WARSH COULD END QE AS WE KNOW IT 👀 Kevin Warsh’s potential return to the Fed is already shaking markets -- especially the $30 TRILLION U.S. Treasury market. Warsh has been clear for years: QE should be used only in true emergencies, not as a permanent policy tool. He’s openly criticized the Fed’s post-2008 and post-COVID bond buying, arguing it violated the spirit of the 1951 Fed-Treasury Accord and enabled unchecked government borrowing. Now, that old idea is back -- possibly in the form of a new accord redefining how the Fed and Treasury coordinate balance-sheet policy. Context matters: 💵 Fed balance sheet is still ~$6.6T 💵 Treasury issuance keeps climbing 💵 Scott Bessent agrees QE ran too long 💵 Markets are debating whether this limits QT... or kills QE outright If the Fed becomes restricted from large-scale bond buying, that’s a structural shift for rates, liquidity, and risk assets. And for crypto? Less QE + clearer rules = harder money narratives matter more, not less.

CryptosRus

@CryptosR_Us

WARSH JUST REFRAMED CRYPTO

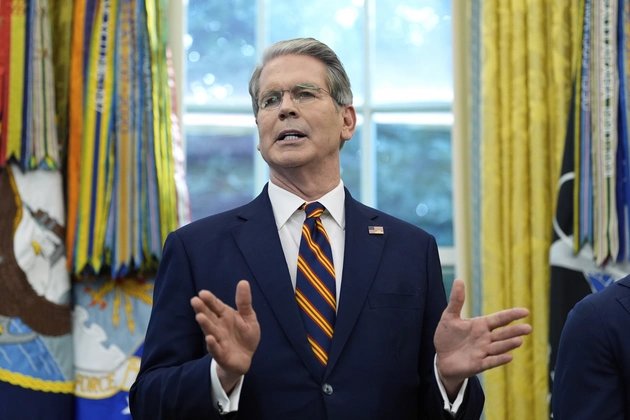

Kevin Warsh -- former Federal Reserve Governor, longtime Stan Druckenmiller partner, and a leading candidate often discussed for Treasury/Fed leadership -- pushed back on the idea that crypto is “secret money.”

His argument is simple: Crypto isn’t

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content