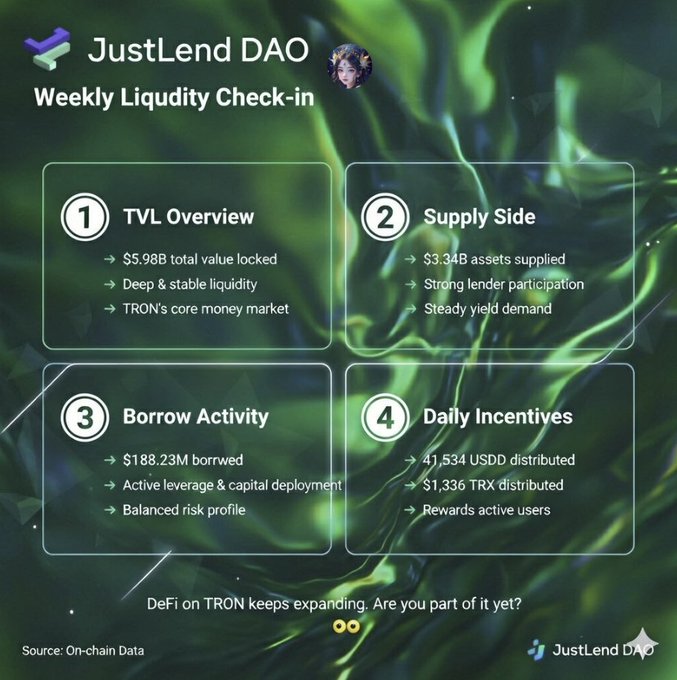

📊 Weekly Check-In: JustLendDAO Shows Strong DeFi Momentum on TRON

The latest on-chain data from #JustLendDAO highlights steady and healthy growth across the TRON DeFi ecosystem. Capital is not sitting idle — it’s being actively supplied, borrowed, and rewarded, signaling real utilization and sustained confidence.

Here’s a clear breakdown using numbered icons and arrows 👇

1️⃣ TVL Overview →

→ $5.98B Total Value Locked

→ Deep and stable liquidity across the protocol

→ Confirms JustLendDAO’s role as TRON’s core money market

This TVL level reflects long-term trust and consistent participation from the community.

2️⃣ Supply Side Strength →

→ $3.34B in assets supplied

→ Strong lender participation and steady yield demand

→ Capital continues flowing into productive DeFi use

Suppliers are not just chasing yield — they are supporting the foundation of TRON DeFi.

3️⃣ Borrow Activity Health →

→ $188.23M currently borrowed

→ Active leverage and capital deployment

→ Balanced risk profile with sustainable utilization

Borrowing at this scale suggests real strategies at work, not short-term speculation.

4️⃣ Daily Incentives →

→ 41,534 USDD distributed daily

→ 31,336 TRX rewarded to active users

→ Incentives aligned with real protocol usage

These rewards continue to encourage engagement while reinforcing long-term ecosystem growth.

📈 DeFi on TRON keeps expanding, and JustLendDAO remains at the center of it all : app.justlend.org/home

With liquidity deepening and capital efficiency improving week by week, the question is simple:

Are you already part of this growth — or still watching from the sidelines? 👀

@DeFi_JUST

@justinsuntron

#TRONEcoStar

JUST DAO

@DeFi_JUST

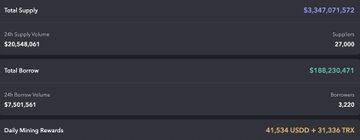

📊Weekly check-in with #JustLendDAO

TVL just hit $5.98B

Supply stands at $3.34B

Borrowed amount $188.23M

Daily rewards 41,534 #USDD + 31,336 #TRX

DeFi keeps growing. Are you part of it yet? 👀

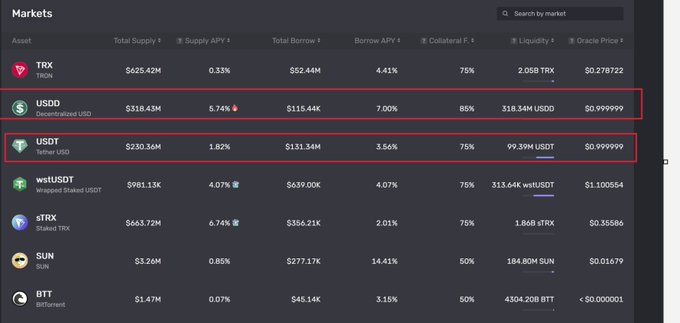

4/4 — Stablecoins Power the Yield Engine

Stablecoins are where utilization and yield converge.

🟢 USDD

Supply: $318.43M

Supply APY: 5.74%

Collateral Factor: 85%

Oracle Price: $0.999999

🟢 USDT

Supply: $230.36M

Borrow: $131.34M

Supply APY: 1.82%

Borrow APY: 3.56%

This shows real demand for leverage and healthy capital rotation on TRON.

🧵 Final Thread

From these numbers, one thing is clear to me:

JustLendDAO is no longer just a lending protocol — it has become the liquidity engine of the TRON ecosystem.

Billions in supply, sustained borrow demand, real daily mining rewards, and stablecoins operating at scale — this is what on-chain financial infrastructure looks like when it actually works.

If this level of capital efficiency and user activity continues, the real question isn’t whether JustLendDAO can grow further —

but how much of TRON DeFi will ultimately route through it?

What do you think — is JustLendDAO already the default money market of TRON, or is this only the beginning?

@DeFi_JUST

@justinsuntron #TRONEcoStar

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content