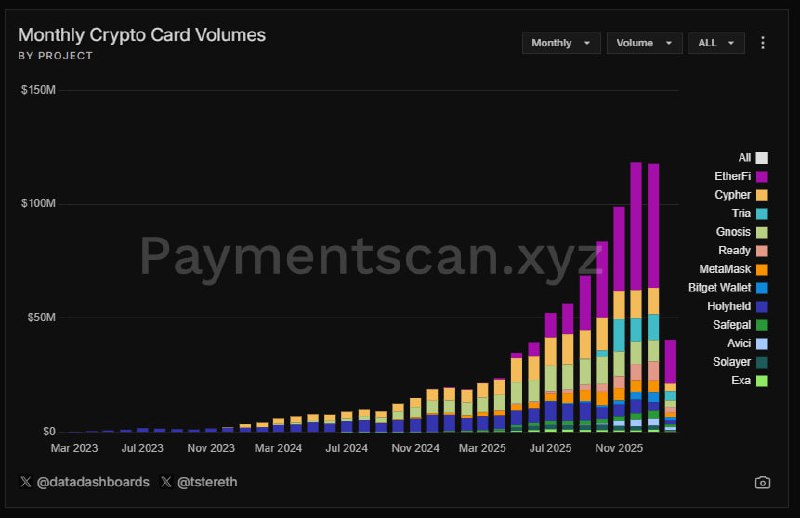

TRIA's Potential Entry into the FDV Revaluation Zone in the Neobank Sector ✅ Despite ranking second in the neobank sector, TRIA is assessed as undervalued compared to its competitors, with an FDV of approximately $160 million. 🗂 TRIA's Position in the Neobank Competition 🔘1st: ETHFI 🔘2nd: TRIA 🔘3rd: GNO 🗂 FDV Comparison by Neobank Project 🔘 ETHFI: $450M 🔘 GNO: $380M 🔘 TRIA: $160M 🗂 Performance Summary for the Past 5 Months 🔘 Project Revenue: $4M+ 🔘 Users: 350,000+ (180 Countries) 🔘 Cumulative Trading Volume: $170M+ 🔘 Global Ambassadors: 12,000+ users 🔘BestPath Cumulative Processing Volume: $140M+ (60+ protocols, including Polygon, Arbitrum, and Injective, are currently in use) 🗂 TRIA Team & Investment Background 🔘Team: Experienced at Binance, Polygon, OpenSea, and Intel 🔘Pre-seed and strategic rounds raised approximately $12M 🔘Participation from Ethereum Foundation C-level investors, P2 Ventures, Aptos, Polygon, Wintermute, and others 🔘Polygon and Polychain participated as pre-seed advisors 🗄 Comment I plan to continue following TRIA's progress, as it boasts a combination of rapid expansion, a self-custody infrastructure, and a lighter FDV compared to its competitors.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share