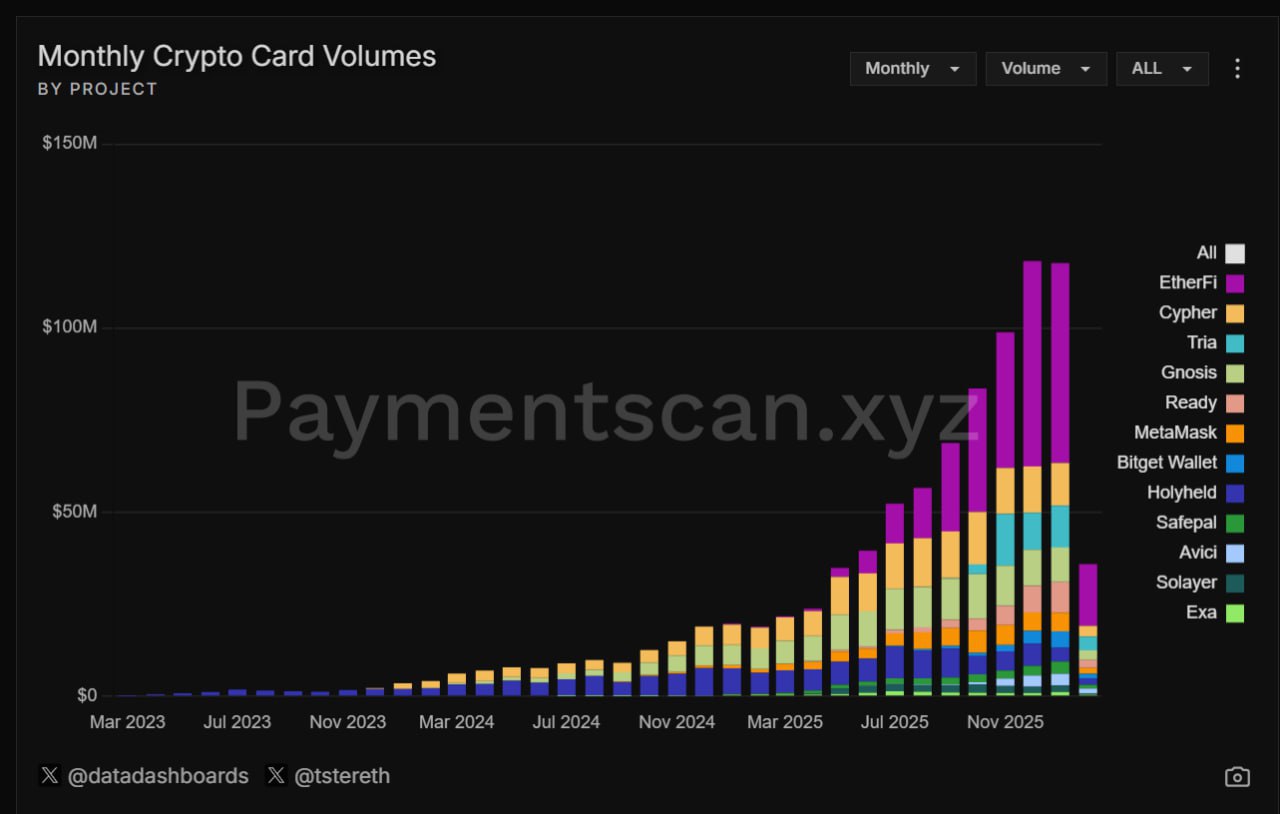

A Look at Neobank Tria ☑️ Light FDV Compared to Competitors ↳ Current FDV of TRIA: $150M ($ETHFI: $435M, approximately 3x difference, $GNO: $375M, more than 2x difference) ↳ Token price rose even during the Bitcoin crash during the TGE period ↳ Spot and futures listings completed on major exchanges including Binance, Coinbase, Bybit, and OKX ☑️ Explosive Growth in 5 Months ↳ A Key Factor in Tria's Growth: Support for "Self-Custody" Services ↳ Project Revenue: Over $4M ↳ Global Users: Over 350,000 (180 Countries) ↳ Cumulative Trading Volume: Exceeds $170M ↳ Global Ambassadors: Over 12,000 ↳ BestPath Revenue: Over $140M (Polygon, Arbitrum, (Over 60 protocols, including Injective and Sentient, are currently in use) ↳ In-app Earn and futures trading services launched ↳ Flight and hotel reservation services coming soon ☑️ Team and Investors ↳ Team members: Binance, Polygon, OpenSea, and Intel ↳ $12M raised in pre-seed and strategic investments (original text) ↳ Key investors: Ethereum Foundation C-level executives, P2 Ventures, Aptos, Polygon, Wintermute ↳ Polygon and Polychain participated as pre-seed advisors ✍🏻 Tria has established itself as the world's second-largest neobank, achieving unprecedented growth in just five months since its launch. We've compiled a list of Tria's competitive advantages and performance over the past five months, so please refer to it if you're interested.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share