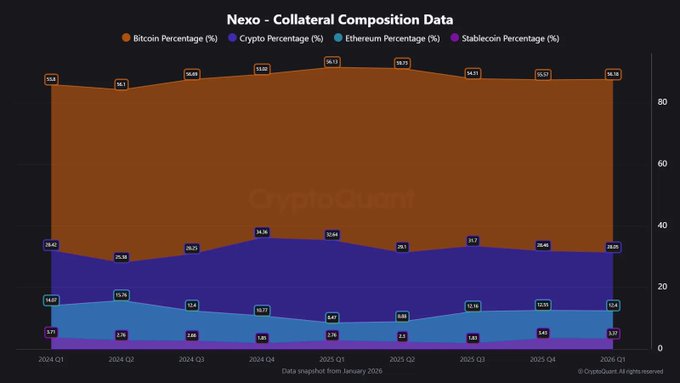

Bitcoin Is the Backbone of Nexo Credit 🟠 Recent collateral composition data shows that Bitcoin remains the dominant strategy for borrowers. This shows that Bitcoin is not only for remittances, or trading, but also for lending and borrowing. Nexo clients treat Bitcoin as pristine collateral. The data included is a chart of Collateral Composition (%) for each quarter. It’s specifically data for @nexo. It shows that borrowers aren’t rotating into BTC for short-term speculation. They’re using Bitcoin as long-term collateral to access liquidity without selling. Key takeaways: - BTC consistently holds ~54–60% share of total collateral - Even as the market corrected, BTC dominance increased to 56.2% in Q1 2026. - Credit demand aligns with conviction, not trading activity It’s a key evidence that Bitcoin is more than a crypto to trade. It’s the asset people trust to back their credit.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content