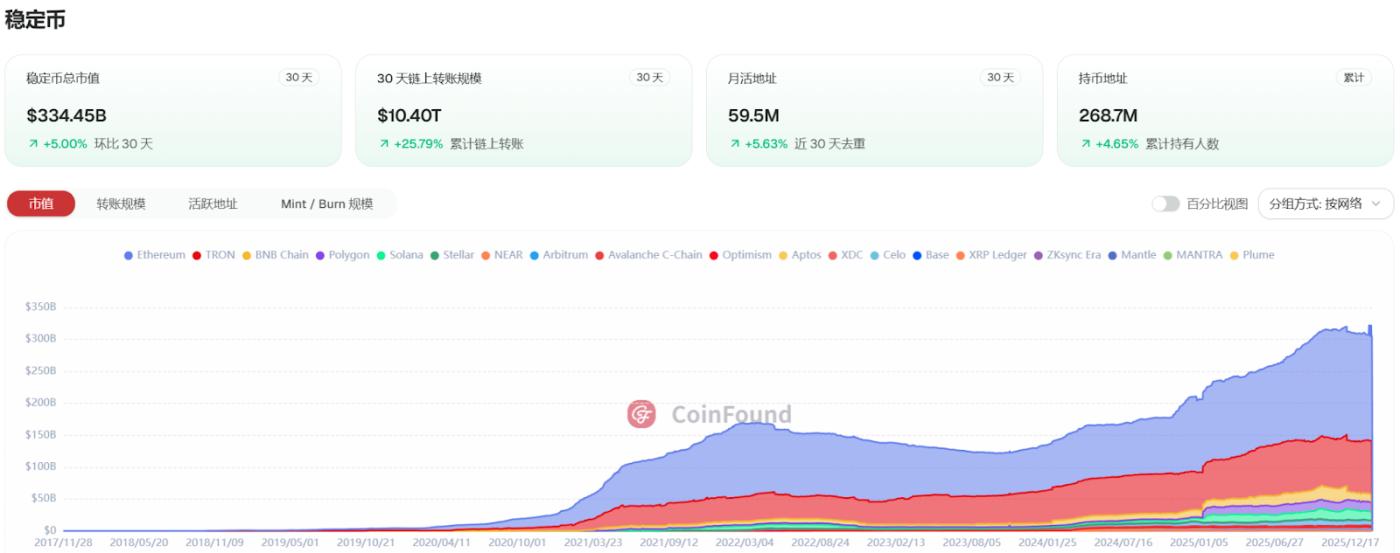

According to ME News, on February 12th (UTC+8), data from CoinFoundry showed:

- USDT market capitalization: $195.24 billion

- USDC market capitalization: $75.11 billion

- EURC's market capitalization: $12.27 billion

- USDS market capitalization: $11.18 billion

- USDe market capitalization: $6.49 billion

- PYUSD Market Cap: $3.92 billion

- USD1 Market Cap: $5.42 billion

Market Dynamics:

- US banks intensify lobbying against interest rate bans on interest-bearing stablecoins.

- Superset has raised $4 million in seed funding to address liquidity fragmentation.

- Visa Direct stablecoin pilot accelerates and enterprise-level treasury applications.

- Tether invests $150 million in Gold.com.

Summarize:

The stablecoin market as a whole has shown relative resilience. Despite significant volatility in the cryptocurrency market, the stablecoin market has remained relatively stable. This reflects investors seeking safe havens amid market uncertainty, with funds shifting from volatile assets to stablecoins as a "safe haven." Overall, in the short term, growth may slow due to macroeconomic uncertainties and the interconnectedness of the crypto market. (Source: ME)