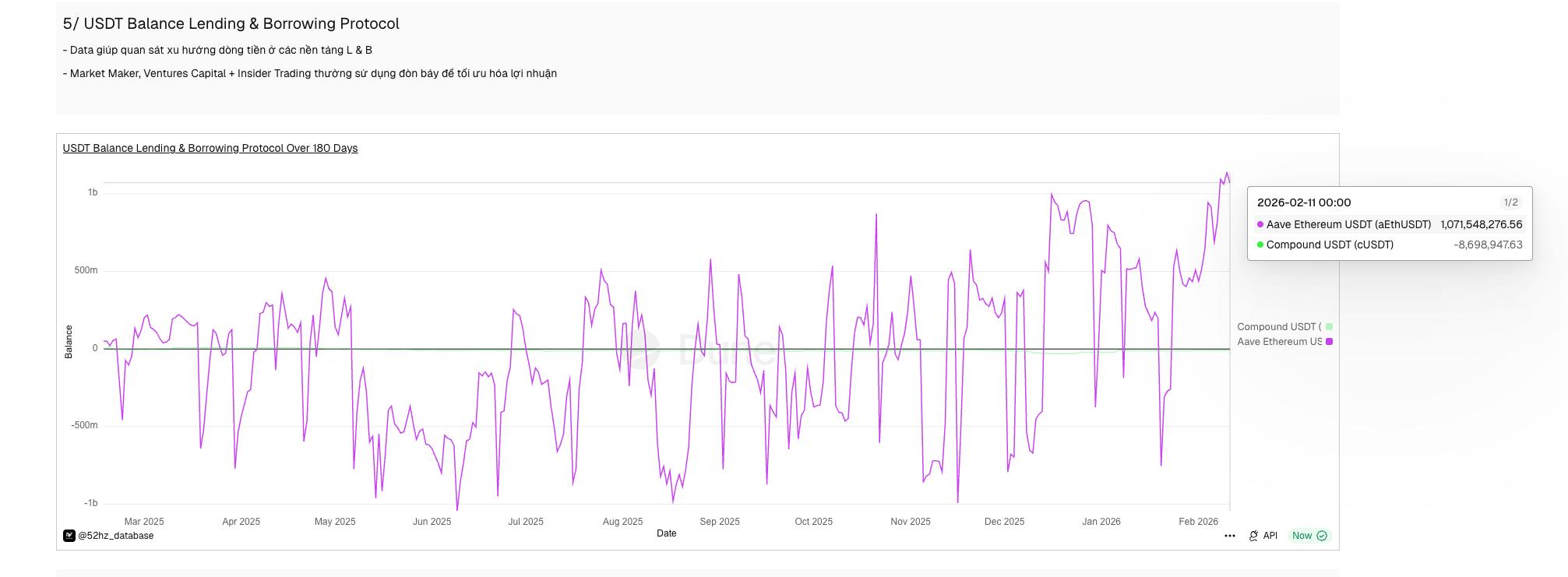

Let's take a look at the data in Lending & Borrowing. Over $1 billion has been borrowed in AAVE from January 20, 2026 to the present. This means borrowers started when the price was $90,000 and $3,100 until now. Typically, during periods of volatility, wallet addresses participating in lending tend to operate within a range of 5000-7000 of the price of $ETH and 500-700 of the price of $ETH. People can see that their operating range is expanding; this is a rare instance of lending wallet addresses operating within such a wide range. Some members have messaged 52Hz with a few opinions. And two of them are the most interesting. First viewpoint: These borrowers are hindering price recovery. This is seen as a leverage burden because they borrowed too much this time. Second perspective: These are catalysts for market recovery and also act as price support positions. Provided their overhead is at maximum and they are always ready to rebalance. Users can track data on the 52Hz USDT Overview Dashboard.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share