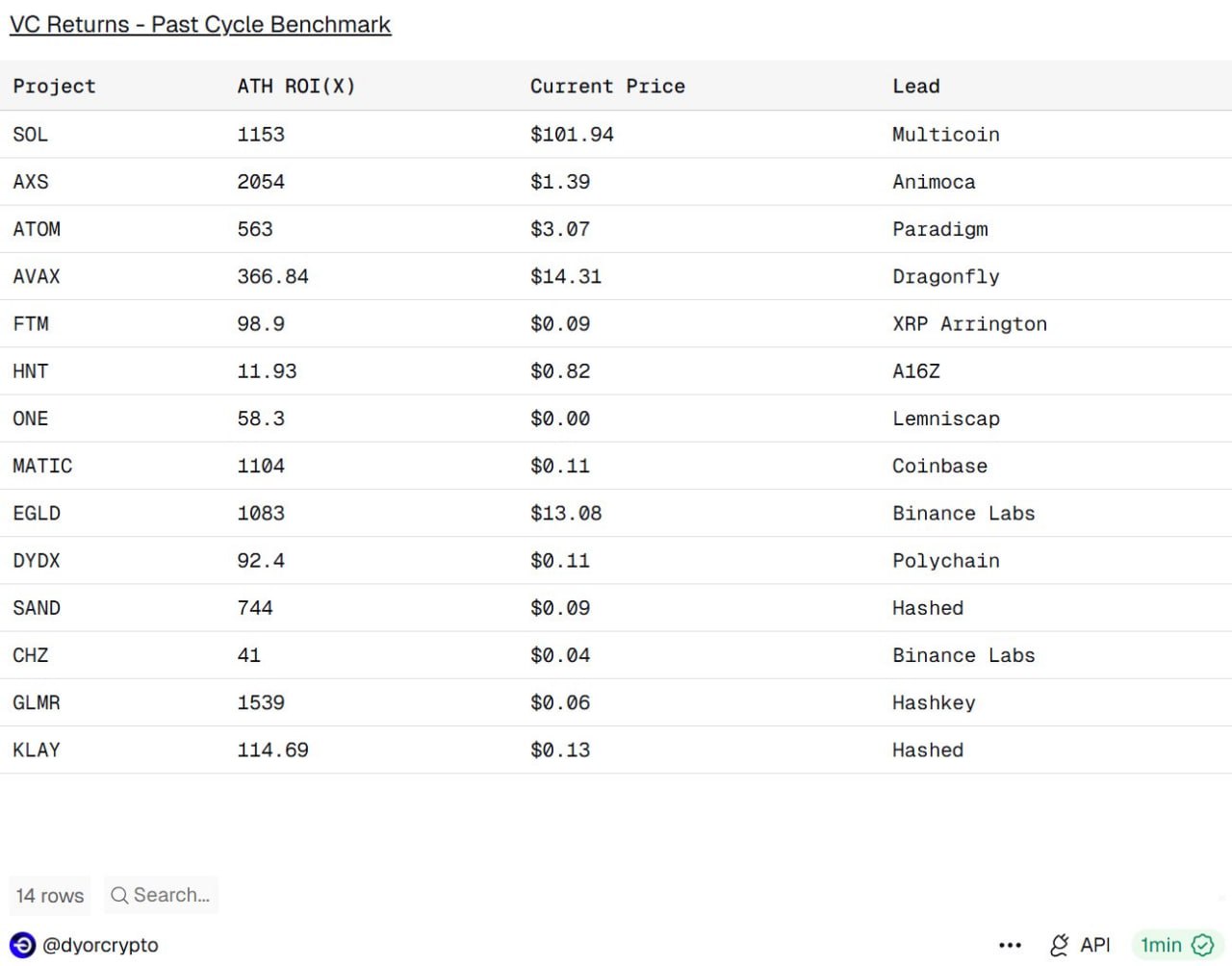

The collapse of the VC profit structure is accelerating compared to the previous cycle. ✅ VC-led altcoins that generated outperformance in the previous bull market are assessed to have largely entered a failure phase this cycle due to structural limitations. 🗂 Key Points 🔘 $AVAX: Past 366x returns → This cycle's worst performance. 🔘 $ATOM: Recorded 563x returns → AppChain narrative collapse, lack of liquidity sustainability. 🔘 $AXS: 2054x returns → Failure to maintain value due to lack of PMF and real-world usage. 🔘 $SAND: 744x returns → Metaverse adoption failed. 🔘 $GLMR: 1539x returns → Failure to expand the Polkadot ecosystem. 🗂 Solana: External Survival Case 🔘 Recorded ATH of $293 in January 2025. 🔘 Achieved 1153x returns compared to past cycles. 🔘 Real-world usage, developer activity, All on-chain metrics are growing in tandem. 🗄 Comment This cryptocurrency cycle clearly demonstrates the end of simple thematic and VC-backed premiums. Going forward, the market is likely to reorganize around real usability, cash flow, and developer density, rather than simply price increases.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content