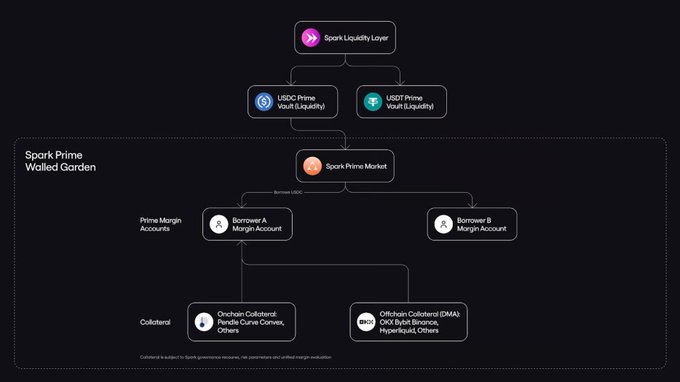

⚡️Spark @sparkdotfi officially launched Spark Prime, a feature that should appeal to all institutions. Over the past year, the market capitalization of stablecoins has exceeded $300 billion, but the utilization rate of the lending market has remained around 30%. Traditional DeFi lending logic is simple: the system provides a loan amount proportional to the amount of collateral you have, recognizing only the notional size of individual positions without understanding the relationships between them. This is sufficient for retail investors, but not so friendly to institutions and hedge funds. Spark Prime aims to change this by tailoring a measurement method specifically for institutions and hedge funds. Through Arkis' risk engine, it brings on-chain positions, exchange positions, and custodial assets into a unified perspective, calculating margin based on portfolio net risk, rather than simply and crudely stacking notional sizes. For example: If you have 100 million in spot trading and simultaneously 100 million in perpetual short trading on a CEX, theoretically, this hedging reduces the actual risk to near zero. Traditional DeFi would treat this as two isolated positions: "100 million in spot trading + 100 million in short trading," requiring a large amount of margin to be locked on both sides. Spark Prime attempts to identify this hedging relationship, calculating margin to more closely reflect actual risk, rather than based on a 200 million notional position. This is simpler and cheaper, significantly freeing up unnecessary liquidity. Currently, it supports identifying positions on Binance, Bybit, OKX, Hyperliquid, Pendle, and Curve. This is excellent. With this cross-scenario risk identification capability, DeFi's lending logic will shift from a simple, crude liquidity pool model to a balance sheet model. Only when the margin logic evolves will institutions truly maximize their scale. Otherwise, no matter how much stablecoin they hold, it will just sit idle on paper. However, I'm thinking about something even more interesting now: Once this path is successful, the ceiling for DeFi lending might not just be raised, but completely redefined. How will other protocols respond and compete?

This article is machine translated

Show original

Spark

@sparkdotfi

Announcing Spark Prime: CeDeFi Margin Lending

Powered by @ArkisXYZ's margin technology, Spark Prime enables institutional borrowers to deploy collateral seamlessly across DeFi and CeFi venues.

Spark Prime provides:

▪ More resilient delta-neutral lending supported by

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share