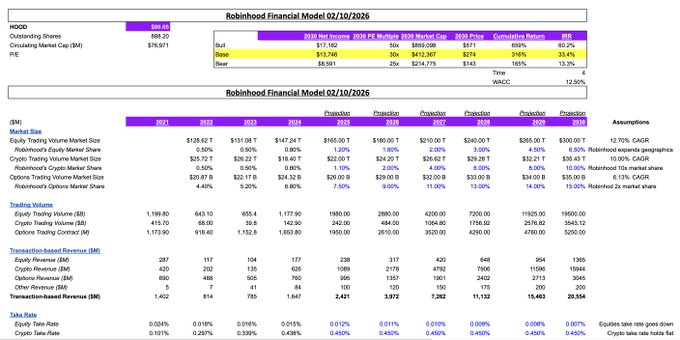

Robinhood looking attractive at $86 or 36x PE with decent upside (~33% IRR) in the long run. Core assumptions: 1. Equity trading market grows 12.7% CAGR and Robinhood has 6.5% of marketshare and 0.7 bps take rate in 2030. 2. Crypto trading market grows 10% CAGR (quite conservative) and Robinhood has 10% of marketshare and 45 bps take rate in 2030. 3. Option trading market grows 6% CAGR and Robinhood capture 15% of marketshare with $0.58 revenue per contract traded. 4. $1T of assets on Robinhood in 2030 growing 30% CAGR with 0.75% take rate for net revenue Core risks: 1. General trading volume cycles down in bear market 2. Lower take rate with more competition or PFOF faces regulatory scrutiny. 3. Other bets like prediction markets and the 11 other bets that are $100m+ ARR so non-transaction based revenue don't play out and grow. Drop in a comment if you want the model below 👇 Kudos @0xslayerrrr for building out THE $HOOD model.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share