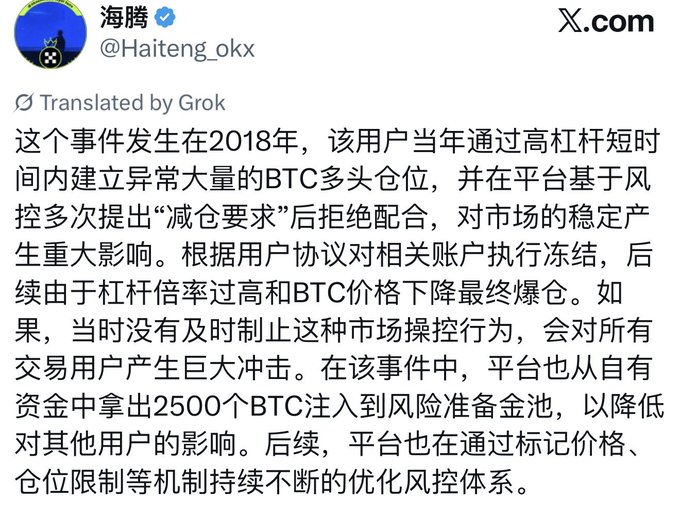

I knew about this at the time; it was actually quite dramatic! The key issue was that in the extremely illiquid and highly leveraged environment of 2018, the abnormally concentrated position building by a single account had already crossed the boundary of systemic risk. 1️⃣ The market depth was extremely thin that year; a large player manipulating the market at 20x leverage already altered the market structure. 2️⃣ If the order book couldn't absorb the liquidation, it would create a huge margin call gap, which would need to be shared by those who were profiting. 3️⃣ From the exchange's perspective, this wasn't just a matter of a single account's profit or loss; it would affect all users holding positions. 4️⃣ If OKX hadn't intervened in advance, it could have triggered platform-wide risk and large-scale liquidation. 5️⃣ OKX injected 2500 BTC into a risk pool with its own funds, prioritizing system stability rather than completely transferring the losses to the market. In short: In a high-leverage market, without a mature liquidation management mechanism, the platform's primary concern must be system security, not the trading freedom of individual accounts. Of course, the market learned its lesson, and exchanges have evolved into what they are today. I don't know why we're suddenly talking about this old issue again.

This article is machine translated

Show original

Mercy

@Mercy_okx

昨天关于2018年的旧事又被翻出来讨论。

我咨询了下经历过当时市场的前辈,有几个关键事实希望能够展现给大家:

2018年,BTC流动性远不如今天。当时永续合约单日交易量是1.5w个BTC左右,而该用户开的不是永续合约而是到期合约

她在短时间内将BTC从7000美元拉到8400美元 x.com/Haiteng_okx/st…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share