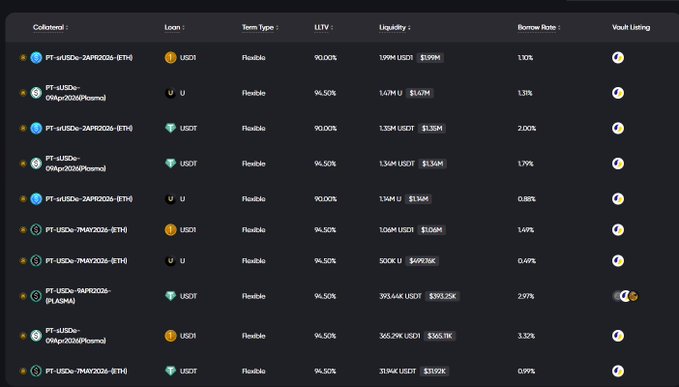

PENDLE Need I say more? @pendle_fi is the king of fixed-rate/fixed-date and you can still often beat all the above yields with a set-and-forget PT position that you can now send crosschain and even leverage now and again. Currently, I think @re's PT-reUSDe is one of the best opportunities simple because it has 133 days and a highly competitive 13.5% APY. It's also the current market leader in reinsurance on EVM (@onrefinance is the market leader on SVM). But the real juice is in crosschain leverage. You can take your PTs over to BSC on @lista_dao and borrow against them for 1-4% with a few million in available liquidity. THAT MEANS, a net of 20-30% APY at max leverage with a fairly conservative SC exposure. But remember, 1M to borrow means a 100K principal position would take 100% of the available liquidity at 11x leverage.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content