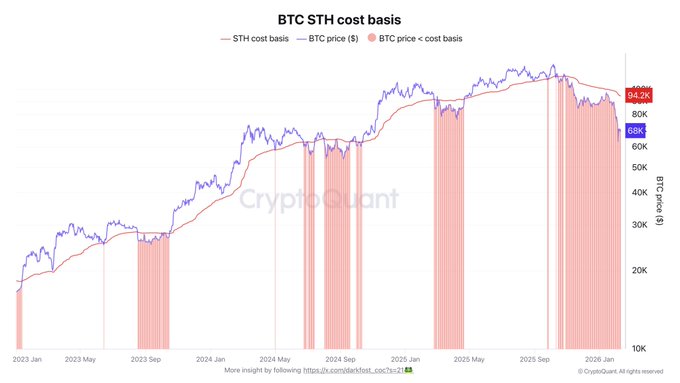

Short term holders keep suffering as this correction drags on. 📊 With an STH cost basis of around $94,200 and BTC at $68,000, the price gap has now reached 28%. So we can roughly estimate an average unrealized loss of about 28% for STHs, if we simplify things. But that is not the most striking part of this chart. 💥 Bitcoin’s price has been trading below the STH cost basis for four months, marking their longest period of stress so far. This is unusual for this cycle and suggests that the current correction is increasingly resembling a bear market. ‼️ During the two previous bear markets, this situation lasted for a little over a year. For now, however, I expect this bear market to be meaningfully different from the previous ones. Much will depend on whether the macroeconomic and geopolitical environment improves.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share