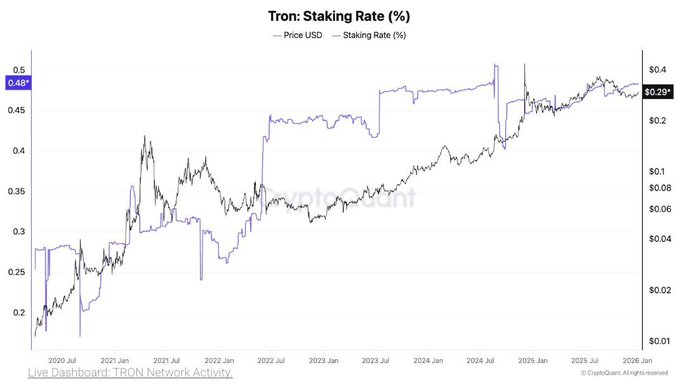

📊 With nearly half of TRX staked, this chart says it all. The first time you see this TRX staking rate curve, your intuition might be "wow, 48%," but it actually means: 👉 TRON has entered a period of "structural stability," not just a short-term hype phase. According to CryptoQuant's on-chain data, approximately 48% of the total TRX supply (about 45.7 billion tokens) is currently staked. More importantly, this isn't an abnormal peak in a single cycle, but rather an upward trend that has persisted for many years, spanning multiple market fluctuations. This in itself illustrates one thing: TRX holders are shifting from "speculators" to "network participants." 1️⃣ High staking rate ≠ Just for returns ➜ It directly determines the operational quality of the TRON network. On TRON, staking is not a passive behavior. Staking TRX plays a triple role: ➜ Participating in network consensus, enhancing security ➜ Providing fundamental guarantees for block production and verification ➜ Allocating Energy and Bandwidth to users, directly impacting transaction costs As more TRX is locked in the system, the network doesn't slow down; instead, it becomes smoother. This is a key reason why TRON can maintain speed, stability, and low cost even under high load. 2️⃣ The changes users truly "feel" actually come from the staking structure ➜ Not market sentiment Many people only look at the price, but those who have actually used TRON will notice these subtle changes: ➜ Almost no sudden spikes in transaction fees during peak periods ➜ Smoother DeFi operations, with a significantly reduced probability of congestion ➜ Smoother large-scale settlements of stablecoins (especially USDT) ➜ Developers can more accurately predict long-term operating costs These are not coincidences, but rather systemic results of high staking rates. 3️⃣ This curve reflects "network maturity," not market price. ➜ Price fluctuates, but the structure is strengthening. The chart clearly shows: ➜ TRX price has experienced multiple rounds of fluctuation. ➜ However, the staking ratio has consistently increased and gradually stabilized at a high level. This represents a shift: From short-term trading → Long-term participation in network building. For DeFi protocols, payment platforms, and applications relying on high-frequency transfers, this stable underlying structure is more important than any short-term price surge. 🔍 From an ecosystem perspective, what does 48% staking mean? ➜ Confidence of long-term holders ➜ Builders' trust in the infrastructure ➜ Institutional and high-frequency users' reliance on cost predictability. TRON's ability to handle massive on-chain transaction volumes is not because it's "cheap," but because its economic and resource model has been validated over a long period. 🧠 Personal opinion (conclusion) At the current stage, simply using price to evaluate TRON is somewhat outdated. What truly deserves attention is this continuously accumulating structural strength. High staking rates are not just a slogan, but a result. It explains why TRON can sustain real-world use cases over the long term, rather than being a fleeting fad. ❓If a public blockchain can continuously increase staking participation, stabilize resource costs, and support real-world transaction demands over a multi-year period—would you consider it a "project with a completed narrative," or "infrastructure that hasn't been fully priced in yet"? @justinsuntron @trondao #TRX #TRONEcoStar

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content