Bitmain CEO: "Seven 60% plunges over the past eight years, all with V-shaped recoveries."

"Strategy 25% rebound signals market bottom."

"Recovery as fast as the decline…A symmetrical pattern repeats."

"It's possible that the virtual asset market is currently bottoming out," Chairman Tom Lee said in an interview with CNBC on the 7th. "The signs we're seeing now, especially considering that Strategy has rebounded about 25%, make that likely."

Seven sharp declines in the past eight years, all with V-shaped recoveries.

Chairman Tom Lee expressed optimism based on Ethereum's historical price patterns. He emphasized, "Over the past eight years, Ethereum has experienced seven declines of more than 60%. The good news is that all seven of these events ended in a V-shaped recovery."

A V-shaped bounce is a pattern in which prices recover rapidly after a sharp, cascading decline. Tom Lee described Ethereum's typical price action as "a cascading decline first, followed by a rapid recovery."

"Decline = Recovery" Symmetrical Pattern

Chairman Tom Lee pointed out the symmetry of Ethereum's price movements, saying, "We recover roughly at a similar rate as we decline."

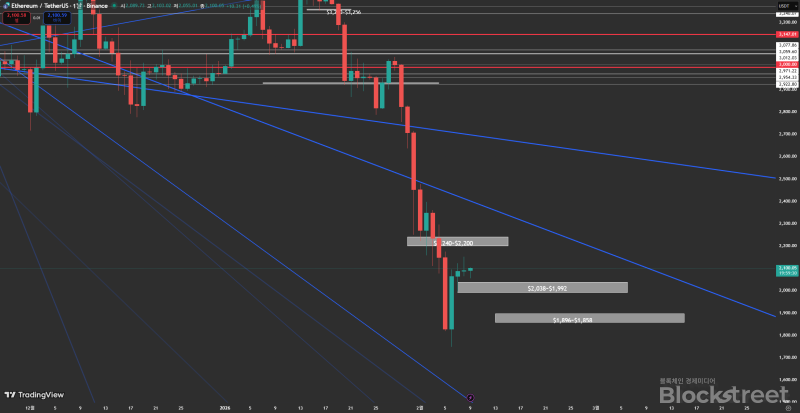

Analysis of Ethereum's log charts from 2018 to this year revealed a V-shaped upward trend in all seven instances of declines of 50% or more. The decline and recovery periods were symmetrical, and rapid rebounds were frequently followed by sharp declines.

Bitmine Maintains Optimism Despite $8 Billion Loss

Interestingly, Tom Lee's optimistic outlook comes as Bitmine faces massive losses. As Ethereum plummeted below $2,000, Bitmine's losses expanded to $8 billion (KRW 11.712 trillion).

Bitmine, a company that has adopted an Ethereum-based financial strategy, holds a significant amount of Ethereum. As of February 3, Bitmine's Ethereum holdings amount to 3.55% of the total ETH supply.

Despite mounting losses and a plummeting stock price, Tom Lee appears to remain confident in Ethereum's long-term value.

Strategy Rebound: A Signal for Market Bottom?

Tom Lee cited the roughly 25% rebound in shares of Strategy, a Bitcoin bull led by Michael Saylor, as a key sign that the market was bottoming.

Strategy, the world's largest publicly traded company with Bitcoin holdings, is considered a leading indicator of sentiment in the virtual asset market. The company's stock price rebound suggests improving sentiment among institutional investors.

Ethereum Attempts Recovery After Breaking Below $2,000

Ethereum shocked investors in early February when it plunged below $2,000. As of today, Ethereum is trading at around $2,093, attempting to reclaim the psychological resistance level of $2,000.

As Tom Lee predicts, the current plunge could mark the beginning of a V-shaped recovery, like the seven previous instances. However, some argue that a cautious approach is necessary, given macroeconomic uncertainty and regulatory risks.

Is the virtual asset market at an inflection point?

Tom Lee's remarks offer a glimmer of hope in the cryptocurrency market, which is experiencing extreme volatility. With market sentiment extremely negative, with Arkham Intelligence's sentiment indicator hitting -330, his analysis, based on historical patterns, is attracting attention.

While past data doesn't guarantee the future, it's true that Ethereum has weathered multiple crises and achieved a V-shaped recovery. Whether the market has truly bottomed or is still headed for further declines will be determined by price action over the next few weeks.

Joohoon Choi joohoon@blockstreet.co.kr