Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author and source: ME News

ETF Directional Data

According to SoSoValue data, Bitcoin spot ETFs saw a total net inflow of $145 million yesterday (February 9th, Eastern Time).

The Bitcoin spot ETF with the largest single-day net inflow yesterday was the Grayscale Bitcoin Mini Trust ETF (BTC), with a single-day net inflow of $131 million. The current total historical net inflow for BTC is $2.071 billion.

The second largest net inflow was into Ark Invest's ARKB ETF, which saw a net inflow of $14.0874 million in a single day. ARKB's total historical net inflow has now reached $1.488 billion.

The Bitcoin spot ETF with the largest single-day net outflow yesterday was BlackRock ETF IBIT, with a net outflow of $20.8541 million. Currently, IBIT's total historical net inflow has reached $61.82 billion.

As of press time, the total net asset value of Bitcoin spot ETFs was $90.053 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 6.37%, and a historical cumulative net inflow of $54.834 billion.

According to SoSoValue data, the Ethereum spot ETF saw a total net inflow of $57.0481 million yesterday (February 9th, Eastern Time).

The Ethereum spot ETF with the largest single-day net inflow yesterday was the Fidelity ETF FETH, with a single-day net inflow of $67.3153 million. The current total historical net inflow of FETH is $2.581 billion.

The second largest inflow was into Grayscale's Ethereum Mini Trust ETF (ETH), with a net inflow of $44.6178 million in a single day. The total historical net inflow into ETH has now reached $1.704 billion.

The Ethereum spot ETF with the largest single-day net outflow yesterday was the BlackRock ETF ETHA, with a single-day net outflow of $44.9874 million. Currently, the total historical net inflow of ETHA is $12.045 billion.

As of press time, the Ethereum spot ETF has a total net asset value of $12.416 billion, an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 4.84%, and a historical cumulative net inflow of $11.866 billion.

BTC Directional Data

According to CoinFound data, 195 listed companies currently hold a total of 1,206,554 BTC, accounting for 6.06% of the total Bitcoin supply. Among them, Strategy Inc (MSTR) holds 714,644 BTC (an increase of 1,142 BTC from the previous holding), accounting for 59.23% of the total holdings of listed companies.

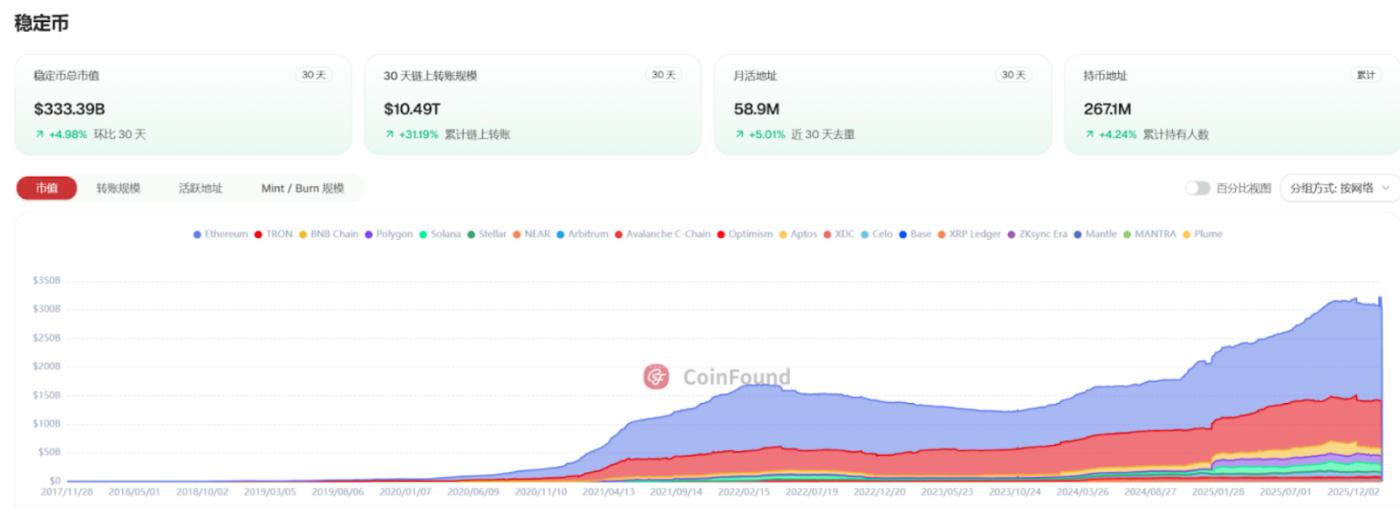

Stablecoin data

According to CoinFound data:

- USDT market capitalization: US$195.63 billion

- USDC market capitalization: $75.04 billion

- EURC's market capitalization: $12.26 billion

- USDS market capitalization: $11.15 billion

- USDe market capitalization: $6.49 billion

- PYUSD Market Cap: $3.9 billion

- USD1 Market Cap: $5.35 billion

Market Dynamics:

- Fidelity's FIDD assets under management surpassed $10 billion within a week.

- The debate over whether stablecoins should be allowed to distribute underlying returns to retail investors has reached a stalemate, with the banking association lobbying to retain the "interest-bearing ban."

- The UK's FCA has confirmed that stablecoin payment rules will be officially implemented in the second half of the year.

Summarize:

With giants like Fidelity entering the fray, stablecoins are no longer just derivatives of the crypto market, but are instead taking center stage, becoming the main players in reshaping the underlying logic of global payment and settlement. Brand and compliance may be replacing liquidity as the primary driving force.

RWA direction data

According to CoinFound data:

- Commodity market capitalization: $6.95 billion

- Market value of government bonds: US$1.5 billion

- Institutional fund market capitalization: US$2.56 billion

- Private lending market capitalization: $29.68 billion

- Market capitalization of US Treasury bonds: $10.2 billion

- Market value of corporate bonds: US$1.62 billion

- Market capitalization of tokenized stocks: $1.71 billion

Market Dynamics:

- BlackRock BUIDL Fund Achieves 24/7 Dividend Payments and Full-Chain Expansion

- The inaugural RWA Global Summit officially opened in Hong Kong, clarifying that Hong Kong will leverage its advantages as an international financial center to lead RWA into a new trillion-dollar era.

- 21Shares has filed an application with the SEC for a spot ONDO ETF.

- Figure Heloc rises to become the world's tenth largest crypto asset.

Summarize:

The RWA market these past few days has shown us that compliance is the true moat. When 21Shares filed for an ONDO ETF and the Hong Kong government took center stage at the summit, RWA had already stepped out of its "niche circle" and officially taken over the main narrative of global asset digitization.