This article is machine translated

Show original

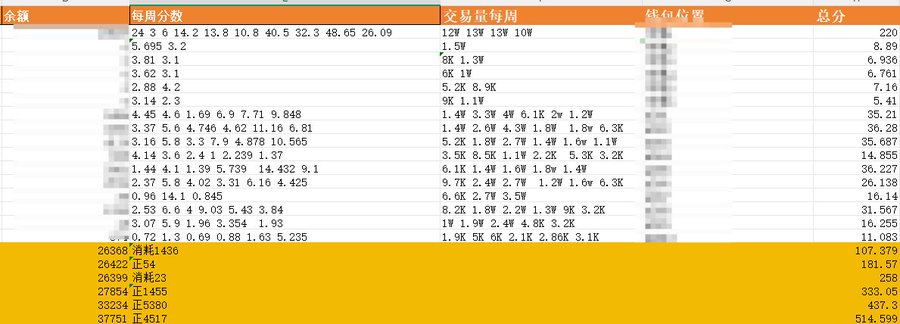

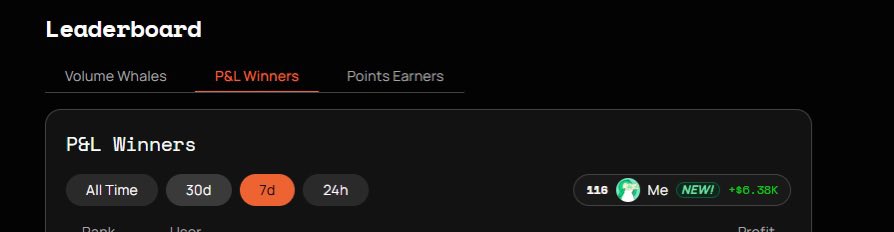

Opinion continued to score 77 points this week at a negative cost, with a profit of 4517 USDT. This marks the third consecutive week of profits exceeding 10,000 USD. Screenshots are included, showing the main account's weekly profit and the record table. This week's score was 25% lower than last week. Subjectively, analysis of the records suggests that the decline in trading volume this week had some impact, even with increased capital. Some accounts had idle funds, and the time spent trading intraday BTC fluctuations wasn't fully utilized. Other accounts incurred losses this week in predicting the @openmind_agi FDV event, and there's currently no strategy to optimize. To continue scoring at zero cost until going live, here are a few tips, as @ZhanweiC posted a review today; you can check his tweets. Most people bet "YES" on events, and "NO" leads to price discrepancies, especially with the previous TGE event where market expectations led to premiums. Aside from intraday BTC events, I prefer to bet "NO," and holding positions for one or two days usually yields a small profit covering transaction fees.

Secondly, there are new markets. Last week, we seized two new markets, and this week, we mainly focused on OpenMind. Of course, the operation of this event was not very good. I have also participated in public funds, but there is too much insider manipulation in these kinds of public fund predictions. New events lack liquidity, but there is room for manipulation in pricing power. Those who have done some research and understanding of a certain event are more likely to seize some opportunities (but it is quite difficult).

Thirdly, during the end of the day, if there are slight losses due to certain events, I will sell to profit from the closing of BTC's intraday settlement. This will wipe out more than 90% of the losses. (Note that this requires only a portion of funds, as there is a risk of reversal at the end of the day. Diversify your accounts to avoid betting on the same event. Also, since I am trading intraday events, I will not bet on all accounts. I will only bet on one or two accounts. If I have a good grasp of the market and am confident in my ability to do so, I will also review the profits and losses of other accounts. I will make one or two profits at the end of the day by profiting around 10%.)

There are many details, but essentially my profits come from subjective betting. Of course, events like the Aster and River last week were basically free money, and I haven't encountered any similar favorable events yet.

Waiting for the market to improve (TGE may continue to make some predictions on the main account after it goes live, if I can still act as a fortune teller).

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content