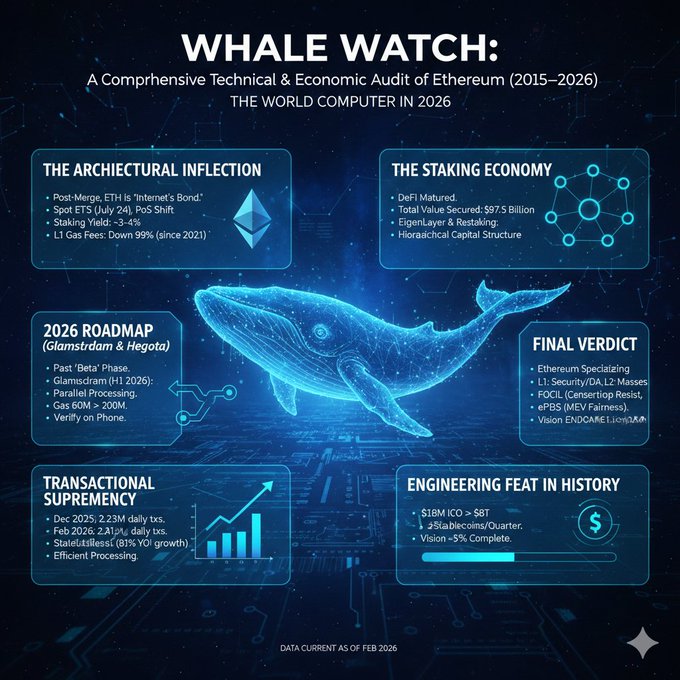

🐋 WHALE WATCH: 1. A Comprehensive Technical & Economic Audit of Ethereum (2015–2026). We are witnessing the most ambitious engineering feat in history. From a $18M ICO to a network settling $8T in stablecoins per quarter. Here is the state of the World Computer in 2026. ↓ 2. The Architectural Inflection Post-Merge, ETH is no longer just "tech"—it’s a high-grade financial asset. With the Spot ETFs (July '24) and the shift to PoS, ETH has become the "Internet's Bond." Current Staking Yield: ~3-4% L1 Gas Fees: Down 99% since 2021. 3. The 2026 Roadmap (Glamsterdam & Hegota) We’ve moved past the "Beta" phase. • Glamsterdam (H1 2026): Introduction of parallel processing. Gas limits jumping from 60M to 200M. • Hegota (H2 2026): Verkle Trees & Statelessness. You’ll soon be able to verify the chain on a phone. 4 Transactional Supremacy Don't let the "L2" talk fool you—L1 is a beast. • Dec 2025: Record 2.23M daily transactions. • Feb 2026: 2.41M daily txs (81% YoY growth). The network is processing more volume than ever, but doing it *efficiently*. 5 The Staking Economy DeFi has matured. TVL is healthy at $58B+, but "Total Value Secured" (bridged assets + L2s) is the real metric to watch: $97.5 Billion. EigenLayer & Restaking have created a hierarchical capital structure that didn't exist 3 years ago. 6 Final Verdict Ethereum isn't just "scaling"; it’s specializing. L1 for security/DA, L2 for the masses. With FOCIL (censorship resistance) and ePBS (MEV fairness), the "World Computer" vision is ~55% complete. The endgame is near.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content