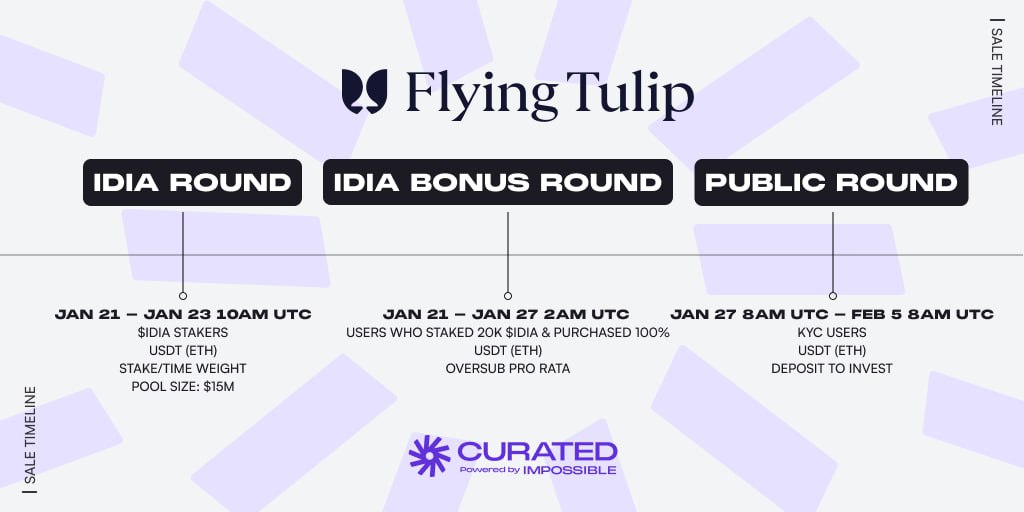

💎 [Reminder] Flying Tulip Public Sale Check This is a unique case among recent public sales, so here are the key points. Currently running on Impossible Finance and running until February 16th. This is not a structure for purchasing tokens directly. → This is a position with 100% principal protection. ✅ Price & Valuation Structure 🟢 Price: Fixed at 1 FT = $0.1 🟢 FDV: Not fixed, based on actual fundraising amount. - Example: $200M raised → FDV $200M 🟢 Hard Cap: $1B (Total 10B FT) ❕ This does not mean you are pre-qualified for the $1B valuation. ✅ Perpetual PUT Mechanism (Expand) Upon purchase, you receive an ftPUT NFT instead of a FT. This single NFT contains all of the options below. 🟢Hold - Hold - Maintain downside protection + leave room for upside potential 🟢Withdraw (when up) - When the price of FT rises - Withdraw FT from the NFT and sell it on the market 🟢Exit (when down) - When the price falls - Burn the NFT → 100% of the deposit is returned ❕ No expiration date, select at any time. ✅ Example for Understanding the Structure (Expand) 100 USDT Deposit → 1,000 FT ftPUT NFT 🟢 Upward - FT $0.2 - FT Withdrawal → Sell → Realize Profit 🟢 Downward - FT $0.05 - NFT Burn → 100 USDT Recovered 🟢 Another Option - Secondary Trading Possible with a Premium on the NFT ✅ Team Unlock Method (Expand) 🟢 Simple Yield ❌ 🟢 Unlock Only When Actual Protocol Revenue is Generated Revenue Generated → Market Price Buyback & Burn → Unlock the Same Value Ratio: - 40% Foundation - 40% Team - 20% Incentives ❕ The team cannot rely solely on price pumping. ✅ CEX Listing Related 🟢 CEX Listing Prerequisite No 🟢Price formation centered on internal market + buyback 🟢Listing possibility is open, but current focus is on product ✔️Participation Information 🟢Period: ~ February 16th (TGE scheduled for February-March) 🟢KYC approximately 5 minutes 🟢No participation amount limit ➡️Click Participate in Sale ⚡ FAQ ㅣ Position Management ㅣ NFT Market ㅣ TVL / Profit ㅣ Fundraising Status 💬 Comment A public sale with structurally closed downsides, and selectively open upsides. The biggest difference is that the NFT itself is a "protected asset." Once you understand the structure, it seems like a reasonably reasonable design.

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content