Compiled by: Jerry, ChainCatcher

Last week's performance of crypto spot ETFs

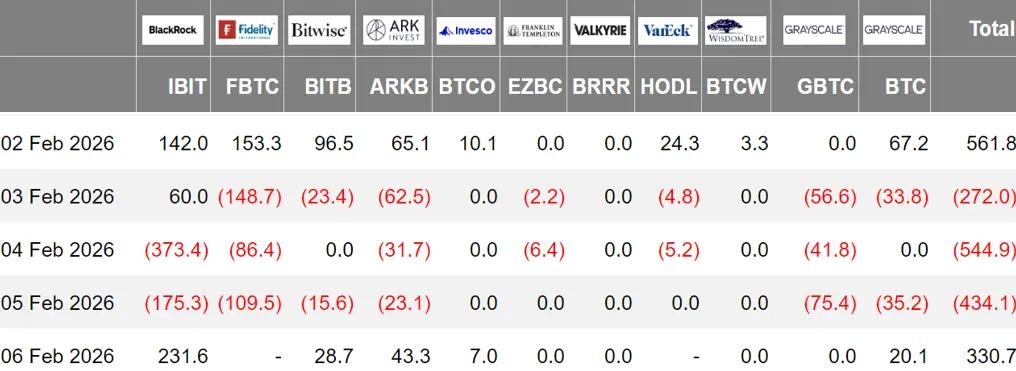

US Bitcoin spot ETFs saw net outflows of $358 million.

Last week, the US Bitcoin spot ETF experienced net outflows for four days, totaling $358 million , bringing its total net asset value to $80.76 billion.

Last week, five ETFs experienced net outflows, with the outflows mainly coming from FBTC, GBTC, and IBIT, amounting to $191 million, $173 million, and $115 million respectively.

Data source: Farside Investors

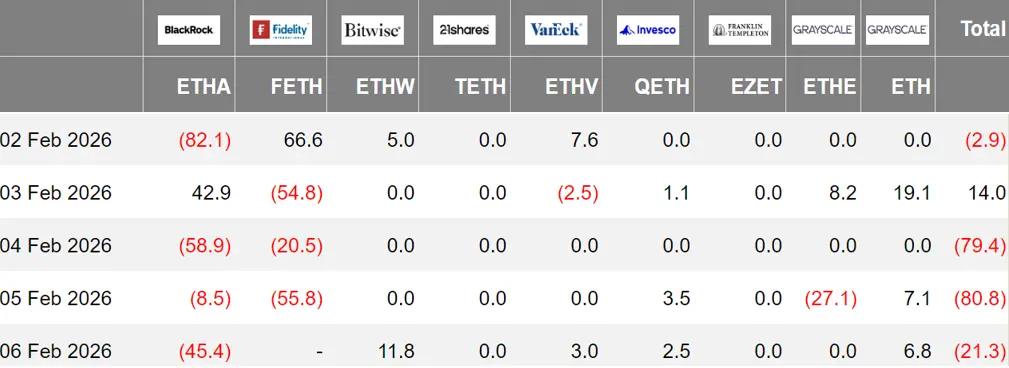

The US Ethereum spot ETF saw a net outflow of $170 million.

Last week, the U.S. Ethereum spot ETF experienced net outflows over three days, totaling $170 million, with total net assets reaching $10.9 billion.

Last week's outflows mainly came from BlackRock ETHA, with a net outflow of $152 million. Three Ethereum spot ETFs were also experiencing net outflows.

Data source: Farside Investors

The Hong Kong Bitcoin spot ETF saw a net inflow of 28.6 Bitcoins.

Last week, Hong Kong Bitcoin spot ETFs saw a net inflow of 28.6 Bitcoins, bringing their net asset value to US$249 million. Among them, the issuer, Harvest Bitcoin ETF, saw its holdings decrease to 290.66 Bitcoins, while ChinaAMC ETF increased its holdings to 2410 Bitcoins.

The Hong Kong Ethereum Spot ETF saw a net inflow of 36.96 Ethereum, bringing its net asset value to US$72.01 million.

Data source: SoSoValue

Crypto spot ETF options performance

As of February 5, the notional total trading volume of U.S. Bitcoin spot ETF options was $5.87 billion, with a notional long/short ratio of 0.78.

As of February 5, the total notional open interest of U.S. Bitcoin spot ETF options reached $22.32 billion, with a notional long/short ratio of 1.56.

Short-term trading activity in Bitcoin spot ETF options has increased, with overall sentiment leaning towards a bearish outlook.

In addition, the implied volatility is 67.61%.

Data source: SoSoValue

A summary of last week's crypto ETF activity

According to official documents, Bitwise has formally submitted its S-1 registration statement to the U.S. Securities and Exchange Commission (SEC) to apply for the launch of the Bitwise Uniswap ETF.

The product is managed by Bitwise Investment Advisers and custodied by Coinbase Custody. It does not currently participate in staking, but may be introduced in the future through revisions to the registration documents.

ProShares launches crypto exchage 20 Crypto ETF

According to CoinDesk, asset management firm ProShares has announced the launch of the KRYP ETF, the first U.S. crypto asset ETF to track the CoinDesk 20 index, providing investors with exposure to a basket of the 20 largest and most liquid cryptocurrencies by market capitalization.

This index uses market capitalization weighting with a weight cap and is rebalanced quarterly to reduce the risk of concentration in a single asset. CoinDesk 20 filters from the top 250 crypto assets by market capitalization, excluding stablecoins, meme coins, privacy coins, and various pegged/wrapped assets.

Raycus Asia reduced its holdings of BlackRock Ethereum ETF by over $16 million.

Singapore-based asset management firm Pilgrim Partners Asia disclosed in a filing with the U.S. Securities and Exchange Commission (SEC) that it sold 620,000 shares of BlackRock's iShares Ethereum Trust ETF in the last quarter, valued at $16.21 million.

As of now, the company also holds $25.49 million worth of BlackRock Bitcoin ETF and $10.64 million worth of Strategy shares.

Grayscale CoinDesk Crypto 5 ETF will add BNB.

According to official sources, Grayscale has announced that it will add BNB to its CoinDesk Crypto 5 ETF. The ETF is already listed on the NYSE Arca and includes Bitcoin, Ethereum, SOL, and XRP. Its trading symbol is GDLC. The product was formerly known as the Grayscale Digital Large Cap Fund.

Opinions and Analysis on Crypto ETFs

Eric Balchunas, a senior ETF analyst at Bloomberg, wrote on the X platform that his previous assessment that the investor structure of Bitcoin ETFs would be stronger than the market expected is still largely valid, but his prediction that ETF funds would reduce market volatility has proven to be wrong.

Eric Balchunas stated that he originally believed that retail funds in ETFs would replace highly speculative retail investors before the FTX incident, thereby improving market stability. However, he did not fully consider the selling pressure caused by early holders (OG) reducing their positions at high levels. He also pointed out that Bitcoin's rise of about 450% in two years is itself a potential risk signal, as rapid price increases are often accompanied by high volatility. Therefore, Bitcoin's high volatility and high risk asset attributes will continue in the foreseeable future.

As the Bitcoin sell-off intensified and the price fell below $70,000, its core selling point of "limited edition of 21 million coins" is being questioned by the market. Analysts point out that derivatives such as ETFs, cash-settled futures, options, and financing have diluted Bitcoin's scarcity, creating a "synthetic supply" that makes the price more driven by derivatives trading rather than supply and demand.

Senior analyst Bob Kendall wrote: "Once the supply can be synthesized, the asset is no longer scarce, and the price becomes a derivatives game, which is exactly what Bitcoin is currently doing. Similar structural changes have also occurred in the gold, silver, oil, and stock markets."

Eric Balchunas, a senior ETF analyst at Bloomberg, wrote on the X platform that despite the 40% drop in Bitcoin prices, which resulted in paper losses for many investors, only about 6% of the assets in Bitcoin ETFs actually flowed out, with 94% still holding their positions.

In contrast, established Bitcoin investors (OGs) may behave differently in similar market conditions, a trend that shows a new generation of ETF investors are more committed to long-term holding strategies.

According to CoinDesk, Citi analysis indicates that Bitcoin is approaching a key pre-US election price support level.

The report states that after weeks of decline, the price of Bitcoin has fallen below the bank's estimated average entry cost of approximately $81,600 for U.S. spot Bitcoin ETFs, and is approaching the key level of around $70,000 before last year's election.

The report points out that the main source of new demand supporting the market—ETF inflows—has slowed significantly, while the futures market continues to see long positions being liquidated. Analysts say the cryptocurrency market is exhibiting volatility similar to precious metals, but has failed to follow the recent safe-haven rally in gold, highlighting that its price is still primarily influenced by liquidity conditions and risk sentiment, rather than safe-haven demand.

The report argues that regulatory progress remains a key potential catalyst, but the slow and uneven progress of the US digital asset market structure bill has dampened related expectations. The report also mentions macroeconomic risks, including concerns about the contraction of the Federal Reserve's balance sheet, which has historically put pressure on crypto assets by reducing liquidity in the banking system.

According to Bloomberg, the core issue behind this "slow" sell-off in Bitcoin is that the group of investors who were expected to be the most stable buyers in the new round have not continued to enter the market. Glassnode data shows that investors who entered through the US spot Bitcoin ETF had an average purchase price of approximately $84,100. With Bitcoin currently hovering around $78,500, this group is experiencing a paper loss of about 8%–9%.

This is not the first time ETF investors have suffered paper losses. Back in November of last year, when Bitcoin briefly dipped below $89,600 (which was then the average cost range for ETF investors), analysts pointed out that this would be a crucial test of the "conviction strength" of newly mainstream investors. Subsequently, while inflows from early 2024 remained profitable, the overall average cost of ETFs decreased, but later-entering funds have all fallen into losses. Looking at the decline from its peak, Bitcoin has fallen more than 35% from its 2025 high, and even briefly dipped below $77,000 in a low-liquidity trading environment over the weekend.

Analysts believe this is the result of a confluence of factors: dried-up capital inflows, declining market liquidity, and a general weakening of macroeconomic attractiveness. Bitcoin's failure to react to traditional bullish factors such as a weakening dollar or geopolitical risks, coupled with its "decoupling" from other assets, has made its price movements increasingly directionless. The biggest difference between the sharp drop in October and the current downturn lies in market sentiment: there is no panic, only "absence."

The 2025 rally that pushed Bitcoin above $125,000 was fueled by market euphoria surrounding regulatory prospects, institutional entry, and a bullish retail base. However, since the October crash liquidated billions of dollars in leveraged positions, these very buyers who had driven the rally have chosen to remain on the sidelines and observe.

According to Glassnode analyst Chris Beamish, Bitcoin has now fallen below the average cost basis (approximately $84,000) for holders of US spot ETFs, resulting in unrealized net losses for ETF buyers. Beamish stated that this is the first real stress test for US spot ETF holders.

After the US stock market opens, will investors choose to buy or will there be a panic sell-off? Tonight may be a "stress test."

Matrixport: Bitcoin lacks new narrative; weak ETF funding may lead to continued consolidation.

A recent analysis by Matrixport points out that the core reason for Bitcoin's recent consolidation lies in the "lack of narrative." Data shows that Bitcoin spot ETFs have recorded net outflows for three consecutive months. Although several US wealth management institutions have opened up access points, the new channels have not brought corresponding incremental funds, and the overall ETF liquidity remains weak.

Matrixport believes that marginal demand in the traditional financial (TradFi) sector may have reached a point of saturation. From a timeline perspective, July was the last significant window for net inflows, after which the momentum of funds has been weakening. The report points out that Bitcoin may need a "narrative reboot" or a new core pricing theme to gain substantial support in terms of funding and expectations and attract funds back to TradeFi; the current trend is more likely a temporary correction than a long-term trend reversal.