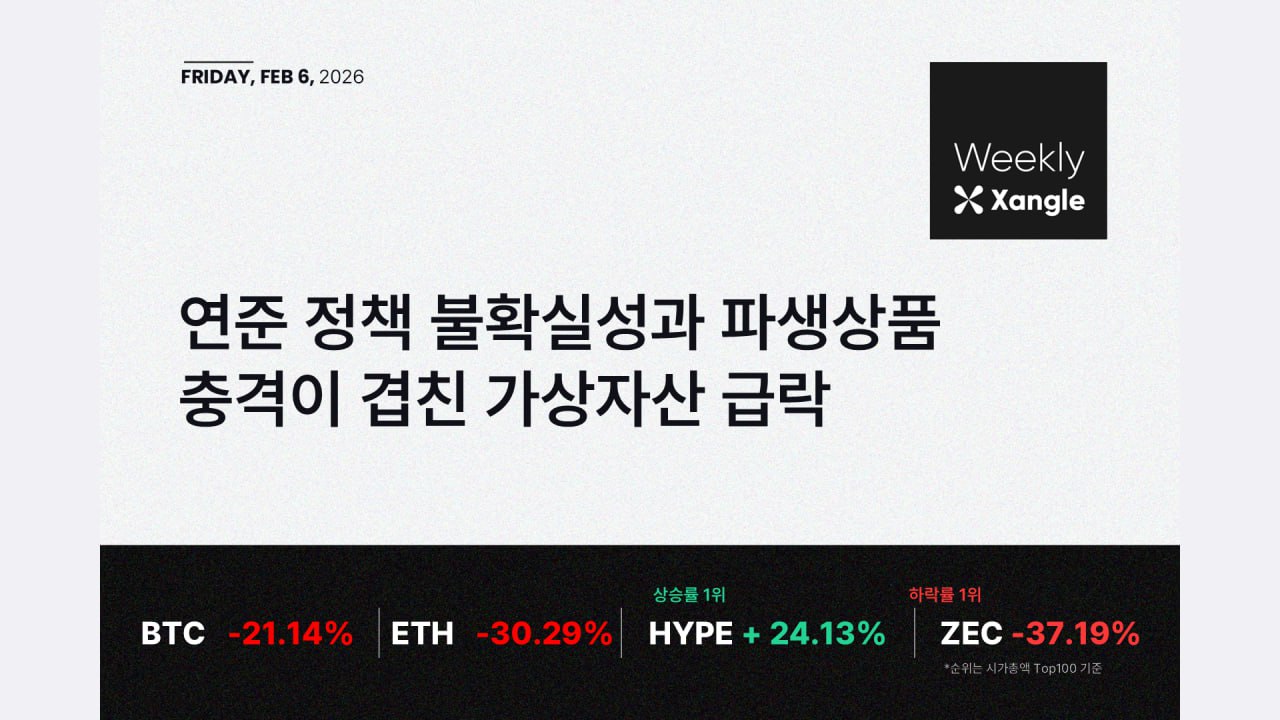

[Weekly Xangle] Virtual Assets Plunge Due to Fed Policy Uncertainty and Derivatives Shock In the first week of February 2026, the virtual asset market underwent a significant correction amid deleveraging pressure across risky assets. Bitcoin closed at $64,564, down 21.1% from the previous week, and Ethereum fell 30.3% to $1,893. The successive collapse of key support levels led to a sharp increase in market volatility, with most altcoins, with the exception of a few, experiencing double-digit declines. Only Hyperliquid (HYPE, +24.13%) showed limited strength, suggesting a general risk-aversion trend in the market. Uncertainty regarding the Federal Reserve's monetary policy played a significant role in this correction. With the possibility of Kevin Warsh being nominated as the next Federal Reserve Chairman, the market began to perceive that the high interest rate environment could be prolonged beyond expectations. As a result, risky asset positions, previously built on the premise of an interest rate cut, rapidly contracted, and the dollar's rebound shifted the global liquidity environment to a disadvantage for virtual assets. This shift in macro policy expectations triggered a position adjustment across risky assets. Furthermore, the expiry of a large Bitcoin options contract at the end of January further amplified the downward pressure. With billions of dollars worth of Bitcoin options expiring simultaneously, investors holding options and market participants hedging against them simultaneously liquidated their positions. This led to a surge in selling pressure in the spot and futures markets, and the rapid decline in prices triggered a chain reaction of forced liquidations in the derivatives market. Consequently, short-term supply-demand imbalances deepened, accelerating the decline. 👉 Watch "Weekly Jangle, First Week of February" on Jangle Official Channel: t.me/xangle_research/1578

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content