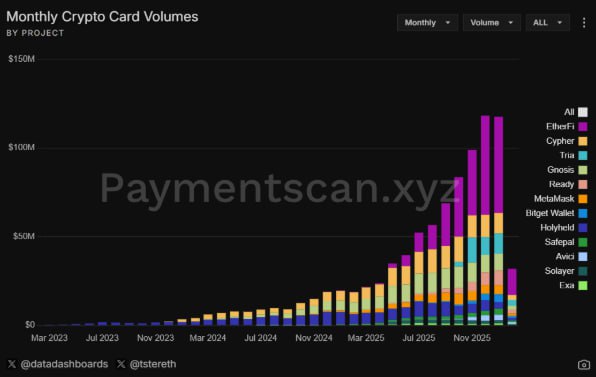

TRIA Ranks Second Among Neobanks, But Market Cap Is Half That of Its Competitors? Reached the second-largest global neobank after ETHFI (according to Paymentscan) just five months after its launch, but FDV feels undervalued compared to its peers. 1. FDV Cost-Effectiveness Comparison - $TRIA: $160M ~ $170M - $ETHFI: $450M / $GNO: $380M - Market cap is half that of its competitors. The "self-custody" service seems to have caught the attention of users. 2. Chart and Listing Status - During the TGE, it had the power to counter the Bitcoin bear market. - Currently, the price is stabilizing after the correction, making it a good spot for spot trading. - All major spot futures platforms, including Binance, Kobe, Bybit, and OKX, are listed. 3. Key Performance (5 Months) - Revenue of $4M / Users of 350,000 / Trading Volume of $170M - BestPath Revenue of $140M+ (integrated with 60 protocols, including Polygon and Arbitrum) - In-app Earn and futures support, as befits a neobank, with flight and hotel bookings coming soon. 4. Fundamentals - Team: Executives from Binance, Polygon, and Intel. - Backers: Ethereum Foundation C-level, P2 Ventures, Wintermute, Polygon, etc. - $12M in investment raised and Polychain advisory. Already a global top-tier indicator, FDV remains undervalued. I hope it's a section... #TRIA

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content