The liquidation of the IBIT spot ETF is not the liquidation of Bitcoin.

Written by: ChandlerZ, Foresight News

When the market experiences a sharp decline, narratives often quickly seek an identifiable source.

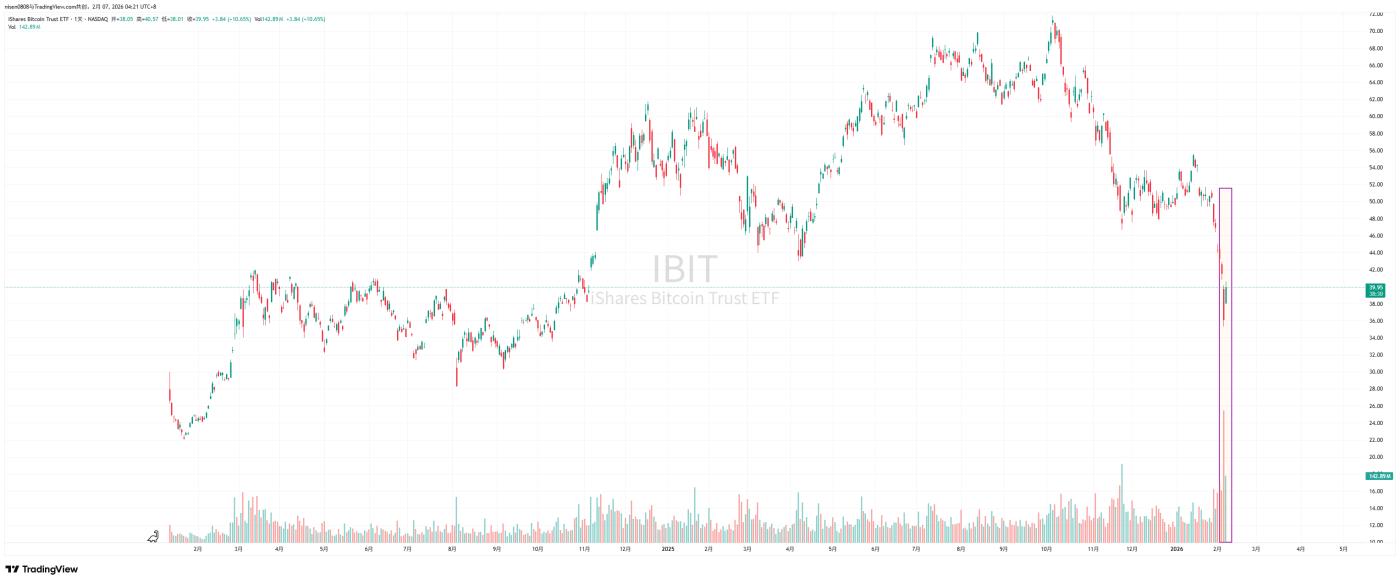

Recently, the market has begun to discuss the sharp drop on February 5 and the rebound of nearly $10,000 on February 6. Jeff Park, advisor at Bitwise and chief investment officer of ProCap, believes that the volatility is more closely linked to the Bitcoin spot ETF system than outsiders imagined, and key clues are concentrated in the secondary market and options market of BlackRock's iShares Bitcoin Trust (IBIT).

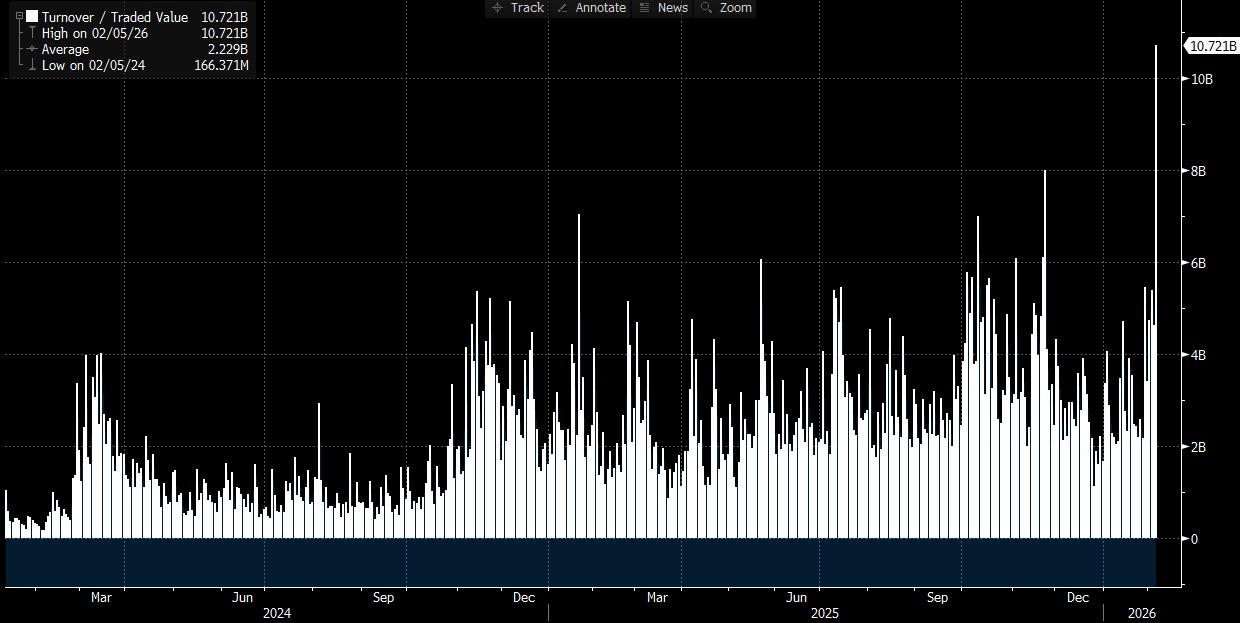

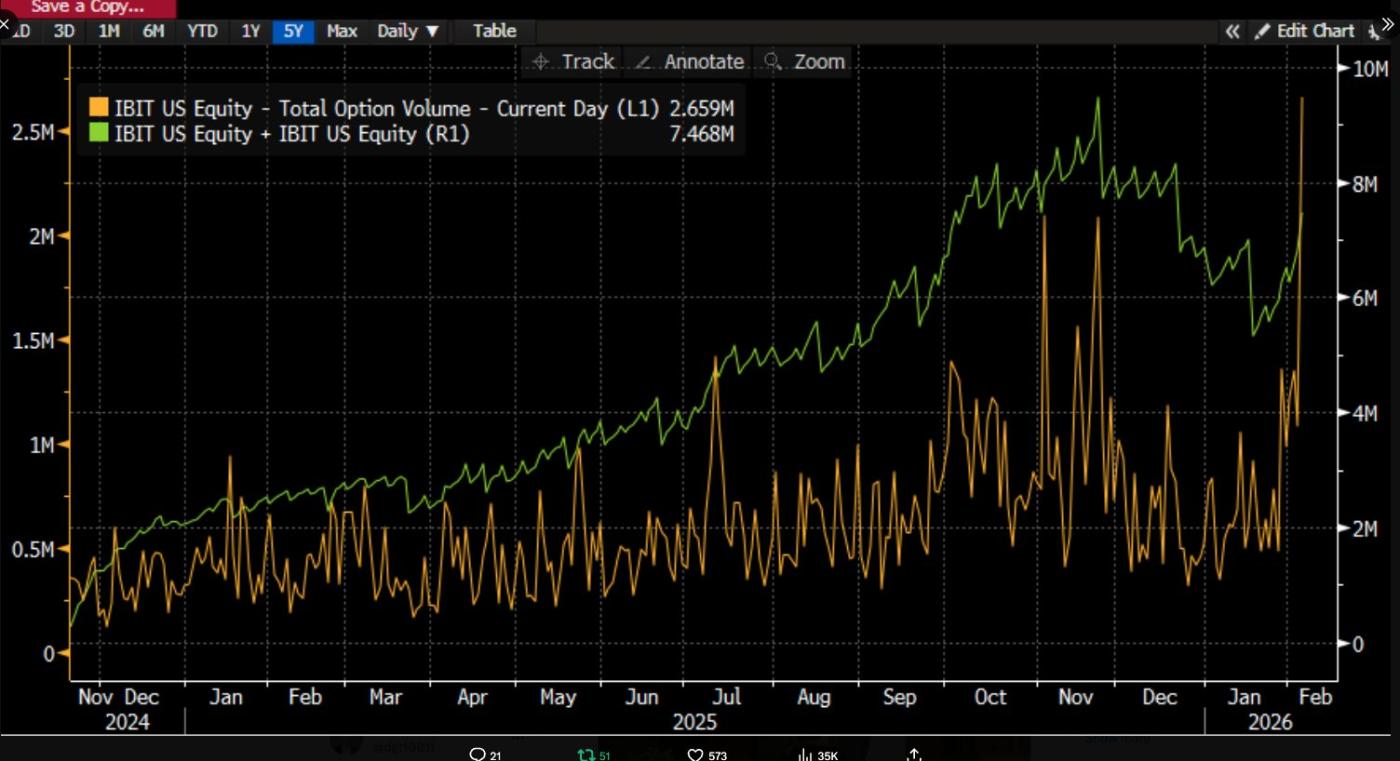

He pointed out that on February 5th, IBIT saw record trading volume and options activity, with trading size significantly higher than usual, and the options trading structure favoring put options. Even more counterintuitively, historically, if prices experience a double-digit drop in a single day, the market usually sees significant net redemptions and capital outflows; however, the opposite occurred. IBIT recorded net creation, with new shares driving up its size, and the entire spot ETF portfolio also saw net inflows.

Jeff Park argues that this combination of "plunge and net creation" weakens the single-path explanation of the decline caused by panic redemptions from ETF investors. Instead, it is more consistent with deleveraging and risk reduction within the traditional financial system, where dealers, market makers, and multi-asset portfolios are forced to reduce risk under the framework of derivatives and hedging. The selling pressure comes more from position adjustments and hedging chain squeezes in the paper capital system, and ultimately transmits the impact to the price of Bitcoin through secondary market trading and options hedging on IBIT.

Many market discussions easily link the IBIT institutional liquidation to the market crash in a single sentence, but this causal chain is easily misinterpreted without dissecting the details of the mechanism. The secondary market trading instrument for ETFs is ETF units; only the creation and redemption in the primary market correspond to changes in the custodian-side BTC. Directly mapping secondary market trading volume linearly to an equivalent amount of spot sales logically omits several crucial explanations.

The debate over whether "IBIT triggered a large-scale liquidation" is actually about the transmission path.

The controversy surrounding IBIT mainly revolves around which ETF market segment and through what mechanism pressure is transmitted to the price formation stage of BTC.

A more common narrative focuses on net outflows from the primary market. The intuition is simple: if ETF investors redeem in panic, the issuer or authorized participants need to sell the underlying BTC to meet the redemption price. This selling pressure enters the spot market, and the price drop further triggers forced liquidation, creating a stampede.

This logic sounds complete, but it often overlooks a crucial fact. Ordinary investors and the vast majority of institutions cannot directly subscribe to or redeem ETF units; only authorized participants can create and redeem them in the primary market. The commonly used term "daily net inflow and outflow" generally refers to changes in the total market share in the primary market. Even large trading volumes in the secondary market only change the holders of the units; they do not automatically change the total number of units, nor do they automatically cause an increase or decrease in the amount of BTC held in custody.

Analyst Phyrex Ni stated that the liquidation Parker referred to was actually the liquidation of the IBIT spot ETF, not the liquidation of Bitcoin. For IBIT, only the IBIT token is traded on the secondary market; its price is pegged to BTC, but the trading activity itself only occurs within the securities market.

The only环节 (stage/step) that truly involves BTC occurs in the primary market, specifically the creation and redemption of IBIT units. This process is executed by AP (which can be understood as a market maker). During creation, each new IBIT unit requires AP to provide corresponding BTC or cash consideration. The BTC then enters a custodian system, subject to regulatory constraints, and cannot be freely used by the issuer or related institutions. During redemption, the custodian transfers the BTC to AP, which then handles the subsequent processing and settles the redemption funds.

ETFs are actually a two-tier market. The primary market mainly involves the buying and redemption of Bitcoin. This part is almost entirely provided by AP, which is essentially the same as using USD to generate USDC. Moreover, AP rarely circulates BTC through exchanges, so the biggest use of buying spot ETFs is to lock up the liquidity of Bitcoin.

Even if redemptions occur, AP's selling activity doesn't necessarily need to go through the open market, especially not through the exchange spot market. AP itself may hold BTC inventory and can complete settlement and funding arrangements more flexibly within the T+1 settlement window. Therefore, even during the large-scale liquidation on January 5th, BlackRock investors redeemed less than 3,000 BTC, and the total amount of BTC redeemed by spot ETF institutions across the United States was less than 6,000 BTC. This means that ETF institutions sold a maximum of 6,000 Bitcoins to the market. Moreover, these 6,000 BTC may not all have been transferred to exchanges.

The IBIT liquidation that Parker mentioned actually occurred in the secondary market, with a total trading volume of approximately $10.7 billion, the largest trading volume in IBIT's history. It did indeed trigger some institutional liquidations, but it is important to note that this liquidation only involved IBIT, not Bitcoin. At least, this liquidation did not spread to the IBIT primary market.

Therefore, the sharp drop in Bitcoin only triggered the liquidation of IBIT, but did not lead to a liquidation of BTC due to IBIT. The underlying asset traded on the secondary market of an ETF is essentially still an ETF, and BTC is merely the price anchor for the ETF. The most impactful event on the market is the liquidation triggered by the primary market sell-off of BTC, not IBIT. In fact, although the price of BTC fell by more than 14% on Thursday, the net outflow of BTC from ETFs only accounted for 0.46%. On that day, the BTC spot ETF held a total of 1,273,280 BTC, with a total outflow of 5,952 BTC.

Transmission from IBIT to spot

@MrluanluanOP believes that when long positions in IBIT are liquidated, a concentrated sell-off will occur in the secondary market. If natural buying pressure is insufficient, IBIT will trade at a discount relative to its implied net asset value (NAV). The larger the discount, the greater the arbitrage opportunity, and the more motivated APs and market arbitrageurs will be to buy discounted IBIT, as this is their basic way of making money. As long as the discount is sufficient to cover costs, theoretically there will always be professional funds willing to take over, so there is no need to worry about "no one buying the selling pressure."

However, after taking over, the issue shifts to risk management. After AP acquires the IBIT shares, it cannot immediately redeem them at the current price, as redemption involves time and procedural costs. During this period, the prices of BTC and IBIT will continue to fluctuate, and AP will face net exposure risk, therefore it will immediately hedge. Hedging methods may include selling physical inventory or opening a short position in BTC futures.

If hedging occurs in spot selling, it will directly suppress spot prices; if hedging occurs in futures short, it will first manifest as changes in price spreads and basis, and then further influence spot prices through quantitative analysis, arbitrage, or cross-market trading.

After hedging, AP has a relatively neutral or fully hedged position, allowing for greater flexibility in choosing when to handle the IBIT at the execution level. One option is to redeem from the issuer on the same day, which will be reflected as redemption and net outflow in the official inflow/outflow data after the market closes. Another option is to choose not to redeem temporarily, waiting for secondary market sentiment to recover or prices to rebound before selling the IBIT back into the market, thus completing the entire transaction without going through the primary market. If the IBIT returns to a premium or discount convergence the next day, AP can sell its position in the secondary market to realize the price difference profit, while simultaneously closing out the previously established short futures position or replenishing the previously sold spot inventory.

Even if the final share processing mainly occurs in the secondary market and there is no significant net redemption in the primary market, the transmission of IBIT to BTC may still occur. This is because the hedging actions taken by AP when taking on discounted positions will transfer the pressure to the BTC spot or derivatives market, thus forming a chain of IBIT secondary market selling pressure spilling over to the BTC market through hedging behavior.