Author: Proton Capital Research Team

I. Abstract

This report focuses on three intertwined and evolving themes: structural changes in the AI investment cycle, a marginal shift in the politicized liquidity environment, and the repricing process of crypto assets under repeated trust shocks.

AI remains a core focus of global capital expenditure, but the return logic is shifting from "computing power expansion" to "application and cash flow realization." While capital expenditure remains high, market demands for efficiency, commercialization pathways, and profitability sustainability have significantly increased, raising the risk of divergence within related assets. At the macro level, changes in the liquidity environment are more likely to be driven by fiscal and political constraints rather than traditional economic cycles. Against the backdrop of high debt and policy constraints, the support for risky assets from easing expectations is more phased, and a systemic decline in volatility is unlikely. The crypto market is evolving from high-beta risky assets to structured assets. In an environment of strengthened trust constraints, funds are more inclined towards targets with clear value consensus, institutionalized pathways, and controllable risks, rather than a general increase in risk appetite. At the portfolio level, we maintain a defensive allocation strategy emphasizing structural opportunities. At this stage, we prioritize risk management, scenario analysis, and internal rotation opportunities, rather than making single-directional bets.

II. Overview of the performance of major global assets in 2025

Table 1: Performance of Major Global Assets

In 2025, the global financial market exhibited significant characteristics of a "tech bull market" driven by the wave of artificial intelligence (AI). However, amidst this boom, the cryptocurrency market showed a marked "cooling down" and divergence. The core reason for this lies in the dual pressures of macroeconomic stagflation risks and unforeseen black swan events, which completely overshadowed the long-term benefits brought about by the deepening market structure (institutionalization and compliance). In 2026, multiple fundamental, macroeconomic policy, and geopolitical variables are quietly changing, indicating that the investment environment in 2026 may be even more complex.

The current fundamentals present a complex picture of "transformation of old and new growth drivers" and "overlapping risk events".

1. Real-world demand for AI and its impact on the stock market : The exponential growth of AI technology from training to deployment has not only boosted the valuation of related technology stocks, but also generated real demand for non-ferrous metals through hardware investment (data centers, servers, chips). In particular, it has created new long-term demand support for commodities such as copper (power infrastructure), aluminum (heat dissipation and structure), and rare earths (permanent magnet motors and special materials), injecting growth logic into traditional cyclical sectors.

2. Structural risks drive demand for safe-haven assets.

De-dollarization and sovereign risk : The continued deterioration of the US fiscal deficit has weakened the foundation of the dollar's credibility. Coupled with the normalization and increasing complexity of geopolitical conflicts (such as Russia-Ukraine and the Middle East), the monetary attributes and safe-haven functions of traditional precious metals like gold have become more prominent again. Central bank gold purchases and private gold savings demand together constitute a solid floor for prices.

Uncertainty in trade policy : While the global tariff war has temporarily subsided, the soil for trade protectionism remains fertile. Recently, Trump has again wielded the tariff weapon in verbal pressure regarding geoeconomic issues such as Greenland resources (potentially involving key minerals like rare earths). While this "verbal intervention" may not immediately translate into legislation, it significantly increases the assessment costs and uncertainty of global trade and supply chains, suppressing corporate capital expenditures and potentially boosting risk aversion in the short term.

3. The cryptocurrency market is "cooling down".

The positive factors have all failed to materialize: Milestone developments such as ETF expansion and the stablecoin bill should have brought long-term funds to the market. The Federal Reserve's passive interest rate cuts highlighted the "stagflation" dilemma, weakening the attractiveness of crypto assets as risk assets. Furthermore, the October 11th black swan event (a large-scale trust crisis in centralized exchanges/custodians, such as the freezing of assets or huge losses involving major compliant custodians) directly attacked the core cornerstone of institutionalization—asset security and custodian trust.

Fund flows have completely reversed: the event triggered a chain reaction, leading to a large-scale and continuous net outflow of funds from Bitcoin spot ETFs. Institutional funds not only adopted a cautious attitude, but also withdrew passively due to risk control requirements, and the market quickly deteriorated from "new player speculation" to "existing player stampede".

III. Macroeconomic Outlook for 2026: A Triple Game of High Valuations, Policy Dilemmas, and Political Cycles

In 2026, the global macroeconomic landscape will revolve around three main themes: growth validation, policy competition, and political turmoil. Markets will continue to fluctuate under the influence of valuation pressures, fiscal and monetary dilemmas, and the election cycle.

1. AI Valuation: From Expected Celebration to Real-World Testing

The AI sector, which saw a significant surge in 2025 driven by optimistic expectations, will see its fundamentals validated in 2026. The focus is on:

Commercialization: The breadth and depth of product application;

Earnings quality: Growth sustainability and actual profit margin levels. If earnings fail to justify current high valuations, valuation systems based on discounted future cash flows will face severe challenges, potentially triggering a significant correction in tech stocks and impacting global risk appetite.

2. The US Fiscal-Monetary Dilemma: Deficit Politics and the Crisis of the Federal Reserve's Independence

The huge fiscal deficit is essentially a political choice, and the solutions lie in:

Fiscal austerity (facing political resistance);

Debt monetization (erodes central bank independence);

Promoting economic growth and expanding the tax base (slow to take effect and difficult). While interest rate cuts can alleviate the pressure on government bond interest rates, they will force the Federal Reserve's monetary policy to passively serve fiscal needs, making it difficult to balance "fighting inflation, stabilizing employment, preventing financial risks, and cooperating with fiscal sustainability," and its policy independence will face a severe test.

3. The 2026 US Midterm Elections: An October Surprise and a Prelude to a Radicalized Foreign Policy

In an effort to win votes, the Trump administration may adopt a more provocative "spotlight" strategy in the areas of diplomacy and trade:

A tough diplomatic stance: Demonstrating a tough position on resource and strategic issues such as Venezuela and Greenland to solidify the image of a "strong leader";

Extreme trade pressure: Reinstating or threatening to impose tariffs on major trading partners in order to attract blue-collar voters and divert attention from domestic problems.

4. Cryptocurrencies: The Road to Recovery and Revaluation

The "10.11 Black Swan event" put pressure on the cryptocurrency market in its institutionalization process, shifting the market focus from "liquidity-driven" to "trust repair" and "infrastructure reassessment".

Short term (until the first half of 2026): The market is entering a period of consolidation and confidence recovery. Regulators are expected to strengthen custody and proof-of-reserve rules, increasing attention on decentralized custody and self-custody solutions.

In the medium to long term: Institutional funds may cautiously return only after macro liquidity expectations shift to easing and the market proves that a more robust infrastructure has been built. At that time, the rebound may be more concentrated on core assets with truly decentralized attributes and clear practical value (such as Bitcoin and Ethereum).

IV. The US AI Market Under Capital Lock-up: Risks During the Bubble Formation Period and Three Evolutionary Paths

The current US AI market is still in the bubble formation stage and has not yet burst, but it has entered a high-risk expansion phase. The market exhibits a clear capital interlocking structure, and the stability of this structure will be key to whether the bubble continues or faces a correction.

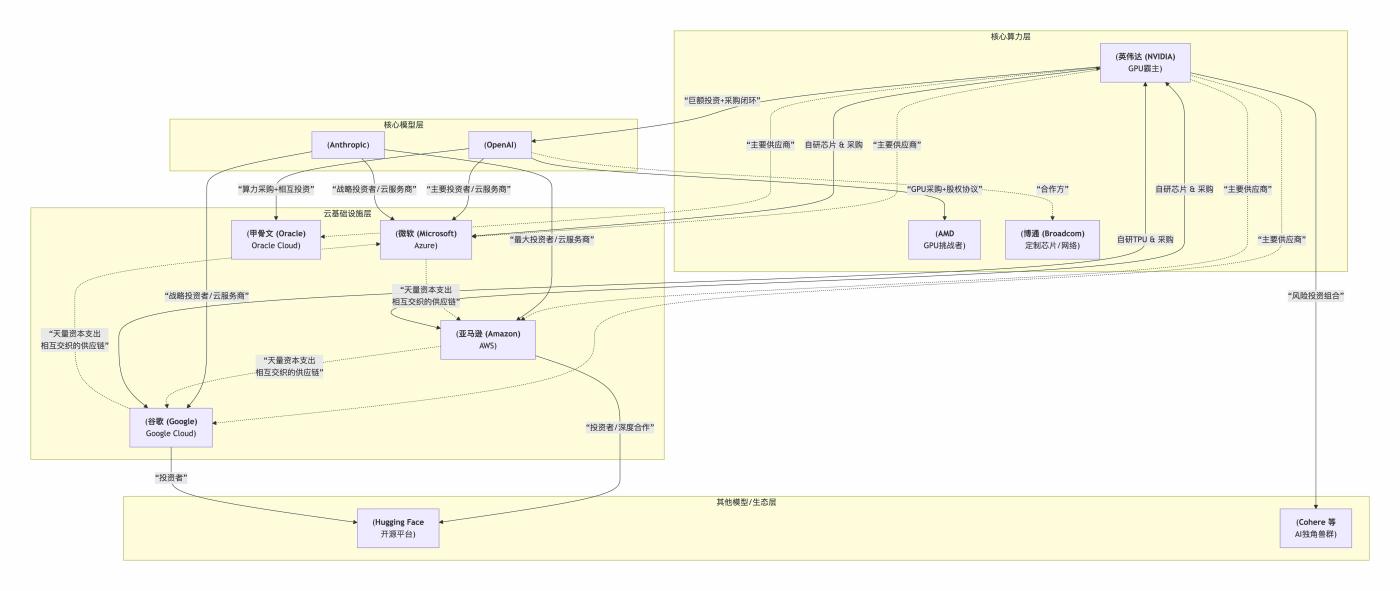

Figure 1: Panoramic Schematic Diagram of AI "Capital Interlocking"

The core of capital interlocking is a closed loop of "investment → procurement", in which funds eventually flow back to investors in the form of operating revenue, supporting stock prices and the next round of investment.

The relationship between these giants has transcended simple buying and selling; they have formed a symbiotic network of shared risks and benefits, tightly intertwined through capital, orders, equity, and long-term agreements.

These interlocking relationships not only exist in the OpenAI-Nvidia-Oracle triangle, but also widely exist among almost all core AI players such as Amazon, Google, Microsoft, Nvidia, AMD, and Broadcom, forming an ecosystem where "all prosper together and all suffer together."

Table 2: AI Investment Data in 2025 and Forecasts for 2026

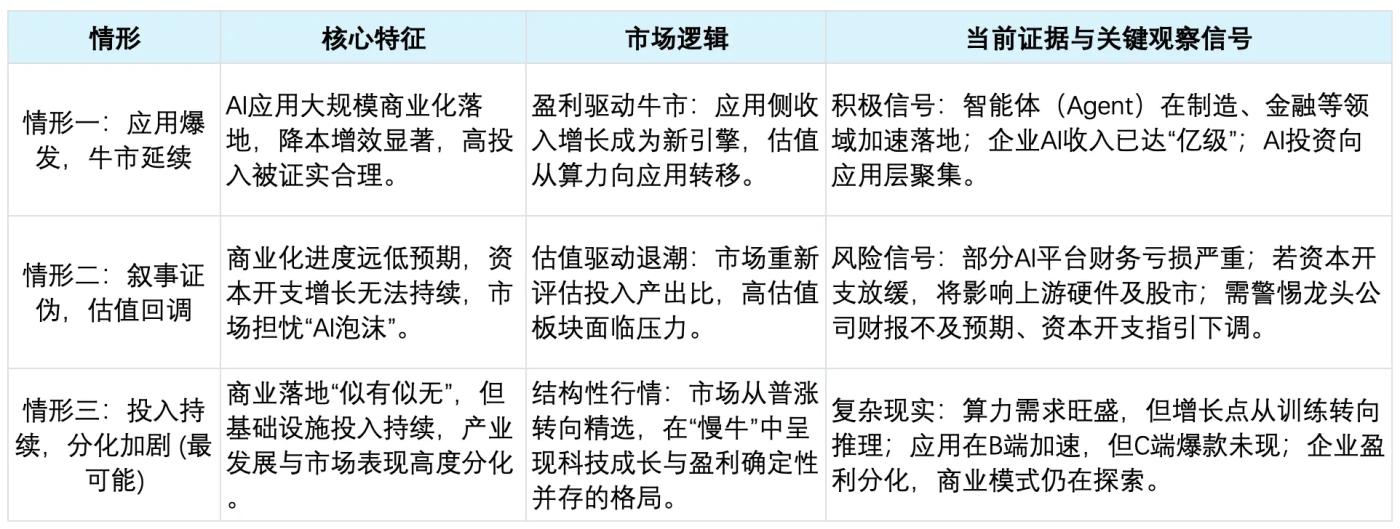

US AI investment is likely to continue its high growth in 2026 due to technological competition, national strategy, and the need for economic growth, especially the capital expenditures of industry giants. However, this will no longer be a simple increase in "quantity"; the market will pay more attention to the core characteristics of three potential scenarios and their corresponding market logic:

Analysis of three potential market scenarios

Table 3: Scenario Analysis

1. Scenario 1: Application explosion, bull market continues.

This is the script of a tech optimist. The driving factors aren't limited to capital expenditure; more importantly, AI is beginning to integrate into workflows on a large scale and generate cash flow. Typical signs include: higher-than-expected AI feature subscription revenue from software giants like Microsoft and Adobe; a significant increase in the proportion of inference business in Nvidia's data center revenue; and continued growth in capital expenditure due to strong demand (such as the $490 billion predicted by Citi).

2. Scenario Two: Narrative Falsification, Valuation Correction

This describes a scenario of collapsing market confidence. The root cause lies in the fact that downstream entities (businesses and consumers) are unwilling or unable to pay for the substantial investments made. There are already signs: as Gartner points out, AI will enter a "bubble burst trough" in 2026, and companies will place greater emphasis on proven results. The signs of this scenario will be that giants like M7 significantly reduce their capital expenditure plans, and AI companies' IPOs will see their share prices fall below their IPO price and remain depressed.

3. Scenario Three: Increased Differentiation, Complex Path Forward (Most Likely)

This is a period of chaos in industrial development. In this situation, the market lacks a single main trend; the key is to identify the winners and losers amidst this differentiation. For example:

Structural opportunities: AI spending will be driven more by existing software vendors than by standalone projects; the penetration rate of “embedded” passive AI applications (such as AI search summaries) will far exceed that of standalone AI applications.

Key challenges: The industry faces challenges such as "high costs, high illusions (e.g., "unreliable output"), and low retention," as well as bottlenecks such as insufficient user trust in AI-generated information.

Market reaction: Financial data from companies like Nvidia (such as revenue growth but slowing growth, and gross margin fluctuations) will amplify market sentiment.

V. Political Drivers and Structural Evolution: Outlook for the Liquidity Environment in 2026

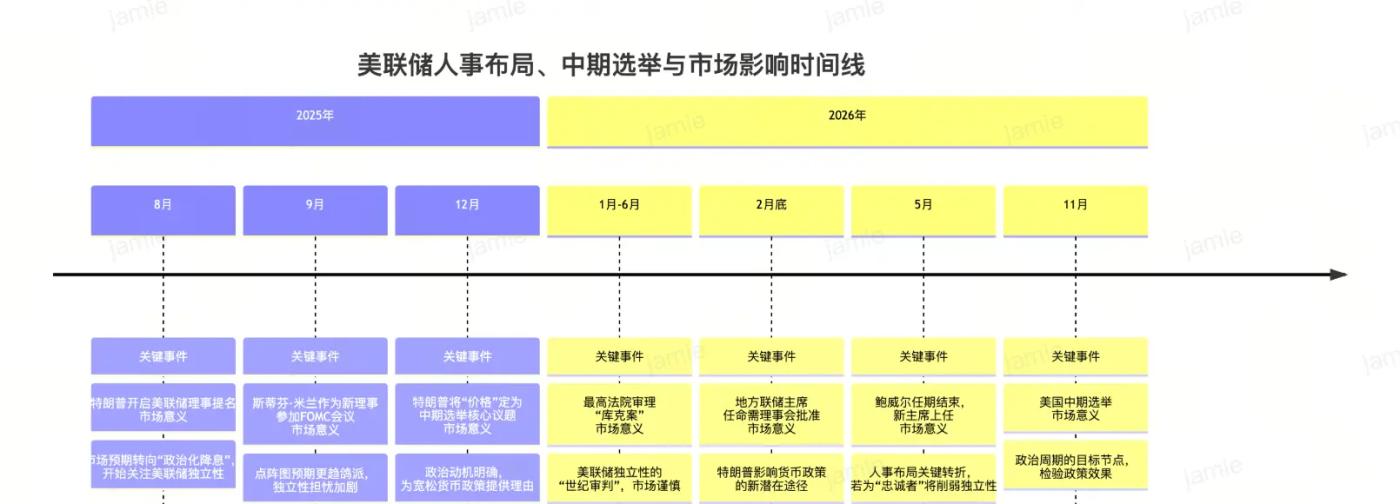

The core logic of the Trump administration surrounding the Federal Reserve personnel appointments, the midterm elections, and expectations in the cryptocurrency market can be summarized by the following timeline:

Figure 2: Timeline of Federal Reserve Personnel Appointments, Midterm Elections, and Market Impact

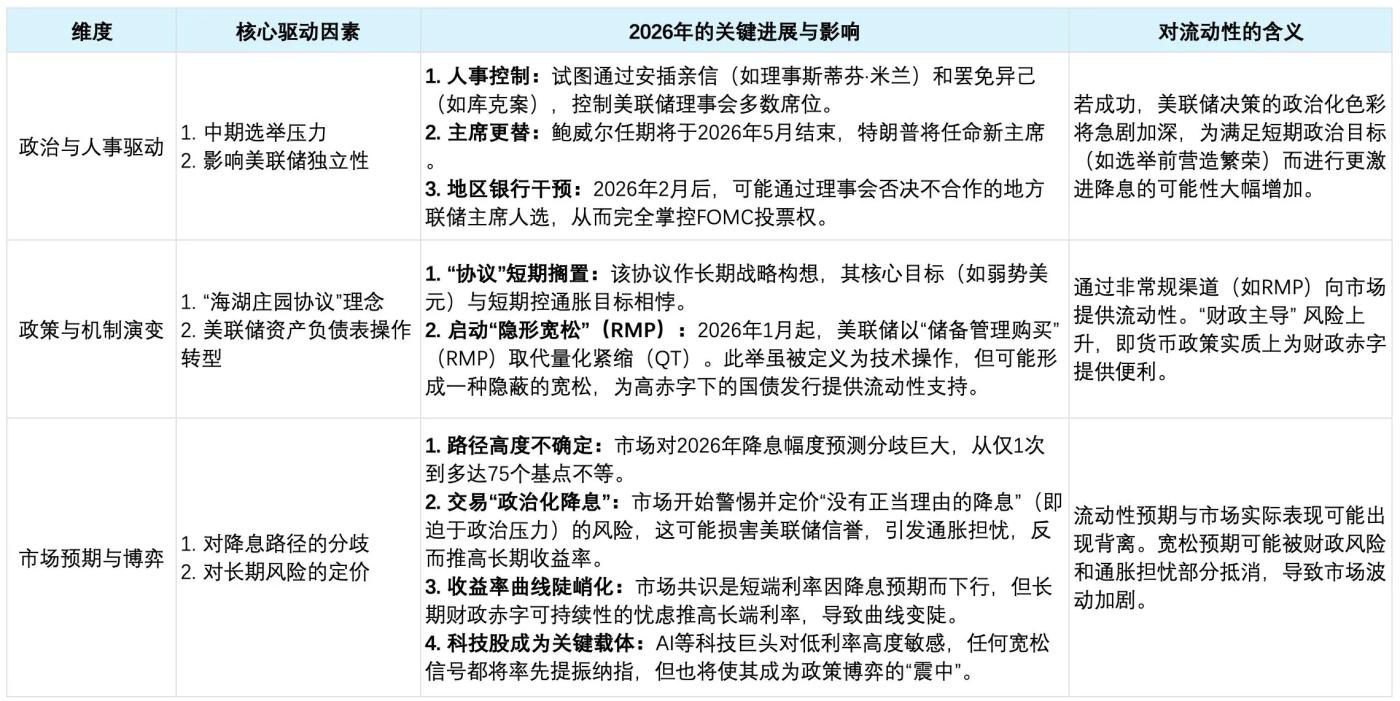

The driving logic behind the current US liquidity environment can be summarized as follows: multiple forces are propelling the formation of a "loose but complex" liquidity environment, characterized by "strengthened political drivers" and "intensified market competition." This environment is particularly profoundly influenced by the US technology and AI industries' reliance on ample liquidity. They require low interest rates and loose financial conditions to maintain high valuations, support continuous financing and capital expenditures, thus becoming a crucial pillar of the stock market, especially the Nasdaq.

Table 4: US Liquidity Environment in 2026: Core Drivers, Progress and Impact

Short term (to mid-2026): Liquidity will tend to ease, but the market will swing wildly between optimistic expectations of "politicized rate cuts" and deep concerns about a rebound in inflation and damage to the dollar's credibility. Technology stocks are highly sensitive to interest rate policy, and any signal of a rate cut could boost growth sectors such as AI. The Supreme Court's ruling in the "Cook v. Fed" case will be the first important indicator, testing whether the Fed's independence can withstand direct intervention.

Medium term (second half of 2026 to the election): If political intervention is successful, the Federal Reserve may initiate a rate-cutting cycle that exceeds economic fundamentals, bringing a strong liquidity boost. This would significantly benefit technology and AI companies by reducing financing costs, increasing valuations, and supporting stock market sentiment. However, this could also exacerbate asset bubbles and stagflation risks, setting the stage for a policy reversal after 2027.

Overall, the US liquidity environment in 2026 is not simply a matter of "flooding the market with liquidity," but rather a complex situation shaped by a combination of tools, including personnel control, the RMP (Relative Monetary Policy), and traditional interest rate cuts, driven by strong political objectives and trending towards easing . The inherent liquidity needs of the technology and AI sectors resonate with the easing tendencies of the political cycle, further strengthening the stock market's, especially technology stocks', dependence on policy paths and increasing the market's oscillation between short-term euphoria and long-term risks.

VI. Cryptocurrency Market: From Trust Freeze to Restorative Rebalancing

In 2025, the cryptocurrency market experienced a significant downturn due to both macroeconomic pressures and internal structural crises, leading to a historic shift in investment preferences. Looking ahead to 2026, the market will enter a complex rebuilding period characterized by trust restoration and capital rebalancing.

1. Capital migration, trust crisis, and liquidity crunch

Phenomenal fund transfer

The cryptocurrency market has shrunk dramatically: In South Korea, for example, the daily trading volume of its largest exchange, Upbit, plummeted from approximately $9 billion in December 2024 to $1.78 billion in November 2025, a drop of 80%. The trading volume of the second-largest exchange, Bithumb, also shrank from approximately $2.45 billion to $890 million, a decrease of about 69%. Market volatility and the near disappearance of the "kimchi premium" indicate a complete retreat of speculative sentiment.

A massive shift of funds towards traditional assets: Outflowing capital is flowing into the South Korean stock market, which is currently experiencing an "epic bull run." In 2025, the South Korean KOSPI index surged by over 72%, reaching a record high. This historic capital migration was driven by industry narratives exemplified by AI semiconductors (such as SK Hynix, which saw a 240% surge this year), domestic policy reforms, and the pursuit of profit by capital, putting crypto assets at a disadvantage in the competition for funds.

The "10.11 Black Swan" event triggered a systemic trust crisis.

A major incident involving a centralized institution has severely damaged market trust in custody security and the institutionalization process. This is not merely a price fluctuation, but a profound systemic shock to trust, leading to a fundamental shift in market sentiment and funding structures.

Institutional withdrawal and a vicious cycle of liquidity

Following the "10.11" incident, institutional funds were forced to withdraw due to the triggering of internal risk control models, and the market shifted from "incremental growth" to "existing capital flight." At the same time, the listing of new projects and the continuous unlocking of VC funds acted as a "liquidity pump," constantly diluting existing funds and causing a systematic downward shift in the market valuation center.

2. Path to 2026: Macroeconomic Respite, Industry Restructuring, and Potential Turning Point

Macroeconomic environment: Providing a bottom for the consolidation, rather than fueling a bull market.

The 2026 US political cycle (midterm elections) will strongly influence monetary policy, tending to promote a "loose but complex" liquidity environment. This could provide bottom support and a chance for a short-term rebound in the crypto market, but the path will be subject to fluctuations in expectations, making it difficult to support a one-sided, trending surge.

Industry Core: From Speculative Ruins to Value Reconstruction

The market's deep cooling is forcing the industry to make "constructive corrections." Regulators will strengthen rules on custody and proof-of-reserve, and there will be increased attention on decentralized and self-custodial solutions. The industry's focus will shift from chasing bubbles to verifying the robustness of infrastructure and its real utility.

Key Turning Point Analysis: The Rebalancing of AI Narratives and the Crypto Market

The US AI stock market is currently in a high-risk expansion phase. If, by 2026, the commercialization of AI falls short of expectations or remains uncertain, leading to high-level volatility or a correction in traditional tech stocks, some funds seeking high-volatility returns may re-evaluate the deeply adjusted crypto market, where compliant tools (such as ETFs) are becoming increasingly sophisticated. Cryptocurrencies, with their differentiated characteristics, may attract capital inflows, initiating a valuation recovery driven by trust restoration.

VII. Conclusion: Structural repairs are needed; we await the right opportunity.

2026 will not be a year of frenzy for the cryptocurrency market, but rather a year of rebuilding. The market will struggle to move forward amidst external macroeconomic tensions and internal trust restoration.

In the short term (first half of the year): the market is expected to fluctuate at low levels. The main pressure comes from the squeeze of traditional markets and the lack of internal liquidity. The expectation of easing can only bring intermittent technical rebounds.

In the medium to long term (second half of the year and beyond): the trend depends on two key factors: first, the actual degree of easing of global liquidity (especially in the United States); and second, whether the process of compliance and institutionalization of cryptocurrencies can achieve substantial breakthroughs, thereby truly entering the traditional capital allocation field of vision.

Structural opportunities: A broad-based rally is unlikely; opportunities are highly differentiated. Key areas to focus on include:

Core assets: such as BTC, ETH, SOL, and BNB, and their safe-haven and consensus value.

Compliance narratives: such as RWA (Real World Assets) combined with physical assets.

Regional opportunities: Localized growth driven by policy clarification in key markets such as South Korea.

The real systemic opportunities will belong to assets that have demonstrated resilience during the crisis, possess a clear compliance path, and are backed by real value. The market is gathering strength for the next cycle, but only after the necessary rebuilding of trust and structural clearing are completed.